Beneficial ownership requirements : FINTRAC's compliance guidance

This guidance explains the beneficial ownership requirements under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the Act) and associated Regulations.

As of October 1, 2025, you must consult Corporations Canada's database for corporations incorporated under the Canada Business Corporations Act that you have assessed pose a high risk of a money laundering or terrorist activity financing offence. If there is a material discrepancy between the beneficial ownership information and the individuals with significant control listed in the database, you must:

- report the discrepancy to Corporations Canada within 30 days

- keep a copy of the notice of acknowledgement you receive from Corporations Canada

In this guidance

- 1. Who must comply

- 2. Who beneficial owners are

- 3. When to obtain beneficial ownership information and confirm its accuracy

- 4. When and how to consult Corporations Canada’s database

- 5. What beneficial ownership information you need to obtain

- 6. How to obtain beneficial ownership information

- 7. How to confirm the accuracy of beneficial ownership information

- 8. What a material discrepancy is and what to do if you identify one with Corporations Canada’s database

- 9. How to submit a Beneficial Ownership Discrepancy Report

- 10. What to do if you cannot obtain beneficial ownership information or confirm its accuracy

- 11. Circumstances where you do not need to obtain beneficial ownership information

- 12. What to do if there are no beneficial owners

- 13. What beneficial ownership records you need to keep

- Annex 1: Example of a record of beneficial ownership information for a corporation

- Annex 2: Example of a material discrepancy requiring a Beneficial Ownership Discrepancy Report

- Annex 3: Example of a record of beneficial ownership information for an entity other than a corporation or a trust

- Annex 4: Example of a record of beneficial ownership information for a trust (other than a widely held or publicly traded trust)

- Annex 5: List of available federal and provincial resources on beneficial ownership

- For assistance

Related links

Related acts and regulations

Related guidance

Related resources

1. Who must comply

This guidance applies to all reporting entities, except for title insurers.

2. Who beneficial owners are

Note: Canada's assessment of money laundering and terrorist financing risks, also referred to as the "National Risk Assessment", details the vulnerabilities posed by Corporations and other legal persons and arrangements. The concealment of beneficial ownership information is a technique used in money laundering and terrorist activity financing schemes. Identifying beneficial ownership removes the anonymity of the individuals (i.e. natural persons) behind the transactions and account activities, which is a key component of Canada's anti-money laundering and anti-terrorist financing regime.

Beneficial owners are the individuals who directly or indirectly own or control 25% or more of a corporation or an entity other than a corporation (such as a partnership).

In the case of a trust, they are the trustees, the known beneficiaries and the settlors of the trust.

If the trust is a widely held trust or a publicly traded trust, they are the trustees and all persons who own or control, directly or indirectly, 25% or more of the units of the trust.

Beneficial owners cannot be other corporations, trusts or other entities. They must be the individuals who are the owners or controllers of the entity.

In order to determine who the beneficial owners are, it may be necessary to search through as many layers of information as possible to determine the actual persons.

For example, the beneficial owners of a corporation that is owned by a trust would include all persons who own or control, directly or indirectly, 25% or more of the corporation through the trust, such as the trustees who manage the trust.

It is important to consider and review the names found on official documentation in order to confirm the accuracy of the beneficial ownership information. It may be necessary to search through many layers of information in order to confirm who are the beneficial owners, as the names found on official documentation may not always reflect the actual beneficial owners.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(1)

3. When to obtain beneficial ownership information and confirm its accuracy

Note: By obtaining beneficial ownership information and confirming its accuracy, reporting entities are performing an important step to mitigate the risk of money laundering and terrorist activity financing, and ultimately, to protect the integrity of Canada's financial system.

You must obtain beneficial ownership information when you verify the identity of an entity in accordance with the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations. For more information about when you are required to verify the identity of entities, see your sector's guidance on When to identify persons and entities.

The beneficial ownership information that you must obtain varies depending on whether the entity is a corporation, an entity other than a corporation (such as a partnership), a trust, or a widely held or publicly traded trust. The specific beneficial ownership information that you must obtain for each type of entity is detailed in section 5. What beneficial ownership information you need to obtain.

You must take reasonable measures to confirm the accuracy of the beneficial ownership information when you first obtain it and in the course of conducting ongoing monitoring of your business relationships.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, paragraph 123.1(b)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(1)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(2)

4. When and how to consult Corporations Canada’s database

In the case of a corporation incorporated under the Canada Business Corporations Act that you assessed poses a high risk of a money laundering or terrorist activity financing offence, you must consult Corporations Canada's database when you first determine there is a high risk and in the course of conducting ongoing monitoring of your high risk business relationships.

When consulting Corporations Canada's database, you must compare the information you obtained on the corporation to the individuals with significant control of the corporation listed in Corporations Canada's database and determine if there is a material discrepancy. More information on what is a material discrepancy is detailed in section 8. What a material discrepancy is and what to do if you identify one with Corporations Canada's database.

For more information on your requirements to assess your money laundering, terrorist activity financing and sanctions evasion risks in the course of your activities, refer to FINTRAC's Risk assessment guidance.

Consult the following resources by Corporations Canada:

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, paragraph 123.1(b)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(2)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138.1(1)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138.1(3)

5. What beneficial ownership information you need to obtain

When you verify an entity's identity in accordance with the Regulations, you must obtain the following information about beneficial owners:

Corporations

- the names of all directors of the corporation and the names and addresses of all persons who directly or indirectly own or control 25% or more of the shares of the corporation

Trusts

- the names and addresses of all trustees and all known beneficiaries and settlors of the trust

Widely held or publicly traded trusts

- the names of all trustees of the trust and the names and addresses of all persons who directly or indirectly own or control 25% or more of the units of the trust

Entities other than corporations or trusts

- the names and addresses of all persons who directly or indirectly own or control 25% or more of the entity

In all cases, you must obtain information establishing the ownership, control and structure of the entity.

The Act and regulations do not prescribe the information that must be obtained to establish the ownership, control and structure of an entity, but you can obtain general information.

For example, the information establishing the ownership, control and structure of an entity could include

- the names of individual owners with a breakdown of percentages owned (in the case of a corporation or other entity)

- the type of entity or structure of the trust

- director roles (in the case of a corporation)

- organizational chart

If you verify the identity of a not-for-profit organization, you must also determine if the entity is:

- a charity registered with the Canada Revenue Agency under the Income Tax Act; or

- an organization, other than one referred to above, that solicits charitable donations from the public.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(1)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(5)

6. How to obtain beneficial ownership information

To obtain beneficial ownership information, which includes information on the ownership, control and structure, you could have the entity provide it, either verbally or in writing, or you could search for publicly available information.

For example:

- publicly available information, including information from federal or provincial registries (see resources in Annex 4)

- the entity can provide you with official documentation

- the entity can tell you the beneficial ownership information and you can write it down for record keeping purposes

- the entity can fill out a document to provide you with the information

Collaboration between federal, provincial and territorial governments within Canada has led to harmonized amendments within most Canadian jurisdictions to require corporations to maintain accurate and up-to-date records of information on all beneficial owners, and to make them accessible upon request to law enforcement, tax authorities, and other relevant bodies. Such amendments have been made in all jurisdictions within Canada, except for Alberta, Northwest Territories and Nunavut. For more details, consult Annex 5: List of available federal and provincial resources on beneficial ownership.

7. How to confirm the accuracy of beneficial ownership information

You must take reasonable measures to confirm the accuracy of the beneficial ownership information that you obtain. These reasonable measures cannot be the same as the measures you used to obtain the information.

Your reasonable measures can include referring to official documentation or records, or consulting available provincial or federal registries.

It is also acceptable to have a client sign a document to confirm the accuracy of the beneficial ownership information you obtained, which includes information on ownership, control and structure. In this case, it is possible for one document to be used to satisfy the two steps—namely to obtain the information and to confirm its accuracy by means of the signature.

Other reasonable measures can include:

- asking the client to provide supporting official documentation

- conducting an open-source search

- consulting commercially available information

The reasonable measures that you take to confirm the accuracy of beneficial ownership information, which includes ownership, control, and structure information, should align with your risk assessment of money laundering or terrorist activity financing offences. The reasonable measures you take with entities assessed to pose a high risk must go further to help you understand and confirm the beneficial ownership, as well as establish the overall ownership, control, and structure of that entity.

The reasonable measures that you take with entities that have a complex business structure must go further to ensure that you are able to understand and confirm the accuracy of beneficial ownership, which includes establishing the ownership, control and structure of that entity. This does not mean, however, that you need to consider or treat a complex entity as automatically posing a high risk. Your reasonable measures should be appropriate to the situation.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(2)

Examples of official documentation or records to confirm the accuracy of the beneficial ownership information obtained:

Corporations or entities other than corporations or trusts

In the case of a corporation or other entity, you could refer to records such as, but not limited to:

- minute book

- securities register

- shareholders register

- internal beneficial ownership register

- articles of incorporation

- annual returns

- certificate of corporate status

- shareholder agreements

- partnership agreements

- board of directors' meeting records of decisions

Trusts, widely held or publicly traded trusts

In the case of a trust, you could confirm the accuracy of the information by reviewing the trust deed.

Not-for-profit organizations

As a best practice, you should also confirm whether a not-for-profit organization is a charity registered with the Canada Revenue Agency by consulting the charities listing on the Canada Revenue Agency website.

8. What a material discrepancy is and what to do if you identify one with Corporations Canada's database

A material discrepancy is a meaningful inconsistency between the beneficial ownership information of a corporation incorporated under the Canada Business Corporations Act and the individuals with significant control listed in Corporations Canada's database that could impact the proper identification, or conceal, the individuals that own or control a corporation.

A material discrepancy does not include a discrepancy that arises from:

- a spelling mistake or minor variation in a name or address

- the use of a service address in one information source and a residential address in another

- the fact that information is not available to the public due to an exception or exemption

- the presence of an exception or exemption is clearly indicated within Corporations Canada's database

- the fact that information on individuals with significant control available in Corporations Canada's database is about persons who are not captured under beneficial ownership information requirements, or vice versa

When you identify a material discrepancy between the beneficial ownership information of a high-risk corporation incorporated under the Canada Business Corporations Act and the individuals with significant control listed in Corporations Canada's database, you must submit a Beneficial Ownership Discrepancy Report to Corporations Canada within 30 days after the day on which the discrepancy is identified.

Note: A material discrepancy that is resolved within 30 days after the day on which it is identified is not required to be reported.

For further clarity, a material discrepancy can be reported upon its identification without waiting for the 30 days to elapse. In addition, it is not a requirement to re-consult Corporations Canada's database within that timeframe to determine if the material discrepancy has been resolved.

To submit a Beneficial Ownership Discrepancy Report, the corporation must have an active status in Corporations Canada's database.

For an example, consult Annex 2 - Example of a material discrepancy requiring a Beneficial Ownership Discrepancy Report

In the case of corporations incorporated under the Canada Business Corporations Act that you have assessed do not pose a high risk of a money laundering or terrorist activity financing offence, but for which you identify a material discrepancy, you have the option to voluntarily submit a Beneficial Ownership Discrepancy Report to Corporations Canada.

If you consulted Corporation Canada's database to confirm the accuracy of the beneficial ownership information you obtained, and if the identification of a material discrepancy prevents you from confirming the accuracy, you may take other reasonable measures that allow you to confirm its accuracy. When you cannot confirm the accuracy of the beneficial ownership information you obtained, you must apply prescribed measures as detailed in section 10. What to do if you cannot obtain beneficial ownership information or confirm its accuracy.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138.1(1)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138.1(2)

9. How to submit a Beneficial Ownership Discrepancy Report

You must submit a Beneficial Ownership Discrepancy Report using the Beneficial Ownership Discrepancy Reporting application from your My ISED account.

For instructions on how to submit a Beneficial Ownership Discrepancy Report, consult Corporations Canada's reporting guidance Beneficial ownership discrepancy reporting.

When submitting a Beneficial Ownership Discrepancy Report, you will be required to enter your reporting entity legal name and reporting entity number assigned by FINTRAC. Failure to provide the reporting entity legal name and reporting entity number will result in an invalid report.

If you do not have a reporting entity number assigned by FINTRAC, you must enroll to the FINTRAC Web Reporting System. To enroll, email your request to FINTRAC at F2R@fintrac-canafe.gc.ca.

Corporations Canada will send a notice of acknowledgement of the Beneficial Ownership Discrepancy Report by email to the contact person who has filed the report.

Note: Notices of acknowledgement cannot be re-issued.

When you submit a Beneficial Ownership Discrepancy Report to Corporations Canada, you must keep a copy of all notice of acknowledgement received.

Retention: You must keep a copy of the notice of acknowledgement for 5 years from the day the record was created.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, paragraph 138.1(1)(b)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, paragraph 148(1)(c)

10. What to do if you cannot obtain beneficial ownership information or confirm its accuracy

If you are unable to obtain the beneficial ownership information, to keep it up to date in the course of the ongoing monitoring of business relationships, or to confirm its accuracy, when it is first obtained, or during the course of ongoing monitoring then you must:

- take reasonable measures to verify the identity of the entity's chief executive officer or of the person who performs that function

- apply the special measures for high-risk clients, including enhanced ongoing monitoring

When you cannot obtain beneficial ownership information, keep it up to date or confirm its accuracy, such as when the ownership structure is too complex or opaque, it should be considered as part of your risk assessment of the client.

For more information, refer to:

How to verify the identity of an entity's chief executive officer or of the person who performs that function

The Regulations do not require that you verify the identity of the chief executive officer or of the person who performs that function in accordance with the prescribed methods. However, you could use one of the methods outlined in the Methods to verify the identity of persons and entities guidance to meet this obligation as your reasonable measure.

Additionally, there is no record keeping obligation if you have identified the chief executive officer or a person who performs that function using the prescribed methods to verify identity. However, during a FINTRAC examination, you could be asked to demonstrate the reasonable measures that you took to identify the chief executive officer or person who performs that function.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(4)

11. Circumstances where you do not need to obtain beneficial ownership information and confirm its accuracy

You do not have to obtain beneficial ownership information and take reasonable measures to confirm its accuracy, including consulting Corporations Canada's database, in the following situations:

- For a group plan account held within a dividend or a distribution reinvestment plan. This includes plans that permits purchases of additional shares or units by the member with contributions other than the dividends or distributions paid by the plan sponsor, if the sponsor is an entity:

- whose shares or units are traded on a Canadian stock exchange; and

- that operates in a country that is a member of the Financial Action Task Force.

- If you are a financial entity, beneficial ownership requirements do not apply to your activities in respect of the processing of payments by credit card or prepaid payment product for a merchant.

- If you are a life insurance company, broker or agent, and you deal in reinsurance, beneficial ownership requirements do not apply to you for those dealings.

In all cases, the beneficial ownership requirements do not apply if you are not required to verify the identity of an entity under the Regulations because of a related exception. This is because your obligation to verify identity for a particular transaction, activity, or client does not apply in that circumstance. For more information, consult your sector-specific guidance on When to identify persons and entities.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(6)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, section 150

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, section 93

12. What to do if there are no beneficial owners

You may obtain information confirming that there is no individual who directly or indirectly owns or controls 25% or more of a corporation, a widely held or publicly traded trust, or an entity other than a corporation or trust. This is not the same thing as being unable to obtain the beneficial ownership information.

If you determine that there is no individual who directly or indirectly owns or controls 25% or more of a corporation, a widely held or publicly traded trust, or an entity other than a corporation or trust, you must keep a record of the measures you took and the information you obtained in order to reach that conclusion. However, you are still required to obtain and take reasonable measures to confirm information about the ownership, control and structure of the entity.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(3)

13. What beneficial ownership records you need to keep

You must keep a record of the beneficial ownership information you obtain and of the measures you take to confirm the accuracy of the information.

The measures that you take to confirm beneficial ownership information can be part of your overall policies and procedures, so a separate record may not be needed. You only need to keep an individual record of the specific measures you take to confirm the accuracy of beneficial ownership information in situations where the measures differ from those that are documented in your policies and procedures.

For a corporation, you must record:

- the names of all directors of the corporation

- the names and addresses of all persons who directly or indirectly own or control 25% or more of the shares of the corporation; and

- information establishing the ownership, control and structure of the corporation

For an example, consult Annex 1: Example of a record of beneficial ownership information for a corporation

For a trust, you must record:

- the names and addresses of all trustees, known beneficiaries and known settlors of the trust; and

- information establishing the ownership, control and structure of the trust

For an example, consult Annex 4: Example of a record of beneficial ownership information for a trust (other than a widely held or publicly traded trust)

For a widely held or publicly traded trust, you must record:

- the names of all trustees of the trust

- the names and addresses of all persons who directly or indirectly own or control 25% or more of the units of the trust; and

- information establishing the ownership, control and structure of the trust

For an entity other than a corporation or trust, you must record:

- the names and addresses of all persons who directly or indirectly own or control 25% or more of the entity; and

- information establishing the ownership, control and structure of the entity

For an example, consult Annex 3: Example of a record of beneficial ownership information for an entity other than a corporation or a trust

If you verify the identity of a not-for-profit organization, you must also keep a record that indicates whether the entity is:

- a charity registered with the Canada Revenue Agency under the Income Tax Act; or

- an organization, other than a registered charity, that solicits charitable donations from the public

In situations where no individual directly or indirectly owns or controls 25% or more of a corporation, a widely held or publicly traded trust, or an entity other than a corporation or trust, you must keep a record of the measures you took to confirm the accuracy of the information, as well as the information you obtained in order to reach that conclusion. The date you took the measures should also be included as a best practice.

Retention: You must keep these records for at least 5 years from the day the last business transaction is conducted.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(1)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, subsection 138(5)

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184, paragraph 148(1)(b)

Annex 1: Example of a record of beneficial ownership information for a corporation

Scenario:

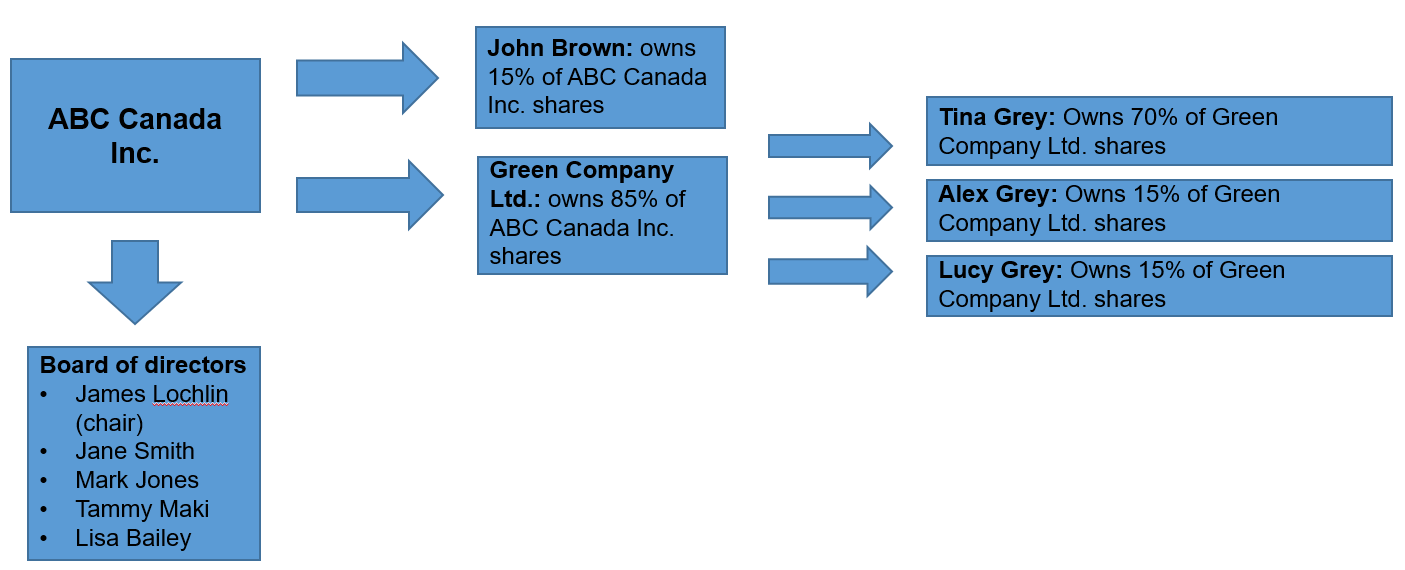

ABC Canada Inc., a privately held corporation incorporated under the Canada Business Corporations Act, carries out a transaction or activity for which you have to verify its identity, triggering your beneficial ownership obligations. You learn that ABC Canada Inc. is owned by John Brown and Green Company Ltd. You discover that John owns 15% of the shares in the company (15 of the 100 total) and that Green Company Ltd. owns 85% of the shares (85 of 100 total). Since Green Company Ltd. owns and controls more than 25% of ABC Canada Inc., you need to find the beneficial owners, who cannot be a corporation or an entity. You inquire further and discover that Tina Grey owns 70% of Green Company Inc.'s shares and her two children, Alex and Lucy Grey, each own 15% respectively. Next, you learn that ABC Canada Inc.'s board of directors is made up of:

- James Lochlin, Chair;

- Jane Smith, Chief Financial Officer;

- Mark Jones, director;

- Tammy Maki, director; and

- Lisa Bailey, director.

Diagram 1—Beneficial ownership information for a corporation

Text description of Diagram 1

The diagram shows the ownership and control structure of ABC Canada Inc. John Brown owns 15% of ABC Canada Inc. shares. Green Company Ltd. owns the remaining 85% of shares. Green Company Ltd. is owned by Tina Grey (70%), Alex Grey (15%), and Lucy Grey (15%). Because Tina Grey owns 70% of Green Company Ltd., she indirectly owns and controls more than 25% of the shares of ABC Canada Inc. The board of directors of ABC Canada Inc. consists of James Lochlin (chair), Jane Smith, Mark Jones, Tammy Maki, and Lisa Bailey.

In this example, you must record:

- The names of all directors of ABC Canada Inc.:

- James Lochlin (chair);

- Jane Smith;

- Mark Jones;

- Tammy Maki; and

- Lisa Bailey.

- The names and addresses of all of the persons who directly or indirectly own or control 25% or more of the shares of ABC Canada Inc.:

- The name and address of Tina Grey, who owns 70% of Green Company Ltd. Since Green Company Ltd. owns 85% of ABC Canada Inc.'s shares, and Tina owns 70% of Green Company Ltd.'s shares, Tina indirectly owns and controls more than 25% of the shares of ABC Canada Inc.

- The information establishing the ownership, control and structure of ABC Canada Inc., including:

- the ownership of ABC Canada Inc. being shared between John Brown (15%) and Green Company Ltd. (85%);

- the ownership of Green Company Ltd. being shared between Tina Grey (70%), Alex Grey (15%), and Lucy Grey (15%);

- the control of ABC Canada Inc. significantly being held by Green Company Ltd. and specifically Tina Grey (who indirectly owns and controls more than 25% of ABC Canada Inc.'s shares);

- the structure of ABC Canada Inc., including that it is a privately held corporation, and

- other structure details about ABC Canada Inc., including the positions held by each director and any organization chart.

- The reasonable measures you took to confirm the accuracy of the information:

- the steps you took as reasonable measures to confirm the accuracy of this information; and

- any official documents obtained to support the measures you took.

Annex 2: Example of a material discrepancy requiring a Beneficial Ownership Discrepancy Report

Using the same scenario in Annex 1, you assessed, based on your risk assessment, that ABC Canada Inc. poses a high risk of a money laundering or terrorist activity financing offence.

As a result, you must also consult Corporations Canada's database to verify the beneficial ownership information you obtained.

Corporation Canada's database indicates 2 individuals with significant control of ABC Canada Inc., who both indirectly and jointly hold 25% or more of shares:

- Tina Grey Johnson

- Mathew Grey

You had previously obtained the information that Tina Grey owns or controls 25% or more of ABC Canada Inc. The additional name "Johnson" is reasonably a minor variation in the name and is not considered a material discrepancy as it refers to the same individual.

Matthew Grey was not included as part of the beneficial ownership information you obtained on ABC Canada Inc. and is considered a material discrepancy.

If the material discrepancy is not resolved within 30 days, you must submit a Beneficial Ownership Discrepancy Report to Corporations Canada within 30 days after the day on which the discrepancy is identified.

In this example, you must also keep a record of the notice of acknowledgement from Corporations Canada you receive by email after you've successfully reported the material discrepancy.

Annex 3: Example of a record of beneficial ownership information for an entity other than a corporation or a trust

Scenario:

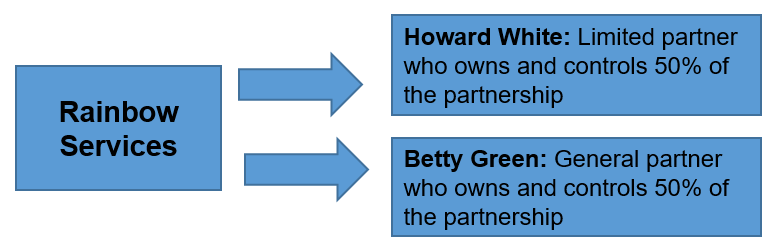

Rainbow Services, a partnership, carries out a transaction or activity for which you have to verify its identity, thus triggering your beneficial ownership obligations. You learn that Howard White and Betty Green are the two partners in this partnership. Betty is the general partner and is responsible for operating the day-to-day operations and Howard is the limited partner who has invested funds into the partnership. All decisions related to the partnership must be unanimous, and either partner can decide to end the partnership.

Diagram 2—Beneficial ownership information for an entity other than a corporation or a trust

Text description of Diagram 2

The diagram shows the ownership and control structure of Rainbow Services. Howard White is a limited partner who owns and controls 50% of the partnership. Betty Green is a general partner who owns and controls the remaining 50% of the partnership.

In this example you must record:

- The names and addresses of all persons who directly or indirectly own or control 25% or more of Rainbow Services:

- Howard and Betty's names and addresses, as the partners who equally own and control the partnership.

- The information establishing the ownership, control and structure of Rainbow Services, including that:

- the ownership and control of Rainbow Services is held equally between Howard (50%) and Betty (50%), the structure of Rainbow Services, including that it is a partnership between Howard and Betty, and

- any other structure details about Rainbow Services, including any organizational chart.

- The reasonable measures you took to confirm the accuracy of the information:

- the steps you took as reasonable measures to confirm the accuracy of this information; and

- any official documents obtained to support the measures you took, such as a copy of the partnership agreement.

Annex 4: Example of a record of beneficial ownership information for a trust (other than a widely held or publicly traded trust)

Scenario:

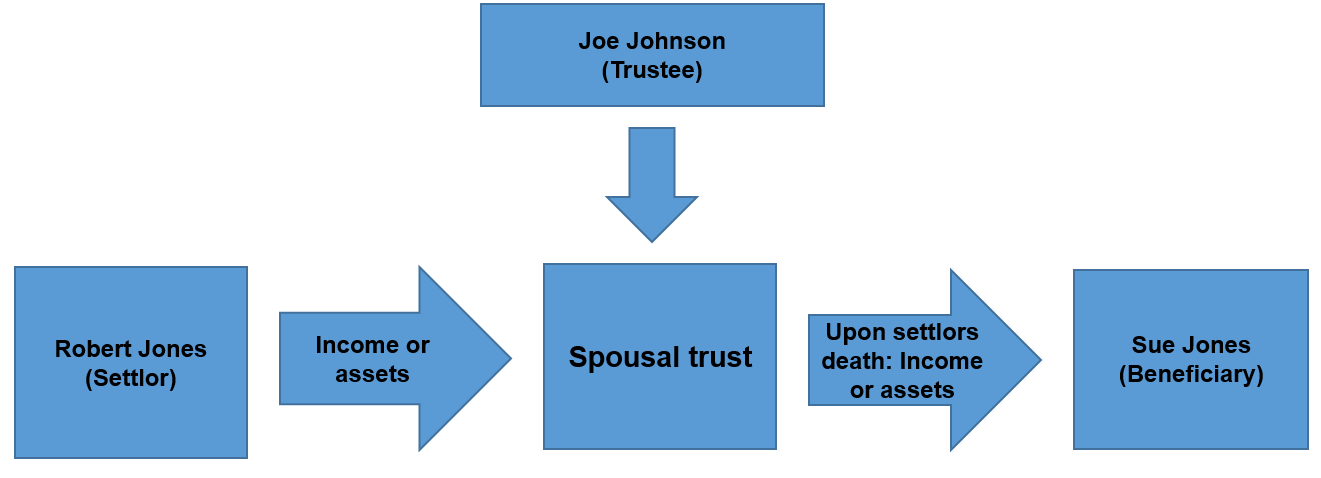

A trust carries out a transaction or activity for which you are required to verify its identity, triggering your beneficial ownership obligations. You learn that Robert Jones established a spousal trust for his wife Sue. He transferred assets into the trust and designated Joe Johnson as the trustee.

Diagram 3—Beneficial ownership information for a trust (other than a widely held or publicly traded trust)

Text description of Diagram 3

The diagram shows the structure of a spousal trust. Robert Jones, the settlor, transfers income or assets into the spousal trust. Joe Johnson is the trustee who manages the trust. Upon the settlor’s death, the income or assets from the trust go to Sue Jones, the beneficiary.

In this example you must record:

- The names and addresses of all trustees, known beneficiaries and known settlors of the trust:

- Robert's name and address, as he is the settlor;

- Joe's name and address, as he is trustee; and

- Sue's name and address, as she is the beneficiary.

- The information establishing the ownership, control and structure of the trust, including:

- The beneficial ownership information is reflected in the information required to be obtained for the trust:

- Robert is the settlor and can modify or revoke the terms of the trust;

- Joe is the trustee and controls the assets in the trust; and

- Sue, as the beneficiary, is the only person entitled to receive the assets or income from the trust.

- The structure of the trust, including that it is a spousal trust.

- The beneficial ownership information is reflected in the information required to be obtained for the trust:

- The reasonable measures you took to confirm the accuracy of the information:

- the steps you took as reasonable measures to confirm the accuracy of this information; and

- any official documents obtained to support the measures you took, such as the trust agreement.

Annex 5: List of available federal and provincial resources on beneficial ownership

Federal resources

Provincial and territorial resources

- British Columbia

- Manitoba

- New Brunswick

- Newfoundland and Labrador

- Nova Scotia

- Ontario

- Prince Edward Island

- Quebec

- Quebec enterprise register

- Saskatchewan

- Yukon

For assistance

If you have questions about this guidance, please contact FINTRAC by email at guidelines-lignesdirectrices@fintrac-canafe.gc.ca.

Definitions

- Accountant

A chartered accountant, a certified general accountant, a certified management accountant or, if applicable, a chartered professional accountant. (comptable)

Reference:

Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations (PCMLTFR), SOR/2002-184, s. 1(2).- Accounting firm

An entity that is engaged in the business of providing accounting services to the public and has at least one partner, employee or administrator that is an accountant. (cabinet d'expertise comptable)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Acquirer

An entity that connects a private automated banking machine to a payment card network, as defined in section 3 of the Payment Card Networks Act, to facilitate transactions. (acquéreur)

Reference:

Payment Card Networks Act- Act

The Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). (la Loi)

Reference:

Proceeds of Crime (Money Laundering) and Terrorist Financing Administrative Monetary Penalties Regulations (PCMLTFAMPR), SOR/2007-292, s. 1, Proceeds of Crime (Money Laundering) and Terrorist Financing Registration Regulations (PCMLTFRR), SOR/2007-121, s. 1, PCMLTFR, SOR/2002-184, s. 1(2), and Proceeds of Crime (Money Laundering) and Terrorist Financing Suspicious Transaction Reporting Regulations (PCMLTFSTRR), SOR/2001-317, s. 1(2).- Administrative monetary penalties (AMPs)

Civil penalties that may be issued to reporting entities by FINTRAC for non-compliance with the PCMLTFA and associated Regulations. (pénalité administrative pécuniaire [PAP])

- Affiliate

An entity is affiliated with another entity if one of them is wholly owned by the other, if both are wholly owned by the same entity or if their financial statements are consolidated. (entité du même groupe)

Reference:

PCMLTFR, SOR/2002-184, s. 4.- Annuity

Has the same meaning as in subsection 248(1) of the Income Tax Act. (rente)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Armoured cars

Persons or entities that are engaged in the business of transporting currency, money orders, traveller’s cheques or other similar negotiable instruments. (Véhicules blindés)

- As soon as practicable

A time period that falls in-between immediately and as soon as possible, within which a suspicious transaction report (STR) must be submitted to FINTRAC. The completion and submission of the STR should take priority over other tasks. In this context, the report must be completed promptly, taking into account the facts and circumstances of the situation. While some delay is permitted, it must have a reasonable explanation. (aussitôt que possible)

- Attempted transaction

Occurs when an individual or entity starts to conduct a transaction that is not completed. For example, a client or a potential client walks away from conducting a $10,000 cash deposit. (opération tentée)

- Authentic

In respect of verifying identity, means genuine and having the character of an original, credible, and reliable document or record. (authentique)

- Authorized person

A person who is authorized under subsection 45(2). (personne autorisée)

Reference:

Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA), S.C. 2000, c 17, s. 2(1).- Authorized user

A person who is authorized by a holder of a prepaid payment product account to have electronic access to funds or virtual currency available in the account by means of a prepaid payment product that is connected to it. (utilisateur autorisé)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Beneficial owner(s)

Beneficial owners are the individuals who are the trustees, and known beneficiaries and settlors of a trust, the trustees and all persons who own or control, directly or indirectly, 25% or more of the units of the widely held or publicly traded trust, or who directly or indirectly own or control 25% or more of i) the shares of a corporation or ii) an entity other than a corporation, such as a partnership. The ultimate beneficial owner(s) cannot be another corporation or entity; it must be the actual individual(s) who owns or controls the entity. (bénéficiaire effectif)

- Beneficiary

A beneficiary is the individual or entity that will benefit from a transaction or to which the final remittance is made. (bénéficiaire)

- Branch

A branch is a part of your business at a distinct location other than your main office. (succursale)

- British Columbia notary corporation

An entity that carries on the business of providing notary services to the public in British Columbia in accordance with the Notaries Act, R.S.B.C. 1996, c. 334. (société de notaires de la Colombie-Britannique)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- British Columbia notary public

A person who is a member of the Society of Notaries Public of British Columbia. (notaire public de la Colombie-Britannique)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Cash

Coins referred to in section 7 of the Currency Act, notes issued by the Bank of Canada under the Bank of Canada Act that are intended for circulation in Canada or coins or bank notes of countries other than Canada. (espèces)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2) and PCMLTFSTRR, SOR/2001-317, s. 1(2).- Casino

A government, organization, board or operator that is referred to in any of paragraphs 5(k) to (k.3) of the Act. (casino)

Reference:

PCMLTFR, SOR/2002-184, s 1(2) and PCMLTFSTRR, SOR/2001-317, s. 1(2).- Certified translator

An individual that holds the title of professional certified translator granted by a Canadian provincial or territorial association or body that is competent under Canadian provincial or territorial law to issue such certification. (traducteur agréé)

- Cheque casher

A person or entity engaged in the business of offering to cash cheques for clients in exchange for funds. (entreprise d’encaissement de chèque)

- Clarification request

A clarification request is a method used to communicate with money services businesses (MSBs) or foreign money services businesses (FMSBs) when FINTRAC needs more information about their registration form. This request is usually sent by email. (demande de précisions)

- Client

A person or entity that engages in a financial transaction with another person or entity. (client)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Client identification information

The identifying information that you have obtained on your clients, such as name, address, telephone number, occupation or nature of principal business, and date of birth for an individual. (renseignements d'identification du client)

- Competent authority

For the purpose of the criminal record check submitted with an application for registration, a competent authority is any person or organization that has the legally delegated or invested authority, capacity, or power to issue criminal record checks. (autorité compétente)

- Completed transaction

Is a transaction conducted by a person or entity, that is completed and results in the movement of funds, virtual currency, or the purchase or sale of an asset. (opération effectuée)

- Completing action

With respect to a reportable transaction, information related to the instructions provided by the person or entity making the request to the reporting entity to complete a transaction. For example, an individual arrives at a bank and requests to purchase a bank draft. The completing action is the details of how the reporting entity fulfilled the person or entity’s instructions which led to the transaction being completed. This includes what the funds or virtual currency initially brought to the reporting entity was used for (see “disposition”). A transaction may have one or more completing actions depending on the instructions provided by the person or entity. (action d’achèvement)

- Compliance officer

The individual, with the necessary authority, that you appoint to be responsible for the implementation of your compliance program. (agent de conformité)

- Compliance policies and procedures

Written methodology outlining the obligations applicable to your business under the PCMLTFA and its associated Regulations and the corresponding processes and controls you put in place to address your obligations. (politiques et procédures de conformité)

- Compliance program

All elements (compliance officer, policies and procedures, risk assessment, training program, effectiveness review) that you, as a reporting entity, are legally required to have under the PCMLTFA and its associated Regulations to ensure that you meet all your obligations. (programme de conformité)

- Context

Clarifies a set of circumstances or provides an explanation of a situation or financial transaction that can be understood and assessed. (contexte)

- Correspondent banking relationship

A relationship created by an agreement or arrangement under which an entity referred to in any of paragraphs 5(a), (b), (d),(e) and (e.1) or an entity that is referred to in section 5 and that is prescribed undertakes to provide to a prescribed foreign entity prescribed services or international electronic funds transfers, cash management or cheque clearing services. (relation de correspondant bancaire)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 9.4(3) and PCMLTFR, SOR/2002-184, s. 16(1)(b).- Country of residence

The country where an individual has lived continuously for 12 months or more. The individual must have a dwelling in the country concerned. For greater certainty, a person only has one country of residence no matter how many dwelling places they may have, inside or outside of that country. (pays de résidence)

- Credit card acquiring business

A credit card acquiring business is a financial entity that has an agreement with a merchant to provide the following services:

- enabling a merchant to accept credit card payments by cardholders for goods and services and to receive payments for credit card purchases;

- processing services, payment settlements and providing point-of-sale equipment (such as computer terminals); and

- providing other ancillary services to the merchant.

- Credit union central

A central cooperative credit society, as defined in section 2 of the Cooperative Credit Associations Act, or a credit union central or a federation of credit unions or caisses populaires that is regulated by a provincial Act other than one enacted by the legislature of Quebec. (centrale de caisses de crédit)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Crowdfunding platform

A website or an application or other software that is used to raise funds or virtual currency through donations. (plateforme de sociofinancement)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Crowdfunding platform services

The provision and maintenance of a crowdfunding platform for use by other persons or entities to raise funds or virtual currency for themselves or for persons or entities specified by them. (services de plateforme de sociofinancement)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Current

In respect of a document or source of information that is used to verify identity, is up to date, and, in the case of a government-issued photo identification document, must not have been expired when the ID was verified. (à jour)

- Dealer in precious metals and stones

A person or entity that, in the course of their business activities, buys or sells precious metals, precious stones or jewellery. It includes a department or an agent of His Majesty in right of Canada or an agent or mandatary of His Majesty in right of a province when the department or the agent or mandatary carries out the activity, referred to in subsection 65(1), of selling precious metals to the public. (négociant en métaux précieux et pierres précieuses)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Deferred profit sharing plan

Has the same meaning as in subsection 248(1) of the Income Tax Act. (régime de participation différée aux bénéfices)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Deposit slip

A record that sets out:

- (a) the date of the deposit;

- (b) the name of the person or entity that makes the deposit;

- (c) the amount of the deposit and of any part of it that is made in cash;

- (d) the method by which the deposit is made; and

- (e) the number of the account into which the deposit is made and the name of each account holder.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Directing services

A business is directing services at persons or entities in Canada if at least one of the following applies:

- The business's marketing or advertising is directed at persons or entities located in Canada;

- The business operates a ".ca" domain name; or,

- The business is listed in a Canadian business directory.

Additional criteria may be considered, such as if the business describes its services being offered in Canada or actively seeks feedback from persons or entities in Canada. (diriger des services)

- Distributed ledger

For the purpose of section 151 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations (PCMLTFR), a digital ledger that is maintained by multiple persons or entities and that can only be modified by a consensus of those persons or entities. (registres distribués)

Reference:

PCMLTFR, SOR/2002-184, s. 151(2).- Disposition

With respect to a reportable transaction, the disposition is what the funds or virtual currency was used for. For example, an individual arrives at a bank with cash and purchases a bank draft. The disposition is the purchase of the bank draft. (répartition)

- Electronic funds transfer

The transmission—by any electronic, magnetic or optical means—of instructions for the transfer of funds, including a transmission of instructions that is initiated and finally received by the same person or entity. In the case of SWIFT messages, only SWIFT MT-103 messages and their equivalent are included. It does not include a transmission or instructions for the transfer of funds:

- (a) that involves the beneficiary withdrawing cash from their account;

- (b) that is carried out by means of a direct deposit or pre-authorized debit;

- (c) that is carried out by cheque imaging and presentment

- (d) that is both initiated and finally received by persons or entities that are acting to clear or settle payment obligations between themselves; or

- (e) that is initiated or finally received by a person or entity referred to in paragraphs 5(a) to (h.1) of the Act for the purpose of internal treasury management, including the management of their financial assets and liabilities, if one of the parties to the transaction is a subsidiary of the other or if they are subsidiaries of the same corporation.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Employees profit sharing plan

Has the same meaning as in subsection 248(1) of the Income Tax Act. (régime de participation des employés aux bénéfices)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Entity

A body corporate, a trust, a partnership, a fund or an unincorporated association or organization. (entité)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Factor

A person or entity that is engaged in the business of factoring, with or without recourse against the assignor. (affactureur)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Facts

Actual events, actions, occurrences or elements that exist or are known to have happened or existed. Facts are not opinions. For example, facts surrounding a transaction or multiple transactions could include the date, time, location, amount or type of transaction or could include the account details, particular business lines, or the client's financial history. (faits)

- Family member

For the purposes of subsection 9.3(1) of the Act, a prescribed family member of a politically exposed foreign person, a politically exposed domestic person or a head of an international organization is:

- (a) their spouse or common-law partner;

- (b) their child;

- (c) their mother or father;

- (d) the mother or father of their spouse or common-law partner; or

- (e) a child of their mother or father.

Reference:

PCMLTFR, SOR/2002-184, s. 2(1).- Fiat currency

A currency that is issued by a country and is designated as legal tender in that country. (monnaie fiduciaire)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2) and PCMLTFSTRR, SOR/2001-317, s. 1(2).- Final receipt

In respect of an electronic funds transfer, means the receipt of the instructions by the person or entity that is to make the remittance to a beneficiary. (destinataire)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Financial entity

Means:

- (a) an entity that is referred to in any of paragraphs 5(a), (b) and (d) to (f) of the Act;

- (b) a financial services cooperative;

- (c) a life insurance company, or an entity that is a life insurance broker or agent, in respect of loans or prepaid payment products that it offers to the public and accounts that it maintains with respect to those loans or prepaid payment products, other than:

- (i) loans that are made by the insurer to a policy holder if the insured person has a terminal illness that significantly reduces their life expectancy and the loan is secured by the value of an insurance policy;

- (ii) loans that are made by the insurer to the policy holder for the sole purpose of funding the life insurance policy; and

- (iii) advance payments to which the policy holder is entitles that are made to them by the insurer;

- (d) a credit union central when it offers financial services to a person, or to an entity that is not a member of that credit union central; and

- (e) a department, or an entity that is an agent of His Majesty in right of Canada or an agent or mandatary of His Majesty in right of a province, when it carries out an activity referred to in section 76.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Financial Action Task Force

The Financial Action Task Force on Money Laundering established in 1989. (Groupe d'action financière)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Financial services cooperative

A financial services cooperative that is regulated by an Act respecting financial services cooperatives, CQLR, c. C-67.3 or the Act respecting the Mouvement Desjardins, S.Q. 2000, c. 77, other than a caisse populaire. (coopérative de services financiers)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Financing or leasing entity

A person or entity that is engaged in the business of financing or leasing of:

- (a) property, other than real property or immovables, for business purposes;

- (b) passenger vehicles in Canada; or

- (c) property, other than real property or immovables, that is valued at $100,000 or more.

(entité de financement ou de bail)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Foreign currency

A fiat currency that is issued by a country other than Canada. (devise)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Foreign currency exchange transaction

An exchange, at the request of another person or entity, of one fiat currency for another. (opération de change en devise)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Foreign currency exchange transaction ticket

A record respecting a foreign currency exchange transaction—including an entry in a transaction register—that sets out:

- (a) the date of the transaction;

- (b) in the case of a transaction of $3,000 or more, the name and address of the person or entity that requests the exchange, the nature of their principal business or their occupation and, in the case of a person, their date of birth;

- (c) the type and amount of each of the fiat currencies involved in the payment made and received by the person or entity that requests the exchange;

- (d) the method by which the payment is made and received;

- (e) the exchange rates used and their source;

- (f) the number of every account that is affected by the transaction, the type of account and the name of each account holder; and

- (g) every reference number that is connected to the transaction and has a function equivalent to that of an account number.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Foreign money services business

Persons and entities that do not have a place of business in Canada, that are engaged in the business of providing at least one of the following services that is directed at persons or entities in Canada, and that provide those services to their clients in Canada:

- (i) foreign exchange dealing,

- (ii) remitting funds or transmitting funds by any means or through any person, entity or electronic funds transfer network,

- (iii) issuing or redeeming money orders, traveller's cheques or other similar negotiable instruments except for cheques payable to a named person or entity,

- (iv) dealing in virtual currencies, or

- (v) any prescribed service.

Reference:

PCMLTFA, S.C. 2000, c 17, s. 5(h.1), PCMLTFRR, SOR/2007-121, s. 1 and PCMLTFR, SOR/2002-184, s. 1(2).- Foreign state

Except for the purposes of Part 2, means a country other than Canada and includes any political subdivision or territory of a foreign state. (État étranger)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Funds

Means:

- (a) cash and other fiat currencies, and securities, negotiable instruments or other financial instruments that indicate a title or right to or interest in them; or

- (b) a private key of a cryptographic system that enables a person or entity to have access to a fiat currency other than cash.

For greater certainty, it does not include virtual currency. (fonds)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2) and PCMLTFSTRR, SOR/2001-317, s. 1(2).- Head of an international organization

A person who, at a given time, holds—or has held within a prescribed period before that time—the office or position of head of

- a) an international organization that is established by the governments of states;

- b) an institution of an organization referred to in paragraph (a); or

- c) an international sports organization.

Reference:

PCMLTFA, S.C. 2000, c 17, s. 9.3(3).- Immediately

In respect of submitting a Listed Person or Entity Property Report, the time period within which a report must be submitted, which does not allow for any delay prior to submission. (immédiatement)

- Information record

A record that sets out the name and address of a person or entity and:

- (a) in the case of a person, their date of birth and the nature of their principal business or their occupation; and

- (b) in the case of an entity, the nature of its principal business.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Initiation

In respect of an electronic funds transfer, means the first transmission of the instructions for the transfer of funds. (amorcer)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Institutional trust

For the purpose of section 15 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations (PCMLTFR), means a trust that is established by a corporation or other entity for a particular business purpose and includes a pension plan trust, a pension master trust, a supplemental pension plan trust, a mutual fund trust, a pooled fund trust, a registered retirement savings plan trust, a registered retirement income fund trust, a registered education savings plan trust, a group registered retirement savings plan trust, a deferred profit sharing plan trust, an employee profit sharing plan trust, a retirement compensation arrangement trust, an employee savings plan trust, a health and welfare trust, an unemployment benefit plan trust, a foreign insurance company trust, a foreign reinsurance trust, a reinsurance trust, a real estate investment trust, an environmental trust and a trust established in respect of endowment, a foundation or a registered charity. (fiducie institutionnelle)

Reference:

PCMLTFR, SOR/2002-184, s. 15(2).- International electronic funds transfer

An electronic funds transfer other than for the transfer of funds within Canada. (télévirement international)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Inter vivos trust

A personal trust, other than a trust created by will. (fiducie entre vifs)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Jewellery

Objects that are made of gold, silver, palladium, platinum, pearls or precious stones and that are intended to be worn as a personal adornment. (bijou)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Large cash transaction record

A record that indicates the receipt of an amount of $10,000 or more in cash in a single transaction and that contains the following information:

- (a) the date of the receipt;

- (b) if the amount is received for deposit into an account, the number of the account, the name of each account holder and the time of the deposit or an indication that the deposit is made in a night deposit box outside the recipient's normal business hours;

- (c) the name and address of every other person or entity that is involved in the transaction, the nature of their principal business or their occupation and, in the case of a person, their date of birth;

- (d) the type and amount of each fiat currency involved in the receipt;

- (e) the method by which the cash is received;

- (f) if applicable, the exchange rates used and their source;

- (g) the number of every other account that is affected by the transaction, the type of account and the name of each account holder

- (h) every reference number that is connected to the transaction and has a function equivalent to that of an account number;

- (i) the purpose of the transaction;

- (j) the following details of the remittance of, or in exchange for, the cash received:

- (i) the method of remittance;

- (ii) if the remittance is in funds, the type and amount of each type of funds involved;

- (iii) if the remittance is not in funds, the type of remittance and its value, if different from the amount of cash received; and

- (iv) the name of every person or entity involved in the remittance and their account number or policy number or, if they have no account number or policy number, their identifying number; and

- (k) if the amount is received by a dealer in precious metals and precious stones for the sale of precious metals, precious stones or jewellery:

- (i) the type of precious metals, precious stones or jewellery;

- (ii) the value of the precious metals, precious stones or jewellery, if different from the amount of cash received, and

- (iii) the wholesale value of the precious metals, precious stones or jewellery.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Large virtual currency transaction record

A record that indicates the receipt of an amount of $10,000 or more in virtual currency in a single transaction and that contains the following information:

- (a) the date of the receipt;

- (b) if the amount is received for deposit into an account, the name of each account holder;

- (c) the name and address of every other person or entity that is involved in the transaction, the nature of their principal business or their occupation and, in the case of a person, their date of birth;

- (d) the type and amount of each virtual currency involved in the receipt;

- (e) the exchange rates used and their source;

- (f) the number of every other account that is affected by the transaction, the type of account and the name of each account holder;

- (g) every reference number that is connected to the transaction and has a function equivalent to that of an account number;

- (h) every transaction identifier, including the sending and receiving addresses; and

- (i) if the amount is received by a dealer in precious metals and precious stones for the sale of precious metals, precious stones or jewellery:

- (i) the type of precious metals, precious stones or jewellery;

- (ii) the value of the precious metals, precious stones or jewellery, if different from the amount of virtual currency received; and

- (iii) the wholesale value of the precious metals, precious stones or jewellery.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Life insurance broker or agent

A person or entity that is authorized under provincial legislation to carry on the business of arranging contracts of life insurance. (représentant d'assurance-vie)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Life insurance company

A life company or foreign life company to which the Insurance Companies Act applies or a life insurance company regulated by a provincial Act. (société d'assurance-vie)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Listed person or entity

A listed person or entity means:

from March 2, 2025,

- a terrorist group as defined in subsection 83.01(1) of the Criminal Code;

- a person or entity that is the subject of an order or regulation made under the United Nations Act;

- a foreign state, as defined in section 2 of the Special Economic Measures Act, that is the subject of an order or regulation made under United Nations Act; and

from October 1, 2025

- a foreign state, as defined in section 2 of the Special Economic Measures Act, that is the subject of an order or regulation made under that Act;

- a person or entity that is the subject of an order or regulation made under the Special Economic Measures Act;

- a person who is the subject of an order or regulation made under section 4 of the Justice for Victims of Corrupt Foreign Officials Act (Sergei Magnitsky Law).

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).Consult the following sanctions lists :

- Under the United Nations Act

- Under the Special Economic Measures Act and the Justice for Victims of Corrupt Foreign Officials Act

Consult the following list for terrorist entities listed under the Criminal Code on the Public Safety Canada website:

- Terrorist group

According to subsection 83.01(1) of the Criminal Code, a terrorist group is defined as:

- an entity that has as one of its purposes or activities facilitating or carrying out any terrorist activity,

- a listed entity, or

- an association of such entities.

Consult the following list for terrorist entities listed under the Criminal Code on the Public Safety Canada website:

(groupe terroriste)

- Managing general agents (MGAs)

Life insurance brokers or agents that act as facilitators between other life insurance brokers or agents and life insurance companies. MGAs typically offer services to assist with insurance agents contracting and commission payments, facilitate the flow of information between insurer and agent, and provide training to, and compliance oversight of, insurance agents. (agent général de gestion)

- Mandatary

A person who acts, under a mandate or agreement, for another person or entity. (mandataire)

- Marketing or advertising

When a person or entity uses promotional materials such as advertisements, graphics for websites or billboards, etc., with the intent to promote money services business (MSB) services and to acquire business from persons or entities in Canada. (marketing ou publicité)

- Minister

In relation to sections 24.1 to 39, the Minister of Public Safety and Emergency Preparedness and, in relation to any other provision of this Act, the Minister of Finance. (ministre)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Money laundering offence

An offence under subsection 462.31(1) of the Criminal Code. The United Nations defines money laundering as "any act or attempted act to disguise the source of money or assets derived from criminal activity." Essentially, money laundering is the process whereby "dirty money"—produced through criminal activity—is transformed into "clean money," the criminal origin of which is difficult to trace. (infraction de recyclage des produits de la criminalité)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Money laundering and terrorist financing indicators (ML/TF indicators)

Potential red flags that could initiate suspicion or indicate that something may be unusual in the absence of a reasonable explanation. [Indicateurs de blanchiment d'argent (BA) et de financement du terrorisme (FT) (indicateurs de BA/FT)]

- Money services business

A person or entity that has a place of business in Canada and that is engaged in the business of providing at least one of the following services:

- (i) foreign exchange dealing,

- (ii) remitting funds or transmitting funds by any means or through any person, entity or electronic funds transfer network,

- (iii) issuing or redeeming money orders, traveller's cheques or other similar negotiable instruments except for cheques payable to a named person or entity,

- (iv) dealing in virtual currencies, or

- (v) any prescribed service.

Reference:

PCMLTFA, S.C. 2000, c 17, s. 5(h), PCMLTFRR, SOR/2007-121, s. 1 and PCMLTFR, SOR/2002-184, s. 1(2).- Money services business agent

An individual or entity authorized to deliver services on behalf of a money services business (MSB). It is not an MSB branch. (mandataire d'une entreprise de services monétaires)

- Mortgage administrator

A person or entity, other than a financial entity, that is engaged in the business of servicing mortgage agreements on real property or hypothec agreements on immovables on behalf of a lender. (administrateur hypothécaire)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 5(i), PCMLTFRR,SOR/2002-184, subsection 1(2)- Mortgage broker

A person or entity that is authorized under provincial legislation to act as an intermediary between a lender and a borrower with respect to loans secured by mortgages on real property or hypothecs on immovables. (courtier hypothécaire)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 5(i), PCMLTFRR,SOR/2002-184, subsection 1(2)- Mortgage lender

A person or entity, other than a financial entity, that is engaged in the business of providing loans secured by mortgages on real property or hypothecs on immovables. (prêteur hypothécaire)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 5(i), PCMLTFRR,SOR/2002-184, subsection 1(2)- Nature of principal business

An entity's type or field of business. Also applies to an individual in the case of a sole proprietorship. (nature de l'entreprise principale)

- New developments

Changes to the structure or operations of a business when new services, activities, or locations are put in place. For example, changes to a business model or business restructuring. (nouveaux développements)

- New technologies

The adoption of a technology that is new to a business. For example, when a business adopts new systems or software such as transaction monitoring systems or client onboarding and identification tools. (nouvelles technologies)

- No apparent reason

There is no clear explanation to account for suspicious behaviour or information. (sans raison apparente)

- Occupation

The job or profession of an individual. (profession ou métier)

- Passenger vehicle

A motor vehicle — other than an ambulance, a hearse, a motor vehicle that is clearly marked for policing activities, a motor vehicle that is clearly marked and equipped for emergency medical response activities or emergency fire response activities or a utility truck — that is designed or adapted primarily to carry no more than 10 individuals on highways and streets. (véhicule de tourisme)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Person

An individual. (personne)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Person authorized to give instructions

In respect of an account, means a person who is authorized to instruct on the account or make changes to the account, such as modifying the account type, updating the account contact details, and in the case of a credit card account, requesting a limit increase or decrease, or adding or removing card holders. A person who is only able to conduct transactions on the account is not considered a person authorized to give instructions. (personne habilitée à donner des instructions)

- Politically exposed domestic person

A person who, at a given time, holds—or has held within a prescribed period before that time—one of the offices or positions referred to in any of paragraphs (a) and (c) to (j) in or on behalf of the federal government or a provincial government or any of the offices or positions referred to in paragraphs (b) and (k):

- (a) Governor General, lieutenant governor or head of government;

- (b) member of the Senate or House of Commons or member of a legislature of a province;

- (c) deputy minister or equivalent rank;

- (d) ambassador, or attaché or counsellor of an ambassador;

- (e) military officer with a rank of general or above;

- (f) president of a corporation that is wholly owned directly by His Majesty in right of Canada or a province;

- (g) head of a government agency;

- (h) judge of an appellate court in a province, the Federal Court of Appeal or the Supreme Court of Canada;

- (i) leader or president of a political party represented in a legislature;

- (j) holder of any prescribed office or position; or

- (k) mayor, reeve or other similar chief officer of a municipal or local government.

Reference:

PCMLTFA, S.C. 2000, c 17, s. 9.3(3).- Politically exposed foreign person

A person who holds or has held one of the following offices or positions in or on behalf of a foreign state:

- (a) head of state or head of government;

- (b) member of the executive council of government or member of a legislature;

- (c) deputy minister or equivalent rank;

- (d) ambassador, or attaché or counsellor of an ambassador;

- (e) military officer with a rank of general or above;

- (f) president of a state-owned company or a state-owned bank;

- (g) head of a government agency;

- (h) judge of a supreme court, constitutional court or other court of last resort;

- (i) leader or president of a political party represented in a legislature; or

- (j) holder of any prescribed office or position.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Possibility

In regards to completing a suspicious transaction report (STR), the likelihood that a transaction may be related to a money laundering/terrorist financing (ML/TF) offence. For example, based on your assessment of facts, context and ML/TF indicators you have reasonable grounds to suspect that a transaction is related to the commission or attempted commission of an ML/TF offence. (possibilité)

- Precious metal

Gold, silver, palladium or platinum in the form of coins, bars, ingots or granules or in any other similar form. (métal précieux)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Precious stones

Diamonds, sapphires, emeralds, tanzanite, rubies or alexandrite. (pierre précieuse)

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Prepaid payment product

A product that is issued by a financial entity and that enables a person or entity to engage in a transaction by giving them electronic access to funds or virtual currency paid to a prepaid payment product account held with the financial entity in advance of the transaction. It excludes a product that:

- (a) enables a person or entity to access a credit or debit account or one that is issued for use only with particular merchants; or

- (b) is issued for single use for the purposes of a retail rebate program.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Prepaid payment product account

An account – other than an account to which only a public body or, if doing so for the purposes of humanitarian aid, a registered charity as defined in subsection 248(1) of the Income Tax Act, can add funds or virtual currency – that is connected to a prepaid payment product and that permits:

- (a) funds or virtual currency that total $1,000 or more to be added to the account within a 24-hour period; or

- (b) a balance of funds or virtual currency of $1,000 or more to be maintained.

Reference:

PCMLTFR, SOR/2002-184, s. 1(2).- Prescribed

Prescribed by regulations made by the Governor in Council. (Version anglaise seulement)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Private automated banking machine

Any automated banking machine that is not owned or operated by a bank as defined in section 2 of the Bank Act, by an association regulated by the Cooperative Credit Associations Act or by a cooperative credit society, a savings and credit union or a caisse populaire regulated by a provincial Act. (guichet automatique privé)

Reference:

PCMLTFA, S.C. 2000, c 17, s. 2(1).- Probability