2023–24 annual report on the administration of the Access to Information Act

On this page

- Introduction

- About FINTRAC

- The Access to Information and Privacy Office

- Delegation of authority

- Statistical overview and accomplishments

- Reporting on access to information fees for the purposes of the Service Fees Act

- ATIP awareness and education

- New access to information-related policies, guidelines, procedures, or initiatives

- Access to information program performance and monitoring

- Closing

- Annex A – Director and Chief Executive Officer’s delegation order

Introduction

This report to Parliament, which is prepared and tabled in accordance with Section 94 of the Access to Information Act and Section 20 of the Service Fees Act, describes the activities of the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in administering these Acts during fiscal year 2023–24. This report should be considered along with FINTRAC’s 2023–24 Annual Report on the Administration of the Privacy Act, which is tabled separately.

The purpose of the Access to Information Act (hereafter the “Act”) is to provide a right of access to information held by government institutions. It does so in accordance with three principles: information should be available to the public; necessary exceptions to the right of access should be limited and specific; and decisions on the disclosure of government information should be reviewed independently of government.

About FINTRAC

FINTRAC is Canada’s financial intelligence unit and anti-money laundering and anti-terrorist financing supervisor. It plays a critical role in combatting money laundering, terrorism financing, and threats to the security of Canada. The Centre has two core responsibilities framed around a duty to protect the personal information with which it is entrusted.

First, FINTRAC is responsible for ensuring compliance with Part 1 and 1.1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and its associated Regulations. This legal framework establishes obligations for reporting entities to develop a compliance regime in order to identify clients, monitor business relationships, keep records, and report certain types of financial transactions to FINTRAC. These obligations allow for certain economic activities to be more transparent, which helps prevent and deter nefarious individuals and organizations from using Canada’s legitimate economy to launder the proceeds of their crimes or finance terrorist activities. FINTRAC is committed to working with businesses to help them understand and comply with their obligations. The Centre also takes firm action when it is required to ensure that businesses take their responsibilities seriously. This includes undertaking compliance enforcement action such as follow-up examinations, the development and monitoring of action plans imposed on businesses and the levying of administrative monetary penalties. The Centre also maintains a registry of Canadian-based money services businesses and foreign money services businesses that direct and provide services to persons and entities in Canada.

Second, FINTRAC generates actionable financial intelligence that assists Canada's police, law enforcement, national security agencies, and international partners in combatting money laundering, terrorism financing and threats to the security of Canada. In addition, the Centre produces strategic financial intelligence for federal policy and decision-makers, the security and intelligence community, reporting entities across the country, international partners, and other stakeholders. FINTRAC's strategic intelligence provides a wide analytic perspective on the nature, scope, and threat posed by money laundering and terrorism financing.

The Access to Information and Privacy Office

FINTRAC’s Access to Information and Privacy (ATIP) Office is responsible for leading, coordinating, and undertaking the Centre’s access to information and privacy responsibilities. The ATIP Office is part of FINTRAC’s Communications Group and led by the Centre’s Head of Communications, who reports directly to FINTRAC’s Director and Chief Executive Officer. The Head of Communications, who is also the Centre’s Chief Privacy Officer, is responsible for the overall management of all access to information and privacy matters within FINTRAC.

FINTRAC’s ATIP Office consists of an ATIP Coordinator and two Senior ATIP Advisors. Key responsibilities of the ATIP Office include:

- developing and implementing policies, procedures, and guidelines to ensure FINTRAC’s compliance with the Act and the Privacy Act;

- ensuring the timely processing of access to information and privacy requests, and meeting proactive disclosure obligations;

- providing advice, guidance, and awareness activities to FINTRAC employees, contractors, and students on ATIP-related matters;

- representing FINTRAC in its discussions and negotiations with external stakeholders, including other government departments, third parties, the Treasury Board of Canada Secretariat, the Office of the Information Commissioner, the Office of the Privacy Commissioner and the general public;

- maintaining Personal Information Banks and conducting privacy impact assessments; and

- preparing annual reports on the administration of the Act and the Privacy Act to Parliament and publishing FINTRAC’s Info Source Chapter.

To support the ATIP Office in meeting its legislative obligations, FINTRAC has established a collaborative network comprised of representatives from all sectors and relevant units within the Centre. These representatives are responsible for coordinating requests, providing guidance on the Act within their work units, and liaising with the ATIP Office on all ATIP-related matters. FINTRAC is not party to any service agreements under section 96 of the Act.

Delegation of authority

Order in Council P.C. 2000-1066 designates the Director and Chief Executive Officer of the Centre as head of FINTRAC for the purposes of administering the Act and FINTRAC’s privacy program. Pursuant to Section 73 of the Act, FINTRAC’s Director and Chief Executive Officer delegated the authority to exercise the powers, functions and duties under the Act to FINTRAC’s Head of Communications and its ATIP Coordinator. These functions have full-delegated authority under the Act and the Privacy Act, in accordance with the delegation of authority instrument approved by the Director and Chief Executive Officer in March 2023.

A copy of the Director and Chief Executive Officer’s Delegation Order in place during 2023–24 is in Annex A.

Statistical overview and accomplishments

Performance of access request case activity

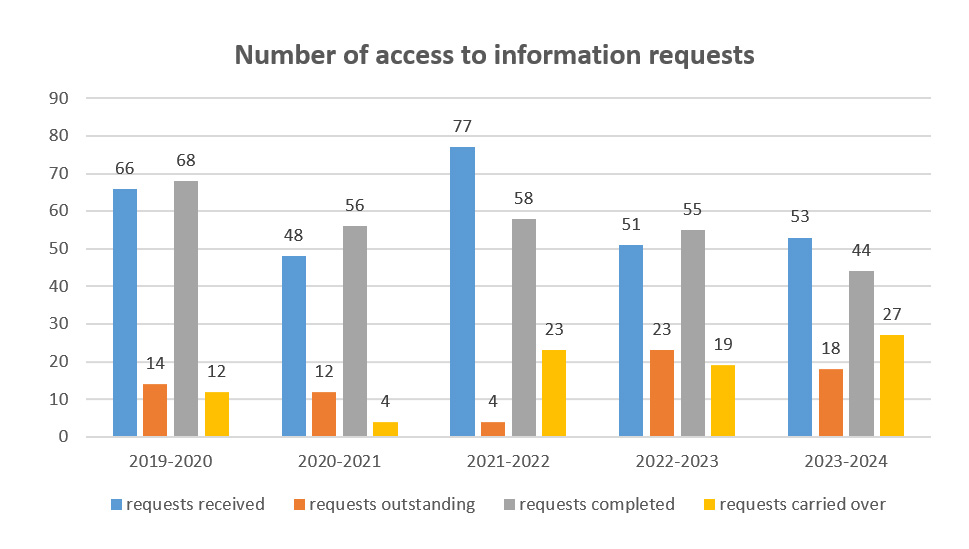

During the reporting period of April 1, 2023 to March 31, 2024, there was a 4% increase in the number of access requests received by FINTRAC (53) as compared to the previous year (51). FINTRAC also managed 18 requests that were outstanding from a previous fiscal year, bringing the total caseload to 71. Of these, FINTRAC closed 44 requests in 2023–24:

- 9 requests were completed in 1-15 days

- 19 requests were completed in 16-30 days

- 4 requests were completed in 31-60 days

- 8 requests were completed in 61-120 days

- 1 request was completed in 121-180 days

- 1 request was completed in 181-365 days

- 2 requests were completed in more than 365 days

View the text equivalent Number of access to information requests

| Year | Requests received | Requests outstanding | Requests completed | Requests carried over |

|---|---|---|---|---|

| 2019–20 | 66 | 14 | 68 | 12 |

| 2020–21 | 48 | 12 | 56 | 4 |

| 2021–22 | 77 | 4 | 58 | 23 |

| 2022–23 | 51 | 23 | 55 | 19 |

| 2023–24 | 53 | 18 | 44 | 27 |

Of the 71 requests active during 2023–24, 27 were carried over to 2024–25. Of those, 14 were carried over within the legislated timeline. Of the remaining 13 that were carried over beyond legislated timelines, 3 requests were received in 2023–24 and 10 were carried over from previous fiscal years and are delayed due to unfinished consultations with other government institutions.

In 2023–24, FINTRAC’s on-time response rate improved to 91% from 82% in the previous reporting year. FINTRAC’s on-time response rate is once again above the federal government's overall average response rate of 72% in 2022–23. FINTRAC’s response to many requests required the intensive review of complex records, including extensive internal and external consultations. FINTRAC observed a significant increase in the time required by other institutions to respond to consultations, which was the primary cause of FINTRAC not meeting the statutory deadline on some requests.

Disposition of completed access requests

FINTRAC completed 44 access requests in 2023–24:

- In 9 cases, representing 20.5% of the overall cases, the applicants received full disclosure of the information requested (a combined 59 pages).

- In 15 cases, representing 34% of the overall cases, the applicants received a partial disclosure of the information requested (a combined 1,905 pages).

- In 1 case, representing 2% of the overall cases, the applicant received a response that the information requested was fully withheld from disclosure.

- In 10 cases, representing 23% of the overall cases, it was determined that no responsive records existed.

- In 9 cases, representing 20.5% of the overall cases, the applicants abandoned their requests.

Completion times and extensions of access requests

The Act allows extensions beyond the 30-day statutory period for specific reasons. Of the 44 completed requests during the reporting period, 40 were finalized within the established deadline (the 30-day statutory or an extended deadline pursuant to Section 9 of the Act). Due to delays resulting from internal and/or external consultations, as well as operational challenges/pressures, 4 requests were completed after their established deadline.

In 2023–24, FINTRAC required an extension to the original 30-day statutory deadline in 16 instances. The following is a breakdown of these cases:

- Paragraph 9(1)(a) was invoked 5 times to overcome workload challenges and operational constraints.

- Paragraph 9(1)(b) was invoked 3 times in order to complete consultations with other government institutions.

- Paragraph 9(1)(a) and (b) were invoked 4 times in order to overcome workload challenges and complete consultations with other government institutions.

- Paragraph 9(1)(a) and (c) were invoked 4 times in order to overcome workload challenges and complete third-party consultations.

Consultations under the Act

Consultations undertaken between institutions are an essential part of processing requests under the Act. They afford institutions that have an interest in the records proposed for disclosure with an opportunity to make recommendations to the processing institution. For this reporting period, FINTRAC completed 18 consultation requests received from other Government of Canada institutions.

Complaints and investigations of access requests

Subsection 30(1) of the Act describes how the Office of the Information Commissioner receives and investigates complaints from individuals regarding the processing of requests under the Act. In 2023–24, FINTRAC received nine complaints under the Act, eight of which centred on extensions taken by FINTRAC to process and respond to the requests, and one alleged that the Centre improperly withheld information under the Act. FINTRAC provided initial representations to the Office of the Information Commissioner in relation to these complaints; however, only one was resolved during the reporting year. The resolved complaint was discontinued in the course of the investigation.

Informal requests

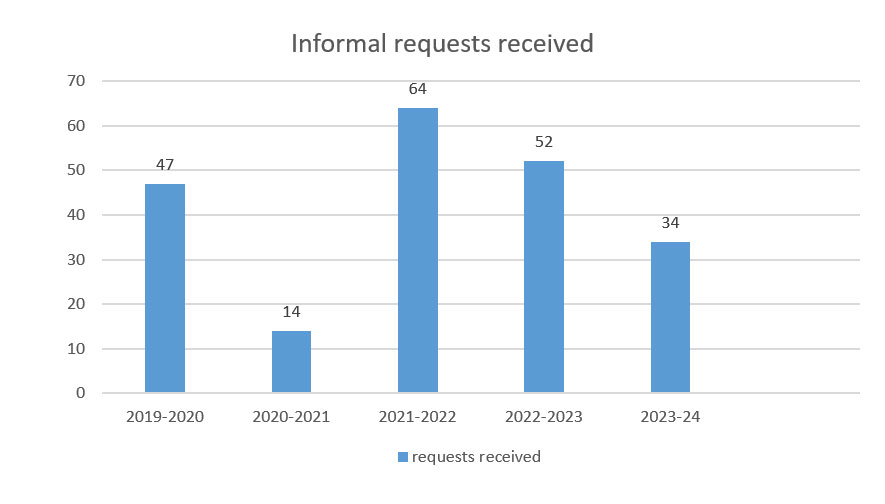

In 2023–24, FINTRAC received 34 informal requests for copies of records released in previously-processed requests. The Centre processed 28 of the informal requests within 30 days and 6 were carried forward to the next reporting period. The following chart shows the number of informal requests received by FINTRAC over the past five years.

View the text equivalent Informal requests received

| 2019–20 | 47 |

|---|---|

| 2020–21 | 14 |

| 2021–22 | 64 |

| 2022–23 | 52 |

| 2023–24 | 34 |

Reporting on access to information fees for the purposes of the Service Fees Act

The Service Fees Act requires a responsible authority to report annually to Parliament on the fees collected by the institution.

With respect to fees collected under the Access to Information Act, the information below is reported in accordance with the requirements under section 20 of the Service Fees Act.

| Total revenues (the $5 application fee is the only fee charged for an ATI request) |

$230 |

|---|---|

| Total operating cost | $261,707 |

In accordance with the Interim Directive on the Administration of the Act, issued on May 5, 2016, and the changes to the Access to Information Act that came into force on June 21, 2019, FINTRAC waives all fees prescribed by the Act and Regulations, other than the $5 application fee set out in paragraph 7(1)(a) of the Regulations. During the reporting period, FINTRAC waived the application fee on 7 occasions, totaling $35.

ATIP awareness and education

Information protection is integral to FINTRAC’s mandate. As such, FINTRAC requires its employees (including students and contractors) to have a heightened awareness of security, privacy, information management and access to information. The FINTRAC Code of Conduct, Values and Ethics specifically describes employees’ legal obligations to protect information under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and makes reference to the Privacy Act, the Canadian Charter of Rights and Freedoms, the Access to Information Act, and the Centre’s privacy, security and information management policies. Adherence to the Code of Conduct, Values and Ethics is a condition of employment for every FINTRAC employee.

The following training and awareness activities took place during the reporting period:

- The ATIP Office published monthly information notices regarding access to information and privacy protection on FINTRAC’s intranet site.

- The ATIP Office also raises awareness by providing day-to-day coaching and targeted information sessions to ATIP representatives across the Centre. In 2023–24, 4 one-on-one training sessions were delivered. This focused training fosters a spirit of collaboration and has been essential to the success of FINTRAC’s broader ATIP program.

- Work is currently underway to modify FINTRAC’s existing ATIP awareness training to a self-directed, online learning format. While working on this modified training format, the ATIP Office delivered 1 virtual ATIP awareness session to 15 employees during the 2023–24 period.

- Access to information and privacy protection messaging is incorporated in mandatory Information Management awareness sessions and in New Employee Orientation Training. In 2023–24:

- Information Management awareness training was received by 151 employees. The sessions raised employee awareness about their information management responsibilities, including in relation to ATIP, and covered the obligations and best practices for managing personal information in accordance with the Privacy Act, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and FINTRAC’s privacy, security, and information management policies.

- The New Employee Orientation Training moved to a virtual/hybrid format and is currently being redesigned into a self-directed, online learning format. The training provides information about the Centre’s mandate and reinforces to employees the importance of information management and safeguarding information and privacy as fundamental components of the work undertaken by FINTRAC. A total of 60 employees and students completed this virtual training.

- FINTRAC employees completed the following online learning courses at the Canada School of Public Service:

- Access to Information and Privacy Fundamentals (4 employees)

- Access to Information in the Government of Canada (2 employees)

- Privacy in the Government of Canada (1 employee)

New access to information-related policies, guidelines, procedures, or initiatives

None to report.

Access to information program performance and monitoring

FINTRAC’s automated case management system facilitates timely responses to requests, documents important actions and decisions, and monitors performance. The system also includes an audit log, has extensive search capabilities to enable analysis of previously processed information, and generates progress and statistical reports. FINTRAC uses the centralized platform ATIP Online Management Tool to receive requests under the Act and communicate with applicants.

FINTRAC is committed to transparency and to helping requesters gain access to readily available information whenever possible. The ATIP Office works closely with sector representatives on all aspects of requests, including ensuring that it is appropriately consulting with FINTRAC partners on information that may affect them if disclosed to the public.

The ATIP Office works with its operational colleagues to assess the implications of making more information available on the Open Government website, and how it can best accommodate frequent recurring requests for specific information. Of note, FINTRAC regularly receives and responds to requests for specific statistical details from its holdings of financial transaction reports. Such requests frequently require significant effort and review to produce data that is comprehensive enough to assist the requestor, yet ensures that FINTRAC’s financial intelligence is protected.

The ATIP Office provides updates to senior management within FINTRAC’s corporate governance, as well as providing briefings on ATIP files to FINTRAC’s Executive Committee on a regular basis.

Proactive publication

As per its Directive on Proactive Disclosure, FINTRAC has an established process in place to ensure the Centre meets all of the proactive publication requirements under Part 2 of the Act. The Directive sets out the roles and responsibilities for all proactive publishing obligations. The ATIP Office is responsible for ensuring and documenting FINTRAC’s compliance with the Act’s requirements.

During the 2023–24 reporting period, FINTRAC met the proactive publication requirement 44 out of 47 times, resulting in a compliance rate of 94%. The Centre publishes its proactive disclosure requirements on open.canada.ca and on fintrac-canafe.canada.ca.

The following table identifies the proactive disclosure requirements for FINTRAC under Part 2 of the Act, Sections 82 to 88.

| Legislative requirement | Section | Publication timeline | Institutional requirement |

|---|---|---|---|

| All Government institutions as defined in section 3 of the Access to Information Act | |||

| Travel expenses | 82 | Within 30 days after the end of the month of reimbursement | Yes |

| Hospitality expenses | 83 | Within 30 days after the end of the month of reimbursement | Yes |

| Reports tabled in Parliament | 84 | Within 30 days after tabling | Yes |

| Government entities or departments, agencies, and other bodies subject to the Act and listed in schedules I, I.1, or II of the Financial Administration Act | |||

| Contracts over $10,000 | 86 | Q1-3: Within 30 days after the quarter

Q4: Within 60 days after the quarter |

Yes |

| Grants and contributions over $25,000 | 87 | Within 30 days after the quarter | No |

| Packages of briefing materials prepared for new or incoming deputy heads or equivalent | 88(a) | Within 120 days after appointment | Yes |

| Titles and reference numbers of memoranda prepared for a deputy head or equivalent, that is received by their office | 88(b) | Within 30 days after the end of the month received | Yes |

| Packages of briefing materials prepared for a deputy head or equivalent’s appearance before a committee of Parliament | 88(c) | Within 120 days after appearance | Yes |

Closing

FINTRAC remains fully committed to applying the spirit and intent of the Act to ensure openness, transparency, and consistency when processing requests within its organization and when responding to the Canadian public.

Annex A – Director and Chief Executive Officer’s delegation order

Delegation order – Access to Information Act and regulations

Pursuant to Section 95 of the Access to Information Act, the Financial Transactions and Reports Analysis Centre of Canada's Director and Chief Executive Officer delegates the full authority to exercise the powers, functions and duties under the Access to Information Act to the Manager of Communications and Chief Privacy Officer, and to the Access to Information and Privacy Coordinator. This delegation order also applies to persons occupying any of these positions on an acting basis.

This designation takes effect as of March 31, 2023

Sarah Paquet

Director and Chief Executive Officer

Financial Transactions and Reports Analysis Centre of Canada

234 Laurier Avenue West

Ottawa, Ontario K1P 1H7 Canada

Telephone: 1-866-346-8722

fintrac-canafe.canada.ca

ISSN 2563-7355

Cat. No. FD2-6/1E-PDF

- Date Modified: