Financial Transactions and Reports Analysis Centre of Canada 2024-2025 Departmental plan

Erratum

Subsequent to tabling in Parliament and online publication of the Financial Transaction and Reports Analysis Centre’s 2024–25 Departmental Plan, five errors have been corrected:

- on the “At a glance” page, in the Highlights section, and under the subheading “Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations”, planned human resources for 2024–25 has been modified from 292 to 273;

- on the “At a glance” page, in the Highlights section, and under the subheading “Production and dissemination of financial intelligence”, planned human resources for 2024–25 has been modified from 250 to 237;

- in the Full Report, in the “Plans to deliver on core responsibilities and internal services” section, under the subheading “Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations”, and under the title “Snapshot of planned resources in 2024–25”, planned full-time resources has been modified from 292 to 273;

- in the Full Report, in the “Plans to deliver on core responsibilities and internal services” section, under the subheading “Production and dissemination of financial intelligence”, and under the title “Snapshot of planned resources in 2024–25”, planned full-time resources has been modified from 250 to 237; and

- in the Full Report, in the “Plans to deliver on core responsibilities and internal services” section, under the subheading “Internal services”, and under the title “Snapshot of planned resources in 2024–25”, planned full-time resources has been modified from 75 to 70.

These changes do not affect the rest of the information contained in the report.

On this page

- From the Director and Chief Executive Officer

- Plans to deliver on core responsibilities and internal services

- Planned spending and human resources

- Corporate information

- Supplementary information tables

- Federal tax expenditures

- Definitions

From the Director and Chief Executive Officer

I am pleased to present to Parliament and Canadians the 2024–25 Departmental Plan for the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This report describes what we plan to do to achieve real and impactful results for our partners and for Canadians in the upcoming year.

As Canada's Financial Intelligence Unit and Anti-Money Laundering and Anti-Terrorist Financing (AML/ATF) Supervisor, FINTRAC must remain adaptive and agile as we work to fulfill our essential role in helping to combat money laundering, terrorist activity financing and threats to the security of Canada.

FINTRAC's operations are shaped by its complex and challenging operating environment with fast-paced technological change and financial product innovations, the rapidly shifting nature of global financial systems, and geopolitical events constantly impacting our work. Against the backdrop of such significant change, FINTRAC remains committed to strengthening our core supervisory and financial intelligence mandates, and to enhancing and expanding our collaboration with key partners. It is only in working together that we can effectively confront the increasingly sophisticated methods of criminals and terrorists as they seek to exploit vulnerabilities and take advantage of any opportunity to enrich themselves and advance their illicit enterprises.

In the year ahead, we will focus on modernizing FINTRAC to meet the challenges – and leverage the opportunities – of the future. We are committed to advancing Centre-wide digital automation, analytics and the use of cutting-edge innovation. By transforming the way we work, we will be better able to support the AML/ATF efforts of Canadian businesses across the country, and more effectively contribute to the investigations of Canada's law enforcement and national security agencies. The ultimate goal of our vision for modernization is to position FINTRAC to work in real time. This means harnessing modern skills, tools and technologies to be able to identify, assess and communicate risk in real time; to support and respond to businesses in real time; to receive reporting in real time; to conduct our analysis in real time; and to generate financial intelligence for law enforcement and national security agencies in real time or as close to it as we can get. Our vision for modernization will position FINTRAC even more effectively to help protect vulnerable Canadians.

In 2024–25, FINTRAC will begin operating under a new assessment of expenses (i.e., cost recovery) funding model for its supervisory activities. In this context, we will continue to advance our Centre-wide modernization efforts, with a particular emphasis on ensuring these activities are more targeted and responsive in meeting the diverse needs, expectations and capacities of all business sectors. We are shifting more fully towards an enhanced risk-based approach, modernizing and evolving our compliance framework to a supervisory one, to promote risk awareness, risk identification and effective risk mitigation by the businesses supervised by FINTRAC. As we strive to be a world-leading Financial Intelligence Unit and AML/ATF Supervisor, our goal is to make it simpler for businesses to fulfill their legal obligations by providing reliable support, refined processes, service and tools, among other efficiencies.

We look forward to finding new and meaningful ways to collaborate with our many stakeholders — our international allies, regulatory partners, thousands of Canadian businesses, Canada's law enforcement and national security agencies — to improve our collective understanding of emerging threats, share information and best practices, and raise awareness of money laundering and terrorism financing risks. This starts with a shared identification of risks by public and private sector partners through the National Inherent Risk Assessment exercise. Strengthening and expanding our partnerships will be critical to FINTRAC's modernization, and to significantly enhancing our collective ability to combat money laundering and terrorist financing. More than ever, it takes a network – strong, equipped and committed – to defeat modern criminal and terrorist networks.

We are also working hard with our partners within Canada's AML/ATF Regime to ensure our overall Regime aligns well with domestic and international priorities and best practices. We welcome the Parliamentary Review of Canada's Regime to ensure our enabling legislation provides the frame to continue to deliver results for Canadians. We are also looking forward to the opportunity to share our progress with international partners through the Financial Action Task Force's Fifth Round peer review of Canada's AML/ATF Regime.

In everything we do, to ensure we can successfully maximize these opportunities, FINTRAC will continue to build on our positive and inclusive workplace culture. Our people are at the heart of our vision for FINTRAC's modernization just as they've always been at the centre of our success. FINTRAC supports Diversity, Equity, and Inclusion in all its forms, so that our employees feel supported and confident in bringing their very best to work every day. This is more than just smart business practice – it is a moral imperative for institutions that serve the Canadian public.

As we look to an ever-evolving future, I am excited to lead FINTRAC and its highly skilled and dedicated workforce in addressing the challenges and leveraging the opportunities of the future – so that we can continue to deliver for Canada and Canadians in the global fight against money laundering and the financing of terrorism.

______________________________

Sarah Paquet

Director and Chief Executive Officer

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services:

- Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

- Production and dissemination of financial intelligence

- Internal services

Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

In this section

- Description

- Quality of life impacts

- Results and targets

- Plans to achieve results

- Snapshot of planned resources in 2024–25

- Program inventory

Description

FINTRAC is responsible for ensuring compliance with Part 1 and Part 1.1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its associated Regulations. This legal framework establishes obligations for reporting entities to develop and implement a compliance program in order to identify clients, monitor business relationships, keep records and report certain types of financial transactions. FINTRAC undertakes enabling and enforcement actions to ensure that the reporting entities operating within Canada's financial system fulfill their PCMLTFA obligations. These obligations provide important measures for countering patterns and behaviours observed in criminals and terrorists in order to deter them from operating within the legitimate channels of Canada's economy. FINTRAC also maintains a registry of money services businesses in Canada and foreign money services businesses that direct and provide services to persons and entities in Canada.

Quality of life impacts

Through all of the activities mentioned in the description, this core responsibility contributes to the "Prosperity", "Society", and "Good governance" domains of the Quality of Life Framework for Canada. More specifically, it contributes to the "Future outlook", "Financial well-being", "Trust in others", "Confidence in institutions" and "Crime Severity Index" indicators.

Results and targets

The following tables show, for each departmental result related to Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations, the indicators, the results from the three most recently reported fiscal years, the targets and target dates approved in 2024–25.

| Indicator | 2020–21 result | 2021–22 result | 2022–23 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of assessed reporting entities not requiring enforcement actionFootnote 1 | 94% | 94% | 95% | 90% | March 31, 2025 |

| Percentage of financial transaction reports submitted to FINTRAC that meet validation rules as an indicator of quality | 88% | 87% | 90% | 90% | March 31, 2025 |

The financial, human resources and performance information for FINTRAC's program inventory is available on GC InfoBase.

Plans to achieve results

FINTRAC's compliance framework is based on three complementary pillars: assistance, assessment and enforcement. Collectively, these pillars form a comprehensive, risk-based approach aimed at influencing compliance behaviour whereby persons and entities subject to the PCMLTFA fulfill their obligations. Central to this are a host of activities aimed at ensuring that reporting entities understand and comply with their 'know-your-client' and record keeping requirements, and that they submit high quality and timely reports to FINTRAC.

To effectively evolve the compliance framework towards a supervisory one requires the right suite of policies and procedures, supported by the right systems and training mechanisms, together with a capacity to change within a complex and dynamic operating environment. In 2024–25, FINTRAC plans to undertake the following major activities:

- FINTRAC will work closely with the Department of Finance Canada, other Regime partners, foreign financial intelligence units and international organizations to help enhance global knowledge of money laundering and terrorist activity financing issues and to combat the threat posed by these and other financial crimes. Priorities will include supporting the work of the Egmont Group, Financial Action Task Force (FATF), the Asia/Pacific Group (APG), of which Canada is a member, and the Caribbean Financial Action Task Force (CFATF), of which Canada is a cooperating and supporting nation. This work will help improve international standards, knowledge of money laundering and terrorist activity financing, and policies for the future.

- The FATF sets international standards that aim to prevent money laundering and terrorist activity financing and the harm they cause to society. The FATF conducts peer review of each member country to assess levels of implementation of the FATF recommendations, providing an in-depth description and analysis of each country's method for preventing criminal abuse of the financial system. As the fifth round Mutual Evaluation of Canada's AML/ATF Regime is expected to be discussed at the FATF plenary in June 2026, FINTRAC will actively support a number of initiatives led by the Department of Finance Canada, including a self-assessment of the Regime to identify gaps and priority actions to address those gaps. The Centre will also advance a number of internal activities to prepare for the review.

- In 2024–25, FINTRAC will update its operations to align with recent legislative and regulatory amendments to the PCMLTFA, including the enhancement of terrorist property reports to include the reporting of sanctions information by reporting entities, and enhancements of the money services businesses (MSB) registration framework. In addition, FINTRAC will conclude the implementation of the new generation of reports with the launch of the suspicious transaction, casino disbursement and electronic funds transfer reports using Application Programming Interfaces (API), a new method for FINTRAC to receive system-to-system reports, and an updated FINTRAC web reporting system. To ease the transition for reporting entities, FINTRAC will provide support through shared documentation, guidance and continued engagement. Lastly, along with the Department of Finance Canada, FINTRAC will support Innovation, Science and Economic Development Canada on the implementation of a federal beneficial ownership registry.

- In addition, legislative amendments were introduced in 2021 and 2022 to cover Armoured Cars and Mortgage Lenders respectively under the PCMLTFA as new reporting entities. These will be coming into force as of July 1, 2024 (Armoured Cars) and October 11, 2024 (Mortgage Lenders). FINTRAC will implement a solution to allow Armoured Cars to register on the MSB registry, as well as to allow both Armoured Cars and Mortgage Lenders to enroll in the FINTRAC web reporting system to submit financial transaction reports. FINTRAC will conduct outreach and focus its supervisory activities to assist the new regulated entities in understanding their obligations, and to build new relationships with regulators and associations.

- In 2024–25, FINTRAC will be implementing new legislative measures to bring white-label automated teller machines (ATMs) and title insurers into the Regime, as well as other initiatives that form part of Budget Implementation Act no. 2, 2023.

- FINTRAC will support the Department of Finance Canada in assessing opportunities to address legislative and regulatory gaps flowing from the Parliamentary Review of the PCMLTFA.

- FINTRAC's new assessment of expenses (i.e., cost recovery) funding model and the associated Financial Transactions and Reports Analysis Centre of Canada Assessment of Expenses Regulations come into force on April 1, 2024. FINTRAC will ensure strong administration of the funding model, including by conducting multi-year forecasting exercises to inform the estimated total costs of the Compliance program that it will recover from reporting entities. FINTRAC will continue to emphasize sound financial management through increased in-year forecasting, training, and monitoring. FINTRAC will routinely review and evaluate the effectiveness and efficiency of the funding model throughout its maturity.

- FINTRAC will continue to modernize its compliance-led activities to ensure they are meeting the diverse needs, expectations and capacities of reporting entity sectors. FINTRAC is shifting towards a risk-based approach, modernizing and evolving its compliance framework to a supervisory one while promoting risk awareness, risk identification and effective risk mitigation. FINTRAC will pursue measures and activities to equip the Centre and its people with automation, digital tools and advanced data management solutions that leverage innovative technologies.

- In 2024–25, FINTRAC will operationalize its new compliance MOU with the Bank of Canada (Bank) which will enable the sharing of information on payment service providers (PSPs) and MSBs in the context of the Bank's new supervisory functions under the Retail Payment Activities Act (RPAA), set to come into force on two separate dates in 2024 and in 2025. The MOU allows the exchange of both mandatory information outlined in the RPAA as well other key supervisory information to assist both regulators in advancing their respective compliance mandates. As of November 1, 2024, FINTRAC will start receiving information from the Bank regarding PSP applicants and will respond with relevant information back to the Bank. As of September 1, 2025, the Bank will begin providing FINTRAC with registration decisions on applicants.

- As a partner in the Government of Canada's National Strategy to Combat Human Trafficking, FINTRAC will continue to raise awareness and support survivors of human trafficking as they work to regain their financial freedom.

- To evolve our innovative partnerships with domestic stakeholders, FINTRAC will continue to engage with diverse stakeholders to advance whole-of-system operational alignment and effectiveness. Current priorities include a risk framework for reporting.

- To enable reporting entities to meet their obligations, FINTRAC will provide ongoing guidance and support through conferences, working groups, training sessions, as well as through collaboration with industry associations and other regulators. In particular, FINTRAC will highlight the findings of Canada's updated National Inherent Risk Assessment (NIRA) and articulate how specific sectors are exposed to various money laundering and terrorist activity financing threats. FINTRAC will provide insight on integrating the NIRA as part of reporting entity's operational frameworks and will engage with sectors that are newly covered under the PCMLTFA obligations to ensure that the requirements are understood and being implemented appropriately. Key investments will be made to enhance engagement and support Canadian businesses by introducing new online educational products and automated onboarding tutorials that are sector-specific.

- FINTRAC will support, collaborate with, and build the capability of the reporting entity population to ensure they have access to tools, guidance and information that allows them to play an active role in preventing, deterring and responding to threats of criminal abuse and exploitation, recognizing that reporting entities, other government agencies, law enforcement and national security agencies, all share a common interest in — and responsibility for — creating a financial system free from criminal abuse.

Snapshot of planned resources in 2024–25

- Planned spending: $49,361,846

- Planned full-time resources: 273

Program inventory

Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations is supported by the following programs in the program inventory:

- Compliance program

- Strategic policy and reviews

Supporting information on planned expenditures, human resources, and results related to FINTRAC's program inventory is available on GC Infobase.

Production and dissemination of financial intelligence

In this section

- Description

- Quality of life impacts

- Results and targets

- Plans to achieve results

- Snapshot of planned resources in 2024–25

- Program inventory

Description

FINTRAC is mandated by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to produce actionable financial intelligence that assists Canada's police, law enforcement, national security and other international and domestic partner agencies in combatting money laundering, terrorist activity financing and threats to the security of Canada, while protecting the personal information entrusted to FINTRAC. The Centre also produces strategic financial intelligence for federal policy and decision-makers, the security and intelligence community, reporting entities across the country, international partners and other stakeholders. FINTRAC's strategic intelligence provides a wide analytical perspective on the nature, scope and threat posed by money laundering, terrorist activity financing and the financing of threats to the security of Canada.

Quality of life impacts

Through all of the activities mentioned in the description, this core responsibility contributes to the "Prosperity" and "Good governance" domains of the Quality of Life Framework for Canada. More specifically, it contributes to the "Financial well-being", "Victimization rate" and "Crime Severity Index" indicators.

Results and targets

The following tables show, for each departmental result related to Production and dissemination of financial intelligence, the indicators, the results from the three most recently reported fiscal years, the targets and target dates approved in 2024–25.

| Indicator | 2020–21 result | 2021–22 result | 2022–23 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of feedback from disclosure recipients that indicates that FINTRAC's financial intelligence disclosure was actionable | 96% | 97% | 96% | 85% | March 31, 2025 |

| Indicator | 2020–21 result | 2021–22 result | 2022–23 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of Regime partners using FINTRAC products to inform activitiesFootnote 2 | 70% | 72% | 75% | 70% | March 31, 2025 |

The financial, human resources and performance information for FINTRAC's program inventory is available on GC InfoBase.

Plans to achieve results

As part of its core mandate, FINTRAC provides actionable financial intelligence to Canada's law enforcement and national security agencies to help them combat money laundering, terrorist activity financing and threats to the security of Canada. The Centre's intelligence plays a key role in helping to protect the safety of Canadians, particularly Canada's most vulnerable citizens and communities.

Given the complexity of connecting the flow of illicit funds often involving organized criminal groups, FINTRAC's financial intelligence often contains thousands of financial transaction reports in each disclosure. At the same time, the value of transactions in each disclosure may be in the millions or even hundreds of millions of dollars.

A financial intelligence disclosure may show links between individuals and businesses that have not been identified in an investigation, and may help investigators refine the scope of their cases or shift their sights to different targets. A disclosure can pertain to an individual or a wider criminal network, and can also be used by law enforcement to put together affidavits to obtain search warrants and production orders. FINTRAC's financial intelligence is used in a wide variety of criminal investigations related to the funding of terrorist activities and the laundering of proceeds originating from such crimes as drug trafficking, fraud, tax evasion, corruption and human trafficking.

FINTRAC's financial intelligence can also be used to reinforce applications for the listing of terrorist entities, sanctioned persons or entities and to advance the government's knowledge of the financial dimensions of threats, including those related to organized crime and terrorism.

In addition to the Centre's financial intelligence disclosures, FINTRAC also produces valuable strategic financial intelligence to fulfill its mandate. Through the use of research and analytical techniques, the Centre is able to identify emerging characteristics, trends and tactics used by criminals and other bad actors to launder the proceeds of crime, fund terrorist activities or finance threats to the security of Canada. The goal of FINTRAC's strategic intelligence is to inform Canada's security and intelligence community, Regime partners and policy decision-makers, businesses, Canadians, and international counterparts about the nature and extent of these illicit financial activities.

In 2024–25, the following activities will be undertaken:

- FINTRAC will strengthen its intelligence capabilities by advancing targeted investments that enhance the quality of financial intelligence disclosures. In 2024–25, FINTRAC will explore new tools to enrich network analysis and visualization and reduce manual processes. As part of the intelligence suite renewal program, FINTRAC will leverage the agile vendor procurement process to establish proof of concepts for new automated tools for discovery and data analysis. FINTRAC's approach will support cutting-edge analysis through more rapid adoption of solutions that better integrate with FINTRAC's analytical system.

- After our people, data is FINTRAC's most important asset for protecting the Canadian financial system and the safety and security of Canadians. Effective management of FINTRAC's data assets is critical to the production of actionable financial intelligence. In 2024–25, FINTRAC will access new analytical methods and techniques, and augment its data science, data analytics, data governance and data management capabilities to ensure the Centre can strategically and sustainably manage, enhance, use and share intelligence data to adapt to the ever-changing threat environment.

- FINTRAC will operationalize Canada's National Inherent Risk Assessment (NIRA) of current and emerging risks of money laundering and terrorist financing to inform the production of FINTRAC's strategic intelligence, tactical intelligence disclosures and targeted threat analysis products.

- As FINTRAC looks to strengthen collaboration and build innovative partnerships with stakeholders, priority will be given to supporting FINTRAC's highly successful, industry-led, public-private partnerships (PPPs). These partnerships address major areas of concern within Canada's NIRA, and are aimed at more effectively combatting money laundering domestically and internationally stemming from all types of human and labour trafficking, online child sexual exploitation, underground banking schemes, romance fraud and emergency scams, the trafficking of illicit fentanyl, and the laundering of proceeds of crime related to illicit cannabis.

- Internationally, FINTRAC will support and expand collaboration with key stakeholders to counter major transnational organized crime. Building on the global success of Project Anton, a first-of-its-kind international PPP targeting the money laundering associated with illegal wildlife trade, FINTRAC will seek opportunities to advance additional international PPPs, particularly with respect to the trafficking of illicit fentanyl, an opioid that is devastating many communities.

- FINTRAC will also continue to share its insight and best practices related to Project Protect with international partners in response to their overwhelming support and interest. Launched in 2016, Project Protect is Canada's highly successful PPP created to target the money laundering associated with human trafficking for sexual exploitation. Since the creation of Project Protect, FINTRAC has seen a 750% increase in suspicious transaction reporting related to money laundering associated with human trafficking in the sex trade.

- As announced under the Fall Economic Statement 2023, FINTRAC will be able to share financial intelligence with new disclosure recipients at Environment and Climate Change Canada and Fisheries and Oceans Canada in 2024–25. Financial intelligence will provide additional tools for these agencies to support their enforcement efforts and combat money laundering associated with environmental crime.

- FINTRAC will demonstrate its leadership within the Egmont Group to ensure that the implementation of good governance practices results in a well-run international organization and delivers results for FINTRAC and financial intelligence units (FIU) globally. Leadership within the Egmont Group also provides FINTRAC an opportunity to demonstrate how it is an effective FIU globally, by sharing operational best practices, experience and expertise, while also learning from others in the application of AML/ATF techniques through operational projects and exchanges.

- In addition, FINTRAC will continue to bolster national and international efforts in combatting trade-based money laundering through active engagement with the Canada Border Services Agency led multi-disciplinary Trade Fraud and Trade-Based Money Laundering Centre of Expertise, and through participation in the Egmont Group of Financial Intelligence Units. FINTRAC will continue to engage in knowledge sharing and training initiatives, which will enhance understanding of trade-based money laundering risks, trends and typologies, and contribute to global efforts to detect and disrupt this type of money laundering activity.

- FINTRAC will continue to develop and deepen its Strategic Intelligence program through targeted reports and analysis that inform federal Regime partners and the security and intelligence community on priority areas of money laundering and terrorist activity financing, such as developing trends related to professional money laundering, the emerging role of virtual currencies, the misuse of corporate structures, and the financing of violent extremists. It will also deepen its analysis within the Strategic Intelligence Program to cover the financing of threats to the security of Canada, reflecting changes to the PCMLTFA in 2023.

- In the year ahead, FINTRAC will continue to participate in the Counter Illicit Finance Alliance of British Columbia, a cross-sectorial partnership that collaborates in the development of strategic information in the interest of protecting the economic integrity of British Columbia through the prevention, detection, and deterrence of illicit financial activity. Under this initiative, FINTRAC continues to collaborate with public and private partners in various subgroups, which seek to enhance awareness and understanding of financial criminal activity to improve the detection, analysis, prevention, and investigation of these activities in Canada.

- FINTRAC will continue to invest analytical resources in 2024–25 into the production of Sector and Geographic advisories. By identifying sectors or geographic areas more at risk from specific money laundering or financing of terrorist activities typologies, reporting entities will better understand the measures they can take to address and mitigate these issues.

Snapshot of planned resources in 2024–25

- Planned spending: $45,123,869

- Planned full-time resources: 237

Program inventory

Production and dissemination of financial intelligence is supported by the following programs in the program inventory:

- Financial intelligence program

- Strategic intelligence research and analytics

Supporting information on planned expenditures, human resources, and results related to FINTRAC's program inventory is available on GC Infobase.

Internal services

In this section

- Description

- Plans to achieve results

- Snapshot of planned resources in 2024–25

- Related government priorities

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

FINTRAC's Internal services support the Centre's core responsibilities and programs. A key priority is ensuring the protection of personal information under its control. All facets of FINTRAC's operations are subject to rigorous security measures that ensure the safeguarding of the Centre's physical premises and IT systems, including the handling, storage and retention of all personal and other sensitive information under its control. Internal services also support the development and delivery of effective and integrated services, policies, advice and guidance in the fields of finance, human resources, culture and change management, security, communication, procurement, administration, information management, and information technology. The overall objective is to ensure that FINTRAC has the proper capacity and corporate infrastructure to allow its workforce to achieve operational success.

As FINTRAC's responsibilities and operations grow in scope and complexity, its ability to deliver on its mandate remains directly tied to its adaptability, the skills and dedication of its employees, and the tools and resources available for them to do their work. As an organization committed to excellence, FINTRAC is focused on the effective management of its human, technological and financial resources, and will continue to enhance its security program, including strengthening its security screening capacity and cybersecurity, while also reinforcing the physical security of the facilities in light of the ever-changing threat landscape.

To achieve its Internal services objectives, FINTRAC will undertake the following activities in 2024–25:

- Guided by the goal and vision of FINTRAC in real time, FINTRAC will prioritize modernization through acceleration to propel the Centre to the forefront of industry advancements, harnessing opportunities and delivering heightened business value. FINTRAC will leverage innovative technologies such as artificial intelligence and machine learning to deliver quicker and more comprehensive responses to address requests. This, in turn, will enhance awareness and understanding of obligations, resulting in improved reporting and, ultimately, the generation of even more insightful intelligence. In 2024–25, the realignment of certain functions within FINTRAC to ensure that opportunities are leveraged in a more nimble way signifies a commitment to this direction, serving as a platform for the exploration and application of advancements.

- FINTRAC will be transitioning to full product management as a key practice, refining processes and governance, and ensuring streamlined and consistent product delivery that aligns with present needs and future demands.

- FINTRAC will continue working closely with the Office of the Comptroller General to procure and implement a Software-as-a-Service Financial Management System solution. The solution will integrate closely with FINTRAC's new Human Capital Management solution, leading to a fully integrated Enterprise Resource Planning platform, streamlined processes and efficiencies. In 2024–25, FINTRAC will continue to play a leadership role on behalf of similar-sized organizations concerning the implementation of a modern Financial Management solution.

- FINTRAC will continue the process of strengthening its Internal Control framework to support an effective system of internal control over financial management and financial reporting. This will ensure alignment with the Office of the Comptroller General's new methodology for internal control risk assessments in small departments and agencies, and allow the Centre to identify and mitigate potential risks resulting from the new business processes to administer the assessment of expenses (i.e., cost recovery) funding model.

- The Office of the Privacy Commissioner launched its biennial audit of FINTRAC in 2023–24. A final report is expected in the year ahead and FINTRAC will take action, as appropriate, in response to the recommendations identified.

- FINTRAC will continue our dedication to enhancing FINTRAC's new Human Capital Management (HCM) system, our people management framework and policy renewal initiative. By leveraging technology, we will equip the Centre and its people with more automation, self-serve options, and new digital tools. These enhancements, along with other innovative people management practices and strategies, such as targeted recruitment campaigns and virtual career fairs, will ensure the Centre is positioned to attract, nurture, and retain the finest talents.

- FINTRAC's Workplace Wellness and Culture Action Plan (the Action Plan) was revised to capture the results of the most recent Public Service Employee Survey. In 2024–25, FINTRAC will focus on advancing the revised Action Plan's commitments to support and sustain a healthy and resilient workplace and the physical and psychological health and safety of employees, including the prevention and resolution of harassment and discrimination.

- In the year ahead, FINTRAC will undergo a comprehensive assessment of its organizational structure and job profiles, as well as a Pay Equity review. These actions will ensure that the Centre is equipped to address both its immediate and long-term priorities and prepared to take meaningful action to increase the diversity of the workforce and foster a culture of inclusiveness and accessibility. FINTRAC is committed to prioritizing initiatives and programs that improve access for employment equity and equity-seeking groups to positions of influence to achieve diversity, inclusion and equality in the workplace.

Snapshot of planned resources in 2024–25

- Planned spending: $14,880,237

- Planned full-time resources: 70

Related government priorities

Planning for contracts awarded to Indigenous businesses

FINTRAC is projecting to exceed the 5% target amount for 2023–24 and will continue to implement its plan to support the Procurement Strategy for Indigenous Businesses in 2024–25. Responding to Indigenous Services Canada in March 2023 and forthcoming in March 2024, FINTRAC has provided a Director and CEO approved procurement plan for meeting the mandatory minimum target, including approved exceptions, for the following two fiscal years.

FINTRAC continues to examine planned procurements at the pre-planning stage to identify opportunities for Indigenous businesses to be included in the process. There is a continued focus by procurement officers on purchasing commodities using tools that leverage Indigenous capacity (i.e., professional services and IT equipment suppliers), setting aside specific opportunities when beneficial to do so, and continuing to provide stakeholders with the tools and resources needed, along with proactive communication and timely change management practices.

| 5% reporting field | 2022–23 actual result | 2023–24 forecasted result | 2024–25 planned result |

|---|---|---|---|

| Total percentage of contracts with Indigenous businesses | 7.3% | 8.0% | 8.5% |

Planned spending and human resources

This section provides an overview of FINTRAC's planned spending and human resources for the next three fiscal years and compares planned spending for 2024–25 with actual spending from previous years.

In this section

Spending

Actual spending summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of FINTRAC's core responsibilities and for its internal services for the previous three fiscal years. Amounts for the current fiscal year are forecasted based on spending to date.

| Core responsibilities and internal services | 2021–22 actual expenditures | 2022–23 actual expenditures | 2023–24 forecast spending |

|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | $25,359,149 | $27,692,974 | $27,077,848 |

| Production and dissemination of financial intelligence | $20,558,417 | $22,877,752 | $31,464,940 |

| Subtotal | $45,917,566 | $50,570,726 | $58,542,788 |

| Internal services | $31,110,709 | $37,582,653 | $44,194,304 |

| Total | $77,028,275 | $88,153,379 | $102,737,092 |

Actual spending was $77.0M in 2021–22 and $88.2M in 2022–23, an increase of $11.2M (14%) following the receipt of new funding announced in Budget 2021 to develop virtual currency expertise, supervision of armoured car companies, and the implementation of a cost recovery funding model for FINTRAC's Compliance program and the receipt of new funding announced in Budget 2022 to further strengthen Canada's AML/ATF Regime.

The forecast for 2023–24 is expected to be to $102.7M, an increase of $14.6M, primarily due to the profile of funds approved to strengthen Canada's AML/ATF Regime by enabling FINTRAC to modernize its tools and processes, build capacity in evolving threat areas, protect its intelligence and information, preserve is supervisory capacity and expand its operations.

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of FINTRAC's core responsibilities and for its internal services for the upcoming three fiscal years.

| Core responsibilities and internal services | 2024–25 budgetary spending (as indicated in Main Estimates) | 2024–25 planned spending | 2025–26 planned spending | 2026–27 planned spending |

|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | $49,361,486 | $49,361,846 | $50,135,945 | $49,663,502 |

| Production and dissemination of financial intelligence | $41,827,939 | $45,123,869 | $31,729,349 | $31,376,115 |

| Subtotal | $91,189,785 | $94,485,715 | $81,865,294 | $81,039,617 |

| Internal services | $13,606,320 | $14,880,237 | $11,378,279 | $11,196,779 |

| Total | $104,796,105 | $109,365,952 | $93,243,573 | $92,236,396 |

Planned spending is expected to decrease from $109.4M in 2024–25 to $93.2M in 2025–26, a decrease in projected expenditures of $16.2M (15%). The following year, expenditures are anticipated to decrease by an additional $1.0M (-1.1%) to $92.2M in 2026–27.

The variance in planned spending between 2024–25 to 2025–26 and between 2025–26 and 2026–27 is largely based on the decrease in the profile of funds announced in Budget 2022 to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime. Additional spending decreases are attributable to the Government of Canada's refocusing spending exercise, which reaches the maximum amount in 2026–27.

The Financial Transactions and Reports Analysis Centre of Canada Assessment of Expenses Regulations will come into force on April 1, 2024, at which time FINTRAC will recover the annual cost of its Compliance function from prescribed reporting entities through the method set out in those Regulations. FINTRAC has refined its program allocation methodology starting in fiscal year 2024–25 in order to include the attribution of applicable direct and indirect costs that were previously captured under the Internal services category to programs. The forecast amount for Compliance forms the basis for the interim assessments to be recovered from reporting entities, with final assessments being determined after the fiscal year is complete.

2024–25 budgetary gross and net planned spending summary

The following table reconciles gross planned spending with net planned spending for 2024–25.

| Core responsibilities and internal services | 2024–25 gross planned spending | 2024–25 planned revenues netted against spending | 2024–25 planned net spending |

|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | $49,361,846 | $49,361,846 | $0 |

| Production and dissemination of financial intelligence | $45,123,869 | $0 | $45,123,869 |

| Subtotal | $94,485,715 | $49,361,846 | $45,123,869 |

| Internal services | $14,880,237 | $0 | $14,880,237 |

| Total | $109,365,952 | $49,361,846 | $60,004,106 |

In the Fall Economic Statement 2020, the Government of Canada announced its intention to amend the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to shift the source of funds for FINTRAC's Compliance function from voted appropriations to the persons and entities (i.e., reporting entities) it regulates. The amendments stipulate that each year, FINTRAC must ascertain the overall cost of carrying out its Compliance function as a regulator and supervisor during the previous fiscal year and then assess that amount against its reporting entities through a mechanism prescribed in regulations. It is anticipated that FINTRAC will be collecting revenues of $49.4M in 2024–25, which will be used to offset spending related to its Compliance function.

Funding

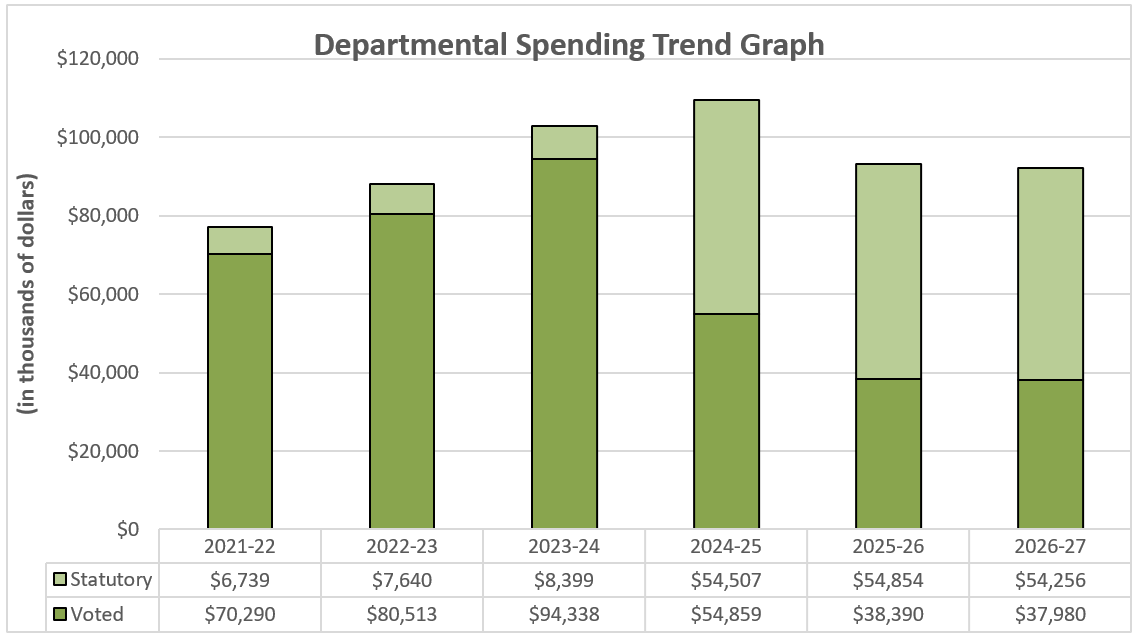

The following graph presents planned spending (voted and statutory expenditures) over time.

Figure 1: Departmental spending 2021–22 to 2026–27

Actual spending (2021–22 and 2022–23)

Actual spending was $77.0M in 2021–22 and $88.2M in 2022–23, an increase of $11.2M (14%). The increase in spending is primarily due to the following:

- Personnel expenditures, including statutory expenditures, increased by $6.0M following an increase in the number of full-time equivalents.

- Transportation and Telecommunications spending increased by $2.1M related to Budget 2022 funding as well as a return to normalized travel spending from pandemic levels.

- Rentals increased by $1.1M due to increased expenditures related to the rental of office buildings and informatics equipment and cloud services.

- Acquisitions of machinery and equipment increased by $1.2M due to increased purchases of informatics equipment.

- Further increases in spending related to information services, and repairs and maintenance in the amount of $0.8M.

Forecasted spending (2023–24)

Total authorities available for use in 2023–24 are anticipated to be $107.3M. This is an increase of $11.6M (12%) over the $95.7M in authorities available for use in 2022–23.

Forecasted spending is anticipated to be $102.7M in 2023–24, consisting of $93.6M in voted authorities and $9.1M in statutory authorities. This is an increase of $14.5M (16%) compared to the actual spending of $88.2M in 2022–23. FINTRAC's expenditures are expected to increase from the prior year due to the funding profile of the funding received in Budget 2022 to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime.

Planned spending (2024–25 to 2025–26)

Planned spending is expected to increase from $102.7M in 2023–24 to $109.4M in 2024–25, an increase in projected expenditures of $6.7M (6.5%). The following year, expenditures are anticipated to decrease by $16.2M (-15%) to $93.2M in 2025–26. Subsequent spending is expected to decrease by $1.0M (-1%) in projected expenditures to $92.2M for 2026–27. The variance in planned spending between 2024–25 to 2026–27 is largely based on reduced funding provided through the profile of funds approved to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, which will enable FINTRAC to modernize its tools and processes, build capacity in evolving threat areas, protect its intelligence and information, preserve its supervisory capacity and expand operations.

Estimates by vote

Information on FINTRAC's organizational appropriations is available in the 2024–25 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of FINTRAC's operations for 2023–24 to 2024–25.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on FINTRAC's website.

| Financial information | 2023–24 forecast results | 2024–25 planned results | Difference (2024–25 planned results minus 2023–24 forecast results) |

|---|---|---|---|

| Total expenses | $105,057,124 | $112,554,352 | $7,497,228 |

| Total revenues | $0 | $49,361,846 | $49,361,846 |

| Net cost of operations before government funding and transfers | $105,057,124 | $63,192,506 | $(41,864,618) |

Human resources

The following table shows a summary of human resources, in full-time equivalents (FTEs), for FINTRAC's core responsibilities and for its internal services for the previous three fiscal years. Human resources for the current fiscal year are forecasted based on year to date.

| Core responsibilities and internal services | 2021–22 actual FTEs | 2022–23 actual FTEs | 2023–24 forecasted FTEs |

|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 173 | 180 | 170 |

| Production and dissemination of financial intelligence | 131 | 137 | 147 |

| Subtotal | 304 | 317 | 328 |

| Internal services | 179 | 209 | 225 |

| Total | 483 | 526 | 542 |

Full-time Equivalents (FTE) was 483 in 2021–22 and increased to 526 in 2022–23. In 2023–24, FTEs are forecasted to increase to 542 due to new FTEs provided through the funding to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime by modernizing its tools and processes, building capacity in evolving threat areas, protecting its intelligence and information, preserving supervisory capacity and expanding its operations.

The following table shows information on human resources, in full-time equivalents (FTEs), for each of FINTRAC's core responsibilities and for its internal services planned for 2024–25 and future years.

| Core responsibilities and internal services | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents | 2026–27 planned full-time equivalents |

|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 273 | 271 | 271 |

| Production and dissemination of financial intelligence | 237 | 215 | 213 |

| Subtotal | 510 | 486 | 484 |

| Internal services | 70 | 62 | 61 |

| Total | 580 | 548 | 545 |

Between 2024–25 and 2025–26, FTEs will decrease from 580 to 548, and decrease further to 545 in 2026–27. These reductions in FTE levels are attributable to the decrease in funding profile announced in Budget 2022 to strengthen Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime as well as the introduction of spending reduction initiatives related to the Government of Canada's refocusing exercise.

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance

Institutional Head: Sarah Paquet, Director and Chief Executive Officer

Ministerial portfolio: Finance

Enabling instrument(s): Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c. 17. (PCMLTFA)

Year of incorporation / commencement: 2000

Organizational contact information

Mailing address

Financial Transactions and Reports Analysis Centre of Canada

234 Laurier Avenue West

Ottawa, Ontario K1P 1H7

Canada

Telephone: 1-866-346-8722 (toll free)

Email: guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Website: https://fintrac-canafe.canada.ca/intro-eng

Supplementary information tables

Information on FINTRAC's Departmental Sustainable Development Strategy can be found on FINTRAC's website.

Federal tax expenditures

FINTRAC's Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government-wide tax expenditures each year in the Report on Federal Tax Expenditures.

Definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A document that sets out a department's priorities, programs, expected results and associated resource requirements, covering a three year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

- A change that a department seeks to influence. A departmental result is often outside departments' immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that consists of the department's core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department's actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. Full time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA Plus)(analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological (sex) and socio-cultural (gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2024–25 Departmental Plan, government-wide priorities are the high-level themes outlining the Government's agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- horizontal initiative (initiative horizontale)

- An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- Indigenous business (entreprise autochtone)

- As defined on the Indigenous Services Canada website in accordance with the Government of Canada's commitment that a mandatory minimum target of 5% of the total value of contracts is awarded to Indigenous businesses annually.

- non budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- planned spending (dépenses prévues)

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

- program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within a department and that focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- An inventory of a department's programs that describes how resources are organized to carry out the department's core responsibilities and achieve its planned results.

- result (résultat)

- An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead, they are within the area of the organization's influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an Appropriation Act. The vote wording becomes the governing conditions under which these expenditures may be made.

- Date Modified: