Quarterly financial report for the quarter ended September 30, 2023

(unaudited)

ISSN 2817-2949

Cat. No. FD3-3E-PDF

1. Introduction

This quarterly report has been prepared by management as required by Section 65.1 of the Financial Administration Act, and in the form and manner prescribed by the Treasury Board of Canada Secretariat in the Directive on Accounting Standards, GC 4400 Departmental Quarterly Financial Reports. This Quarterly Financial Report should be read in conjunction with the 2023–24 Main Estimates for the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

This quarterly financial report has not been subject to an external audit or review.

1.1. Authority, mandate and program activities

FINTRAC (the Centre) is Canada’s financial intelligence unit and anti-money laundering and anti-terrorist financing regulator. The Centre assists in the detection, prevention and deterrence of money laundering and the financing of terrorist activities. FINTRAC's financial intelligence and compliance functions are a unique contribution to the safety of Canadians and the integrity of Canada's financial system.

FINTRAC acts at arm's length and is independent from the police services, law enforcement agencies and other entities to which it is authorized to disclose financial intelligence. It reports to the Minister of Finance, who is in turn accountable to Parliament for the activities of the Centre. FINTRAC’s headquarters is in Ottawa, with regional offices located in Montréal, Toronto, and Vancouver.

FINTRAC was established by, and operates within the ambit of, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its Regulations. The Centre is one of several domestic partners in Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, which is led by the Department of Finance Canada.

FINTRAC fulfills its mandate by engaging in the following activities:

- Receiving financial transaction reports and voluntary information in accordance with the legislation and regulations;

- Safeguarding personal information under its control;

- Ensuring compliance of reporting entities with the legislation and regulations;

- Maintaining a registry of money services businesses in Canada;

- Producing financial intelligence relevant to investigations of money laundering, terrorist activity financing and threats to the security of Canada;

- Researching and analyzing data from a variety of information sources that shed light on trends and patterns in money laundering and terrorist activity financing; and

- Enhancing public awareness and understanding of the threat posed by money laundering and terrorist activity financing.

In addition, FINTRAC is part of the Egmont Group, an international network of financial intelligence units that collaborate and exchange information to combat money laundering and terrorist activity financing across the globe. FINTRAC also contributes to other multilateral fora such as the Financial Action Task Force (FATF), the Asia-Pacific Group on Money Laundering (APG), the Caribbean Financial Action Task Force (CFATF) and the Global Coalition to Fight Financial Crime, participating in international policy-making and the provision of technical assistance to other FIUs.

The description of the program activities for the Centre can be found in Part II of the 2023–24 Main Estimates and in the 2023–24 Departmental Plan.

1.2. Basis of presentation

This quarterly financial report has been prepared by management using an expenditure basis of accounting and a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities. The accompanying Statement of Authorities includes the Centre’s spending authorities granted by Parliament, and those used by the Department, consistent with the Main Estimates and Supplementary Estimates for both fiscal years as well as transfers from Treasury Board central votes that are approved by the end of the quarter.

The authority of Parliament is required before monies can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts or through legislation in the form of statutory spending authority for specific purposes.

FINTRAC uses the accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted on by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

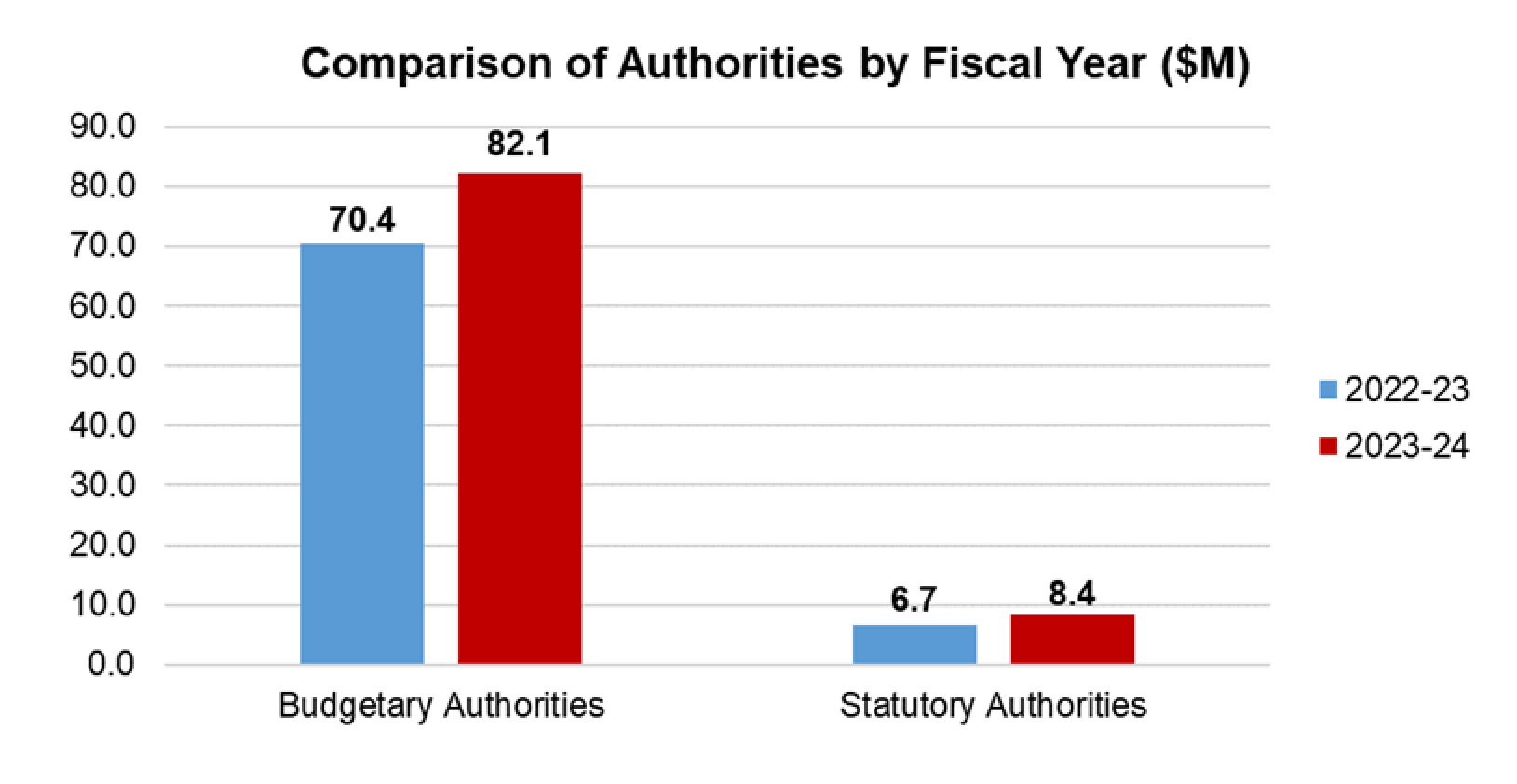

This departmental quarterly financial report reflects the results of the current fiscal period. The following graph provides a comparison of budgetary and statutory authorities available for the first six months of 2023–24 compared to 2022–23.

2.1. Authorities analysis

The following table provides a comparison of cumulative authorities by vote for the current and previous fiscal years.

| Authorities available ($ thousands) |

2023–24 | 2022–23 | Variance ($) | Variance (%) |

|---|---|---|---|---|

| Budgetary | ||||

| Voted | ||||

| Vote 1 – Program authorities | 82,139 | 70,383 | 11,756 | 17% |

| Statutory | ||||

| Employee benefits plan | 8,399 | 6,694 | 1,705 | 25% |

| Total budgetary authorities | 90,538 | 77,076 | 13,462 | 17% |

| Non-budgetary | 0 | 0 | 0 | 0% |

| Total authoritiesFootnote 1 | 90,538 | 77,076 | 13,462 | 17% |

2.1.1. Voted budgetary authorities

The total Vote 1 – Program Authorities available as at September 30, 2023 are $82.1 million compared to $70.4 million for the same period in 2022–23.

2.1.2. Statutory budgetary authorities

The total statutory authorities available as at September 30, 2023 are $8.4 million compared to $6.7 million for the same period in 2022–23, which represents an increase of $1.7 million or 25%.

2.2. Expenditure analysis

The following table provides a comparison of year-to-date spending as at September 30, 2023, by Vote for the current and previous fiscal years.

| Year-to-date expenditures ($ thousands) |

2023–24 | 2022–23 | Variance ($) |

Variance (%) |

|---|---|---|---|---|

| Budgetary | ||||

| Voted | ||||

| Vote 1 – Program expenditures | 38,157 | 32,180 | 5,977 | 19% |

| Statutory | ||||

| Employee benefits plan | 4,199 | 2,231 | 1,968 | 88% |

| Total budgetary expenditures | 42,356 | 34,411 | 7,945 | 23% |

| Non-budgetary | 0 | 0 | 0 | 0% |

| Total year-to-date expendituresFootnote 2 | 42,356 | 34,411 | 7,945 | 23% |

2.2.1. Voted budgetary expenditures

Total voted expenditures at September 30, 2023 were $38.2 million in 2023–24 compared to $32.2 million in 2022–23, an increase of $6 million or 19%. The net increase is the result of the following variances in expenditure categories:

- Personnel expenditures increased by $5.7 million commensurate with an increase in personnel, as well as the implementation of an approved annual cost of living increase;

- Expenditures for transportation and communication increased by $0.8 million. The variance is primarily due to the timing of invoicing for telecommunications ($0.5M).

- Expenditures for professional and special services increased by $0.8 million related primarily to translation services, security services, moving services, and new office furniture.

- Rental costs decreased by $1.5 million. The majority of this decrease is related to the timing for the lease payment of the HQ building.

- Expenditures for information decreased by $0.3 million mainly due to lower expenditures for electronic publications.

- The remaining variance is a small increase in purchase, repair and maintenance expenditures ($0.2M) as well as acquisition of machinery and equipment expenditures ($0.3M).

2.2.2. Statutory budgetary expenditures

Statutory expenditures in the first two quarters increased by $2.0 million or 88%, from $2.2 million during 2022–23 to $4.2 million in 2023–24. This is due, in large part, to timing differences in the payment of these expenditures ($1.1 million). The remaining variance is due to a decrease in employer contributions to the public service pension and death benefit programs proportional to the increase in personnel expenditures for students who do not participate in these programs. This decrease was offset by a small increase in employer contributions to Employment Insurance (EI) and Canada Pension Plan (CPP) as a result of increased personnel expenditures.

3. Risks and uncertainties

As Canada’s financial intelligence unit and a partner in Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime, FINTRAC operates in a dynamic, constantly changing environment. In seeking to identify risks and opportunities proactively, FINTRAC must anticipate and assess internal and external risk factors that can affect the design and delivery of its programs and the achievement of its strategic objectives. Additionally, FINTRAC must identify factors and risks that could adversely affect its ability to manage its resources effectively.

FINTRAC maintains a Corporate Risk Profile (CRP) to identify and manage its key corporate risks. The development of the CRP is a self-assessment process to identify, validate and measure risks where action or intervention can improve results or prevent harm. Senior level committees review the CRP regularly and the business planning process identifies activities to mitigate the risks. The objective of the CRP is to create information that FINTRAC managers and decision makers can use when planning and setting priorities.

3.1. Risk factors and mitigation

One area of risk identified in FINTRAC’s CRP is that legacy IM/IT hardware and software capacity will limit the Centre’s ability to achieve its objectives. FINTRAC depends on a sophisticated information technology infrastructure to receive, store and secure over 30 million new financial transaction reports every year. The Centre’s systems support the heavily technology-enabled Compliance Framework, allowing businesses to submit financial transaction reports, facilitating the tracking and recording of compliance, and enabling businesses to meet their legislative and regulatory obligations. At the same time, this infrastructure allows intelligence analysts to filter the information, analyze it and generate actionable financial intelligence for Canada’s police, law enforcement and national security agencies. This is only possible with modern systems that can manage the high volume of information, make the connections and produce the needed results, all in real-time or close to it.

To address the risks related to legacy IM/IT hardware and software capacity, FINTRAC is engaged in a broad multi-year modernization effort underpinned by its long-term Digital Strategy. With the support of significant new funding in Budget 2023, the Centre is focused on upgrading its information technology systems in order to keep pace with the rapid technological innovation taking place in the financial sector and all sectors around the world. FINTRAC’s Digital Strategy is focused on ensuring the organization is able to leverage new and emerging technology, add business value, improve performance, enhance digital services, enrich the user experience and explore modern new ways to deliver on the Centre’s mandate.

4. Significant changes in relation to operations, personnel and programs

4.1. Key personnel changes

There were no key personnel changes at the executive level during the second quarter of fiscal year 2023–24.

5. Approval by senior officials

Approved by:

Jessica Kaluski, Chief Financial Officer (CFO)

Date: November 30, 2023

Donna Achimov, A/Director and Chief Executive Officer

Date: November 30, 2023

| Fiscal year 2023–24 | Fiscal year 2022–23 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2024 Footnote 3 | Used during the quarter ended September 30, 2023 | Year-to-date used at quarter-end | Total available for use for the year ending March 31, 2023 Footnote 4 | Used during the quarter ended September 30, 2022 | Year-to-date used at quarter-end | |

| Budgetary authorities | ||||||

| Vote 1 – Program expenditures | 82,139 | 20,471 | 38,157 | 70,383 | 17,642 | 32,180 |

| Budgetary statutory authorities | ||||||

| Contributions to employee benefit plans | 8,399 | 2,100 | 4,199 | 6,694 | 558 | 2,231 |

| Total budgetary authorities | 90,538 | 22,571 | 42,356 | 77,076 | 18,200 | 34,411 |

| Non-budgetary authorities | 0 | 0 | 0 | 0 | 0 | 0 |

| Total authorities Footnote 5 | 90,538 | 22,571 | 42,356 | 77,076 | 18,200 | 34,411 |

| Expenditures | Fiscal year 2023–24 | Fiscal year 2022–23 | ||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending March 31, 2024 | Expended during the quarter ended September 30, 2023 | Year-to-date used at quarter-end | Planned expenditures for the year ending March 31, 2023 | Expended during the quarter ended September 30, 2022 |

Year-to-date used at quarter-end | |

| Personnel | 62,203 | 18,213 | 34,564 | 52,382 | 13,153 | 26,876 |

| Transportation and communications | 919 | 764 | 992 | 1,042 | 161 | 235 |

| Information | 872 | 92 | 409 | 452 | 453 | 723 |

| Professional and special services | 5,927 | 2,384 | 3,502 | 10,958 | 1,768 | 2,698 |

| Rentals | 7,767 | 679 | 1,464 | 7,291 | 2,080 | 2,963 |

| Repair and maintenance | 573 | 73 | 570 | 570 | 146 | 369 |

| Utilities, materials and supplies | 204 | 65 | 99 | 278 | 70 | 125 |

| Acquisition of land, buildings and works | 0 | 0 | 0 | 0 | 0 | 0 |

| Acquisition of machinery and equipment | 12,068 | 268 | 721 | 4,088 | 361 | 410 |

| Transfer payments | 0 | 0 | 0 | 0 | 0 | 0 |

| Other subsidiaries and payments | 3 | 33 | 34 | 16 | 9 | 12 |

| Total budgetary expenditures Footnote 6 | 90,538 | 22,571 | 42,356 | 77,076 | 18,200 | 34,411 |

- Date Modified: