Updated indicators: Laundering the proceeds of crime through underground banking schemes

Reference number: FINTRAC-2023-OA002

July 2023

Purpose

This Operational Alert updates FINTRAC’s 2019 Project Athena Operational Alert Laundering the proceeds of crime through a casino-related underground banking scheme. It lists additional indicators to assist reporting entities in recognizing financial transactions suspected of being related to the laundering of proceeds of crime with roots in underground banking related to China, notably in Hong Kong. Through financial transaction reports, FINTRAC is able to facilitate the detection, prevention and deterrence of all stages of money laundering (placement, layering and integration) and the financing of terrorist activities by providing actionable financial intelligence disclosures to law enforcement and national security agencies.

Project Athena

A public-private partnership in collaboration with the Combined Forces Special Enforcement Unit – British Columbia and supported by FINTRAC. First launched in 2019, Project Athena focuses on improving the collective understanding of the money laundering threat, strengthen financial systems and controls, and disrupt money laundering activity in British Columbia and across Canada.

Background

Underground banking refers to banking activities that run parallel to and operate outside of the formal banking system, commonly in the form of informal value transfer. Informal value transfer systems involve dealers who facilitate the transfer of value to a third party in another jurisdiction without having to physically move the items. The final settlement between brokers occurs through the exchange of cash, trade or by other means. Informal value transfer systems are regulated under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act but are often successfully exploited in an effort to evade sanctions, state currency control restrictions through capital flight, or to facilitate criminal activities such as professional money laundering (see FINTRAC’s Sectorial and Geographic Advisory on Underground Banking for a comprehensive perspective). For the purposes of this Operational Alert, underground banking refers to the criminal abuse of the informal value transfer sector to launder the proceeds of crime.

Underground banking and the formal banking system inevitably intersect as certain transactions demand the use of the formal banking system, such as the purchase of financial instruments used to launder funds through various sectors such as the real estate or automotive industries. It is at this stage where underground banking is partially observed by regulated financial institutions and becomes subject to FINTRAC reporting obligations.

Given the focus of Project Athena on links to China, notably in Hong Kong, the indicators in this Operational Alert reflect underground banking activities suspected of being tied to China-linked money laundering organizations. The prominence of China, notably Hong Kong, in the indicators is a result of professional money launderers exploiting efforts by the Chinese diaspora in Canada to circumvent currency control restrictions to access their funds outside of that country. Hong Kong provides a key geographic risk as a transition point for China-based transactions into international underground banking schemes given that, as a Special Administrative Region, Hong Kong is excluded from the currency controls in place for the rest of China. Although not all funds entering Canada from China are necessarily avoiding Chinese currency control restrictions, nor is the circumvention of these controls in itself a crime in Canada, the currency control restrictions create black market opportunities for professional money launderers to launder proceeds of crime.

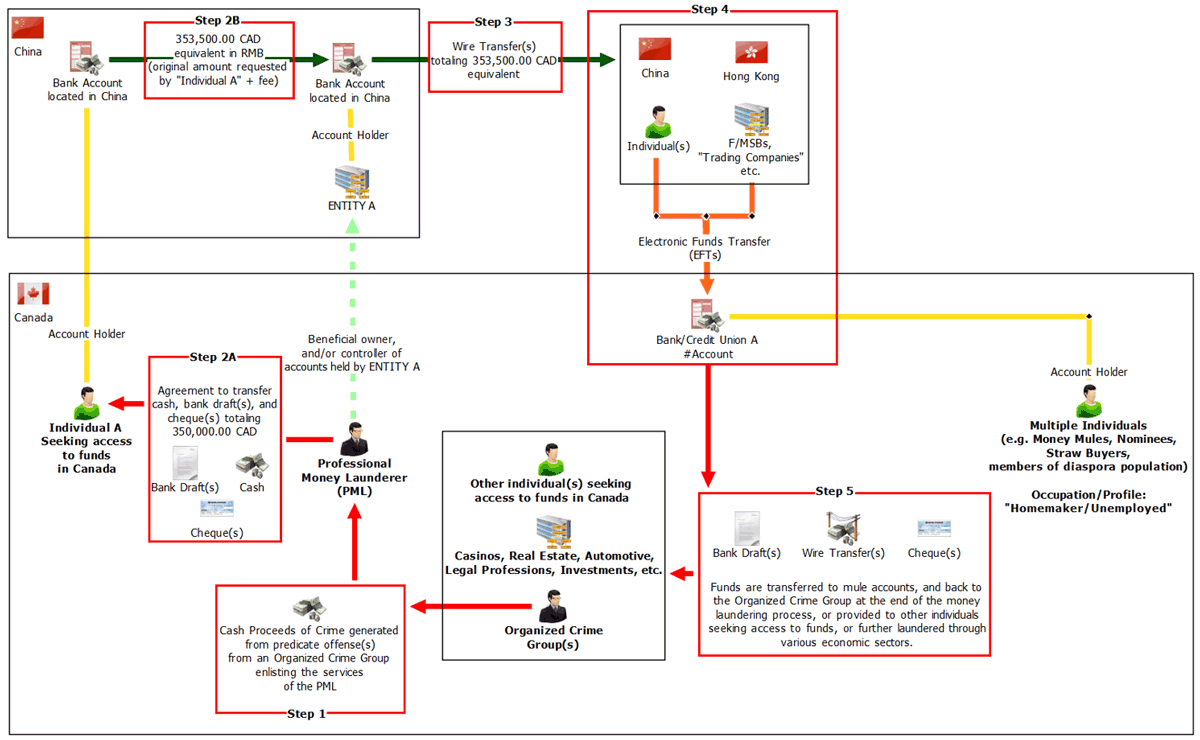

Figure 1 illustrates one method of informal value transfer systems that the Chinese-Canadian diaspora may use to move their funds from China/Hong Kong to Canada. Funds are transferred to the bank/credit union accounts of multiple, unrelated individuals in Canada, by means of foreign money service businesses (MSBs). This mechanism provides professional money launderers with a potential supply of money mulesFootnote 1 who can receive deposits of cash sourced from the professional money launderers’ criminal clients, following a transfer of the customers’ funds held in China. Transactions from informal value transfer systems simultaneously facilitates money laundering and the circumvention of Chinese currency controls.

Figure 1: Underground banking key steps

View the text equivalent

Informal value transfer systems are misused by professional money launderers to move funds between China/Hong Kong and Canada.

The method starts with a criminal organization hiring a professional money launderer to return laundered proceeds of crime back to them.

The professional money launderer then enters into an agreement to transfer a given amount to an individual seeking access their funds in Canada for an equivalent transfer between their accounts in China.

Next, the professional money launderer initiates transfer of funds in China to a foreign MSB in China that then transfers funds to multiple individuals in Canada by means of bank drafts, cheques and wire transfers.

These individuals serve as money mules who can then move funds back to the criminal organizations through bank drafts, wire transfers or cheques.

Evolution of Project Athena

Project Athena, a public-private partnership focused on combatting money laundering in Canada, initially began as a Combined Forces Special Enforcement Unit – British Columbia probe into the use of bank drafts at casinos in Lower Mainland, British Columbia. As money laundering was also observed to be taking place beyond the casino sector, Project Athena’s scope expanded to a national level and includes other sectors such as real estate, securities, and automotive.

Casino-related underground banking transactions showed a continuation of the same activity highlighted in the 2019 Operational Alert on laundering the proceeds of crime through a casino-related underground banking scheme. However, as a result of the temporary closures of Canadian casinos due to the COVID-19 pandemic, professional money launderers began to diversify their money laundering methods. During this time, FINTRAC observed a rise in money laundering typologies involving transferring large sums of funds to Canada from foreign money services businesses, often located in China, notably Hong Kong, and the laundering of the funds primarily through the real estate, securities, automotive and the legal professions. FINTRAC also observed a resurgence of casino transactions when casinos re-opened in between the pandemic-related temporary closures. Therefore, FINTRAC’s indicators on casino-related transactions remain relevant.

Overview of FINTRAC’s analysis of disclosures related to laundering the proceeds of crime through an underground banking scheme

FINTRAC analyzed a sample of nearly 48,000 transactions in relation to the laundering of the proceeds of crime through underground banking schemes. The majority of the underground banking-related disclosures primarily involved incoming wire transfers from entities or individuals in China, notably in Hong Kong, followed by the movement of these funds through financial institutions into the following sectors: casinos, real estate, securities, automotive and the legal profession. There were instances of crossover between these sectors. Overall, electronic funds transfers, email money transfers, cash deposits, and bank drafts were the primary transaction types used in underground banking-related disclosures. Additionally, FINTRAC observed the frequent layering of funds between related accounts and the use of investment accounts to launder funds.

Commonly listed occupations for individuals involved in disclosures related to underground banking schemes included students; homemakers; office managers; business owners/CEOs (frequently listed within the automotive industry, construction/property development and securities firms); real estate agents; and unemployed. FINTRAC notes that it is possible that many of these individuals reported in suspicious transactions involving Project Athena with a listed occupation of student, homemaker, office manager and unemployed were used as money mules. These individuals also operated as “straw buyers”Footnote 2, purchasing assets with funds received from individuals or entities in China, notably Hong Kong. Additionally, these individuals may also service Asian “daigou”Footnote 3 networks by buying high demand goods on behalf of clients in China. Although not illegal, “daigou” networks, by their nature, obscure both the identity of the client and source of funds, which creates an effective mechanism to integrate illicit cash into Chinese underground banking. Differentiating between entrepreneurial activity and money laundering in “daigou” networks may be challenging.

Use of money mules

The bank accounts of suspected money mules demonstrated in-and-out activity, with a high volume of cash deposits or large incoming wire transfers from parties located in China, notably in Hong Kong, whose relationship is unknown. These funds were then used to purchase bank drafts payable to individuals and/or entities listed in the following sectors: real estate, securities, automotive and the legal profession.

Misuse of real estate

Funds going through the real estate sector were sent to individuals involved in property management, real estate development, real estate agents, sellers, brokers, real estate consultants, mortgage brokers, and individuals who own any of these types of businesses. Often, incoming funds from China, notably in Hong Kong, were used to fund a series of structured draft purchases to a property developer with memos referencing the same address or a series of unit numbers within the same address.

Misuse of securities

Investment firms, along with individuals listed as financial planners and investors, were often the recipient of large bank drafts ultimately funded from unknown sources in China, notably in Hong Kong. Additionally, individuals receiving wires from parties located in these jurisdictions used the funds to purchase short-term investment products such as a Guaranteed Investment Certificates. These Guaranteed Investment Certificates would then be redeemed shortly after, incurring early redemption penalties, and the funds would be transferred to other client accounts, or used to purchase bank drafts payable to either the client or related individuals.Misuse of automotive industry

Transactions involving the automotive sector included car dealerships, particularly high-end car dealerships or used car dealerships, automotive-related import/export entities, and owners of such businesses. Individuals, operating as suspected “straw buyers”, used funds received from individuals or entities located in China, notably Hong Kong, to fund bank drafts to purchase from high-end car dealerships. These purchases were often inconsistent with stated occupation of the purchasing client, such as student or homemaker. Additionally, FINTRAC observed a circular flow of funds between different entities listed as used car dealerships and import/export entities, with one or more entities located in China, notably in Hong Kong.

Misuse of the legal profession

Legal professionals, such as individual lawyers, law firms and notaries, are inherently vulnerable, wittingly or unwittingly, to exploitation for money laundering and terrorist financing given that the identity of originating conductors and ultimate beneficiaries involved in financial transactions, as well as the purpose of the funds, may be legally withheld. Methods commonly exploited to launder proceeds of crime include the misuse of client accounts, purchase of property, creation and management of trusts and companies, and managing client affairsFootnote 4. FINTRAC observed several instances of legal professionals specializing in real estate listed as the beneficiary of bank drafts and less frequently cheques sourced from an unknown source in China, notably in Hong Kong. Once the draft is sent, no further financial transactions relating to the purchase or maintenance of a property are observed in the bank account of the sending client.

Reasonable ground to suspect and how to use indicators

How reporting entities determine if they should submit a suspicious transaction report to FINTRAC (for either a completed or an attempted financial transaction) requires more than a “gut feel” or “hunch,” although proof of money laundering is not required. Reporting entities are to consider the facts, context and money laundering indicators of a transaction. When these elements are viewed together, they create a picture that is essential to differentiate between what may be suspicious and what may be reasonable in a given scenario. Reporting entities must reach grounds to suspect that a transaction is related to the laundering or attempted laundering of proceeds or crime before they can submit a suspicious transaction report to FINTRAC.

Indicators of money laundering can be thought of as red flags indicating that something may very well be wrong. Red flags typically stem from one or more characteristics, behaviours, patterns, and other contextual factors related to financial transactions that make them appear inconsistent with what is expected or considered normal. On its own, an indicator may not initially appear suspicious. However, it could lead you to question the legitimacy of a transaction. This may prompt you to assess the transaction to determine whether there are further facts, contextual elements or additional money laundering or terrorist activity financing indicators, that would increase your suspicion and submit a suspicious transaction report to FINTRAC (see Reporting suspicious transactions to FINTRAC).

Money laundering indicators

Below are additional money laundering indicators related to the laundering of the proceeds of crime through China, notably in Hong Kong, on underground banking schemes derived from FINTRAC’s analysis. They reflect the types and patterns of transactions, contextual factors and those that emphasize the importance of knowing your client. All indicators from FINTRAC’s 2019 Operational Alert on laundering the proceeds of crime through a casino-related underground banking scheme remain relevant. The following additional indicators should be considered in addition to those in the 2019 Operational Alert.

These indicators should not be treated in isolation; on their own, they may not be indicative of money laundering or other suspicious activity. They should be assessed by reporting entities in combination with what they know about their client and other factors surrounding the transaction to determine if there are reasonable grounds to suspect that a transaction or attempted transaction is related to the commission or attempted commission of a money laundering offence. Several indicators may reveal unknown links that, taken together, could lead to reasonable grounds to suspect that the transaction is related to the laundering of proceeds derived from underground banking schemes. It is a constellation of factors that strengthen the determination of suspicion. These indicators aim to help reporting entities in their analysis and assessment of suspicious financial transactions.

General

- Client moves funds sourced from individuals/entities located in China, notably in Hong Kong, within a short period of time to one or more of the following sectors: real estate, investments, automotive and/or the legal profession.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are immediately transferred to a client’s associated personal or businesses account(s) or to unrelated party(ies).

- Client has ties to China and is using their accounts for pass-through activities funded by individuals/entities located in China, notably in Hong Kong, whose relationship is unclear.

- Client is receiving funds from entities located in China, notably in Hong Kong, that are connected to the money service business industry, with no ultimate remitting party names listed.

- Funds are received from entities in China, notably in Hong Kong, with limited to no online presence and there are no details relating to the types of services offered by the sending entity.

- Stated purpose of incoming funds from individuals/entities located in China, notably in Hong Kong, is for the purchase of property but the funds were used to purchase Guaranteed Investment Certificates.

- Business accounts are funded by multiple transfers, mainly from the business’ directors and/or authorized signatories’ personal accounts.

- Adverse media mentions client, or related transacting parties of the client, as being linked to criminal activity such as fraud, possession of proceeds of crime, corruption/bribery, or illicit gambling/betting charges.

Real estate

- Incoming funds of unknown origin sent by individuals/entities located in China, notably in Hong Kong, to a real estate-related party (e.g., real estate agent/brokerage or real estate developer) in structured amounts with indications suggesting the purpose of funds is for a real estate-related transaction (such as memos referencing an address).

- Cash deposit(s) are followed by funds sent to a real estate party (e.g., real estate agent/brokerage) with indications suggesting the purpose of payment is for a real estate-related transaction (such as memos referencing the same address repeatedly).

- Client receives funds from individuals/entities located in China, notably in Hong Kong, marked for education or personal purposes (e.g., “tuition” or “living expense”), but funds are then used towards payments with indications suggesting the purpose of payment is for a real estate-related transaction (such as memos referencing “property purchase” or “mortgage”).

- Mortgage payments are sourced from incoming funds from China, notably in Hong Kong, where the original source of funds is unclear.

Securities

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to purchase shorter-term investment products (such as Guaranteed Investment Certificates), which are then redeemed before the term date, despite incurring a penalty.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are quickly transferred to holding companies, trust companies or investment firms.

- Cash deposits are transferred within a short period of time to a holding company, trust company or investment firm.

Automotive

- Cash deposits are transferred within a short period of time to vehicle import/export companies, often located in China, notably in Hong Kong.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds to high end car dealerships that are inconsistent with clients stated occupation.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds to entities listed in the automotive sector who have newer profiles (1-2 years at most).

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds to entities listed in the automotive sector who have residential addresses as their business locations.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds to entities listed in the automotive sector who have limited to no online presence.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds in a similar amount to a car dealership.

- Circular flow of funds between different entities listed in the automotive industry and import/export entities, with one or more entity located in China, notably in Hong Kong.

- Outgoing fund transfers to entities operating in China, notably in Hong Kong, with references to the automotive industry (such as “car purchases” or “buying cars”) that are inconsistent with client’s stated occupation (e.g., student, homemaker or unemployed).

- Inter-account transfer from personal to business accounts (or vice-versa) sourced through high value domestic fund transfers from individuals/entities in the automotive sector.

- Client receiving funds from entities with no apparent online presence that appear to be involved in automotive import/export activities and are inconsistent with clients stated occupation or expected pattern of activities (e.g., student, homemaker, unemployed).

Legal profession

- Incoming funds of unknown origin from individuals/entities located in China, notably in Hong Kong, are sent to a legal professional in structured amounts with no clear relationship or stated purpose.

- Incoming funds from individuals/entities located in China, notably in Hong Kong, are used to send funds to legal professionals who specialize in real estate and are inconsistent with client’s stated occupation or expected pattern of activities (e.g., student, homemaker, unemployed).

- Client’s account is mainly or in part funded by bank drafts, email money transfers and/or cheques from legal professionals who have limited or no open source footprint.

- Cash deposits, not in line with account holder’s stated occupation, were used to send funds to legal professionals with no clear relationship.

- Financial transactions such as cash deposits/withdrawals, use of personal negotiable instruments (e.g., cheques), electronic funds transfers and foreign exchange using legal professional’s personal account.

Reporting to FINTRAC

To facilitate FINTRAC’s disclosure process, please include the term #ProjectAthena or #Athena in Part G-Description of suspicious activity on the suspicious transaction report. See also, Reporting suspicious transactions to FINTRAC to FINTRAC.

Contact FINTRAC

Email: guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Telephone: 1-866-346-8722 (toll-free)

Mail: FINTRAC, 24th Floor, 234 Laurier Avenue West, Ottawa ON K1P 1H7, Canada

© His Majesty the King in Right of Canada, 2023.

Cat. No. FD4-32/2023E-PDF

ISBN 978-0-660-49479-1

Resources

Several other FINTRAC and external reports also describe the contextual and financial aspects of underground banking. For more information on underground banking, as well as associated financial intelligence, please consult the following resources:

Canada

- FINTRAC: Underground Banking through Unregistered Money Services Businesses

- FINTRAC: Professional money laundering through trade and money services businesses

- Department of Finance Canada: Updated Assessment of Inherent Risks of Money Laundering and Terrorist Financing in Canada

International

- AUSTRAC: Strategic analysis brief: Money laundering through real estate

- Financial Action Task Force: Money Laundering & Terrorist Financing Through the Real Estate Sector

- Financial Action Task Force: Money Laundering and Terrorist Financing Vulnerabilities of Legal Professionals

- Financial Action Task Force: Professional Money Laundering

- Financial Action Task Force: The Role of Hawala and other Similar Service Providers in Money Laundering and Terrorist Financing

- Date Modified: