Departmental Results Report 2020–2021

For the period ending March 31, 2021

The Honourable Chrystia Freeland P.C, M.P.

Deputy Prime Minister and Minister of Finance

ISSN 2560-8924

On this page

- From the Director and Chief Executive Officer

- Results at a glance

- Results: What we achieved

- Analysis of trends in spending and human resources

- Corporate Information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: Definitions

From the Director and Chief Executive Officer

I am honoured to have been appointed as the new Director and Chief Executive Officer for the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in November 2020, and I am proud to submit to Parliament and Canadians FINTRAC’s Departmental Results Report for 2020–21.

I want to recognize and thank my predecessor, Nada Semaan, for her tremendous leadership over the first seven plus months of activity covered by this report and for her incredible commitment, throughout her tenure, to strengthening FINTRAC as an employer of choice, a more open and transparent organization and a trusted leader in the global fight against money laundering and terrorist activity financing.

The global pandemic has had a significant impact on FINTRAC's operations, just as it has had on Canadians across the country. Through the determined and dedicated efforts of our staff, FINTRAC quickly and effectively mobilized and reoriented its operations at the beginning of the global pandemic to ensure that it was able to deliver on its critical financial intelligence and compliance mandates, while keeping its people and workplace safe.

The results that FINTRAC has been able to achieve throughout the global pandemic would not have been possible without the dedicated efforts of businesses across the country. In the face of public health restrictions in place in Canada’s provinces and territories throughout the year, businesses continued to report significant levels of suspicious transactions, allowing us to keep producing actionable financial intelligence for Canada’s police, law enforcement and national security agencies in support of their money laundering and terrorist financing investigations.

In uncertain times, the Centre's financial intelligence is more important than ever as criminals and terrorists look to take advantage of opportunities to enrich themselves and advance their illicit enterprises. Throughout the 2020–21 reporting period, FINTRAC provided 2,046 disclosures of actionable financial intelligence in support of investigations related to money laundering, terrorist activity financing and threats to the security of Canada. While working in a pandemic environment, the Centre managed to generate roughly the same number of disclosures as it has in previous years.

We also worked closely with businesses over the past year to implement significant new legislative and regulatory changes that came into effect in 2020 and on others that will be coming into effect in 2021. These changes are strengthening Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime by covering dealers in virtual currencies and foreign money services businesses, extending obligations related to beneficial ownership and politically exposed persons to all business sectors and requiring all businesses subject to our Act to report virtual currency transactions of $10,000 or more to the Centre.

Ultimately, our people are our greatest strength and the key to delivering on our commitments to Canadians. In the face of a global pandemic, FINTRAC staff have demonstrated great resilience and commitment to protecting Canada's financial sector and Canadians from criminal abuse. Under very challenging circumstances, their commitment to serving and protecting Canadians has been truly inspiring.

______________________

Sarah Paquet

Director and Chief Executive Officer

Results at a glance

| 2020–21 Main Estimates | 2020–21 Planned spending | 2020–21 Total authorities available for use | 2020–21 Actual spending (authorities used) | 2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 56,809,452 | 62,211,026 | 80,283,212 | 61,710,955 | -500,072 |

| 2020–21 Planned full-time equivalents | 2020–21 Actual full-time equivalents | 2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 372 | 390 | 18 |

FINTRAC continues to pursue its vision and strategic priorities, built on a foundation of three pillars that, together, bring to life the vision of contributing to the safety of Canadians and the security of the economy, as a trusted leader in the global fight against money laundering and terrorist activity financing.

Inside the overarching pillars of 1) Promote a culture of accountability; 2) Prepare FINTRAC for the future; and 3) Collaborate to strengthen results, FINTRAC's Strategic Plan articulates six priorities that are summarized below, along with some of the key strategic actions that will enable the Centre to realize its vision.

Pillar 1: Promote a culture of accountability

FINTRAC's objective is to have a resilient, agile workforce accountable for achieving the Centre's priorities within a culture that values diversity, collaboration, civility and ethical behaviour.

| FINTRAC Priorities | 2020–21 Results Achieved |

|---|---|

| Maximize the potential of our people |

|

| Ensure transparency through results and performance |

|

Pillar 2: Prepare FINTRAC for the future

FINTRAC’s objective is to maintain a work environment that supports innovation and provides the support and tools, especially information and data, to deepen the Centre’s analysis and approaches.

| FINTRAC Priorities | 2020–21 Results Achieved |

|---|---|

| Modernize the workplace |

|

| Explore and implement innovative solutions |

|

Pillar 3: Collaborate to strengthen results

FINTRAC’s objective is to leverage the knowledge and expertise of our domestic and international partners to influence change in the way we detect and deter money laundering and terrorist activity financing.

| FINTRAC Priorities | 2020–21 Results Achieved |

|---|---|

| Cultivate strategic relationships with key external stakeholders |

|

| Strengthen cross-government cooperation |

|

As a small agency, FINTRAC embraces the concept of ‘experimentation’ through its continued commitment to innovate and evolve its operational programs and internal services activities. Moving ahead to 2021–22, FINTRAC is committed to exploring new collaborations and work arrangements within Canada's AML/ATF Regime and through public and private partnerships with its major reporting entities in the continuing fight against money laundering and terrorist activity financing.

For more information on FINTRAC's plans, priorities and results achieved, see the "Results: what we achieved" section of this report.

Results: What we achieved

Core Responsibility: Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

Description

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is responsible for ensuring compliance with Part 1 and Part 1.1 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) and its associated Regulations. This legal framework establishes obligations for reporting entities to develop a compliance regime in order to identify clients, monitor business relationships, keep records and report certain types of financial transactions. FINTRAC undertakes assistance, assessment, and enforcement actions to ensure that the reporting entities operating within Canada's financial system fulfill their PCMLTFA obligations. These obligations provide important measures for countering patterns and behaviours observed in criminals and terrorists in order to deter them from operating within the legitimate channels of Canada's economy. FINTRAC also maintains a registry of money services businesses in Canada.

Results

The global pandemic had a significant impact on FINTRAC’s approach to compliance over the past year. The Centre, however, effectively mobilized its operations in order to deliver on its critical compliance mandate. This included working closely with businesses to minimize the impact of their regulatory requirements, given the challenging circumstances, while ensuring that FINTRAC was still able to protect Canadians and Canada’s economy.

Throughout the pandemic, FINTRAC’s compliance program has remained focused on its three pillars: assistance, assessment and enforcement.

Assistance to Businesses

As the severity of the COVID-19 pandemic intensified in Canada in March 2020, FINTRAC published guidance to support businesses that were facing challenges in meeting their obligations as a result of provincial emergency measures and staffing issues. In addition to suspending its onsite examinations, the Centre emphasized that it was committed to working constructively with businesses and provided temporary flexibility in areas such as the verification of client identity and transaction reporting.

In its communications with businesses, FINTRAC stressed the importance of prioritizing and submitting suspicious transaction reports given their importance to the production of financial intelligence, and provided alternate means of doing so if businesses could not access their regular systems. Businesses responded positively and suspicious transaction reporting to FINTRAC increased by more than 20% over the previous year.

The Centre updated its pandemic-related guidance on three additional occasions throughout 2020–21 in relation to record keeping, confirming the existence of a corporation or entity other than a corporation, and the resumption of desk examinations.

FINTRAC also provided substantial new and revised guidance to businesses throughout the year regarding the regulatory changes that came into effect in June 2020 and on others that will be coming into effect in 2021. These changes are intended to strengthen Canada’s Anti-Money Laundering and Anti-Terrorist Financing Regime by, among other things, including dealers in virtual currencies and foreign money services businesses, as well as extending obligations related to beneficial ownership and politically exposed persons to all reporting entity sectors.

Throughout 2020–21, FINTRAC continued to implement its five-year Compliance Engagement Strategy, which sets the priorities for the Centre’s engagement activities. Based on this strategy, FINTRAC undertook 208 outreach and engagement activities in 2020–21, including working groups, teleconferences, presentations, training sessions and meetings with businesses and stakeholders. The Centre also conducted consultations on a number of topics, including new and revised guidance, reporting forms and the implementation of regulatory amendments.

During the year, FINTRAC provided 445 policy interpretations to clarify its approach to the application of the PCMLTFA. Common interpretations were related to ascertaining identity, reporting international electronic funds transfers, and determining if a business was considered a reporting entity under the Act. FINTRAC’s policy interpretations, many of which involve complex business models, are generally posted on its website without identifying information, to assist other businesses that may have similar questions.

Throughout 2020–21, FINTRAC continued to operate its external call centre telephone line, which is usually managed by Service Canada. In total, during the year, the Centre responded to 6,778 enquiries from businesses in every reporting sector on a broad range of issues, including reporting obligations, access to reporting systems and the registration of money services businesses.

Businesses that exchange foreign currencies, transfer money or cash/sell money orders or traveller’s cheques must register with FINTRAC before offering these services to the public. Last year, 887 new money services businesses registered with FINTRAC and 366 businesses were renewed. In addition, 147 businesses ceased their registrations and 211 registrations expired. As of March 31, 2021, 2,070 money services businesses were registered with the Centre.

Assessment

In 2020–21, examinations remained the Centre's primary instrument for assessing the compliance of businesses subject to the Act. FINTRAC uses a risk-based approach to select the businesses that will be examined every year, focusing a significant portion of its examination resources on businesses that report large numbers of transactions or are at a higher risk of being deficient or exploited by money launderers or terrorist financiers. Consistent with its transition from an audit to an assessment approach over the past few years, FINTRAC has undertaken more complex, lengthy and in-depth examinations of larger businesses in higher-risk sectors in order to determine how effectively they are fulfilling their compliance obligations.

Largest Number of Examinations by Sector (Top Three)

2020–21 Real Estate (53)

MSBs (50)

Securities Dealers (25)

2019–20 Real Estate (146)

MSBs (114)

Securities Dealers (58)

2018–19 Real Estate (190)

MSBs (112)

Securities Dealers (57)

Given the impact of COVID-19 on Canada’s businesses, including the implementation of public health restrictions across the country, FINTRAC informed businesses in April 2020 that it was reprioritizing its supervisory work, including temporarily pausing any new examinations.

Following this temporary pause, FINTRAC effectively migrated to conducting virtual examinations in July 2020. The Centre communicated that it would continue to be flexible and reasonable by providing additional time—where required—for business to prepare necessary documentation and to respond to its requests.

During the year, FINTRAC conducted 151 compliance examinations, the largest number of which was focused on the real estate sector (53), followed by money services businesses (50) and securities dealers (25).

Enforcement

FINTRAC is committed to working with businesses to assist them in understanding and complying with their obligations. However, the Centre is also prepared to take firm action when it is required to ensure that businesses take their responsibilities seriously.

Follow-up examinations are an assessment tool that FINTRAC leverages, when appropriate, to determine if a business has addressed previous instances of non-compliance. In 2020–21, FINTRAC conducted 11 follow-up examinations. Of these, five resulted in enforcement actions (46%), two were considered for a follow-up activity (18%) and four required no further activity (36%).

In 2008, FINTRAC received the legislative authority to issue administrative monetary penalties to businesses that are in non-compliance with the PCMLTFA. Under the legislation, penalties are intended to be non-punitive and are focused on encouraging compliance with the Act.

In 2020–21, FINTRAC issued nine Notices of Violation for non-compliance, five in the real estate sector for a total of $538,230, two in the money services business sector for a total of $143,219 and two in the dealers in precious metals and stones sector for a total of $272,910. FINTRAC has issued 107 Notices of Violation across most business sectors since it received the legislative authority to do so in 2008.

Under the PCMLTFA, FINTRAC may disclose cases of non-compliance to the police and law enforcement when it is extensive or if there is little expectation of immediate or future compliance. In 2020–21, the Centre disclosed nine such cases. In recent years, law enforcement agencies have increasingly looked to leveraging the Non-compliance Disclosure tool to pursue criminal charges under the PCMLTFA.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018–19 Actual results |

2019–20 Actual results |

2020–21 Actual results |

|---|---|---|---|---|---|---|

| Reporting entities are compliant with Anti-Money Laundering and Anti-Terrorist Financing obligations and requirements | Percentage of assessed reporting entities not requiring enforcement action | 90% | March 31, 2021 | Not applicable | Not applicable | 94% |

| Percentage of financial transaction reports submitted to FINTRAC that meet validation rules as an indicator of quality | 90% | March 31, 2021 | 91.7% Percentage of Financial Transaction Reports submitted to FINTRAC that meet quality requirements |

88.1% Percentage of Financial Transaction Reports submitted to FINTRAC that meet quality requirements |

88% |

| 2020–21 Main Estimates |

2020–21 Planned spending |

2020–21 Total authorities available for use |

2020–21 Actual spending (authorities used) |

2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 21,452,641 | 23,621,954 | 28,261,343 | 19,944,414 | -$3,677,540 |

| 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents |

2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 128 | 138 | 10 |

Financial, human resources and performance information for FINTRAC’s Program Inventory is available in GC InfoBase.

Core Responsibility: Production and Dissemination of Financial Intelligence

Description

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is mandated by the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA) to produce actionable financial intelligence, including disclosures that assist Canada's police, law enforcement, national security and other partner agencies in combatting money laundering, terrorism financing and threats to the security of Canada, while protecting the personal information entrusted to FINTRAC. FINTRAC also produces strategic financial intelligence for federal policy and decision-makers, reporting entities across the country, international partners and other stakeholders. FINTRAC's strategic intelligence provides a wide analytic perspective on the nature, scope and threat posed by money laundering and terrorism financing.

Results

Financial Intelligence

| 2020–21 | 2,046 |

| 2019–20 | 2,057 |

| 2018–19 | 2,276 |

| 2017–18 | 2,466 |

| 2016–17 | 2,015 |

FINTRAC responded quickly and effectively at the beginning of the COVID-19 global pandemic, and throughout, to ensure that it was able to continue to provide actionable financial intelligence to Canada’s police, law enforcement and national security agencies to help them combat money laundering, terrorism financing and threats to the security of Canada. While working in a pandemic environment, the Centre managed to generate roughly the same number of disclosures as it has in previous years, adding to the more than 20,000 financial intelligence disclosures that it has provided to Canada's police, law enforcement and national security agencies since becoming operational in 2001.

During the 2020–21 reporting period, FINTRAC provided 2,046 disclosures of actionable financial intelligence in support of investigations related to money laundering, terrorist activity financing and threats to the security of Canada. Of these, 1,812 were related to money laundering, 146 were related to terrorism financing and threats to the security of Canada, and 88 were related to money laundering, terrorism financing and threats to the security of Canada.

While FINTRAC is an arm’s length financial intelligence unit, the Centre maintains productive working relationships with Canada’s police, law enforcement and national security agencies to ensure that its financial intelligence is relevant, timely and valuable. In 2020–21, FINTRAC conducted dozens of virtual outreach presentations across the country with disclosure recipients, including with the Canadian Police College’s Financial Investigators Course; the Ontario Police College’s Fraud Course, Internet Child Exploitation Course and Drug Investigators Course; the Privy Council Office’s Intelligence Analyst Learning Program; the Royal Canadian Mounted Police’s Proceeds of Crime Course, Terrorist Financing Investigators Course and Counter Proliferation Course; York Regional Police Service’s Financial Crimes Investigators Course; a Financial Crime Course at École nationale de police du Québec; and the Canadian Armed Forces National Counter Intelligence Unit’s Intake Training Course.

Throughout the year, FINTRAC's financial intelligence contributed to 376 major, resource intensive investigations at the municipal, provincial and federal levels across the country. Canadian police forces—particularly the Royal Canadian Mounted Police—continue to be the main recipients of FINTRAC's financial intelligence.

In 2020–21, FINTRAC’s financial intelligence was used in a wide variety of money laundering investigations where the origins of the suspected criminal proceeds were linked to fraud (including related to the global pandemic), drug trafficking, tax evasion, corruption, theft and other criminal offences.

FINTRAC always seeks feedback on its financial intelligence from disclosure recipients at the municipal, provincial and federal levels. Over the past year, the Centre received 201 completed disclosure feedback forms, 96 percent of which indicated that FINTRAC’s financial intelligence was actionable. This is a clear and significant measure of the effectiveness of, and results achieved by, FINTRAC under the PCMLTFA.

Results through Public-Private Partnerships

FINTRAC continues to play a role in advancing and supporting innovative project-based, public-private partnerships (PPPs). These partnerships are aimed at more effectively combatting online child sexual exploitation, money laundering in British Columbia and across Canada, human trafficking in the sex trade, romance fraud and the trafficking of illicit fentanyl.

By partnering with Canadian businesses, police and law enforcement agencies across Canada, FINTRAC has been effective in following the money to identify potential subjects, uncovering broader financial connections and providing intelligence to advance national project-level investigations. In total, in 2020–21, FINTRAC was able to provide 602 disclosures of actionable financial intelligence to Canada’s police and law enforcement agencies in relation to PPPs.

Building on its existing PPPs, Projects Protect, Guardian, Chameleon and Athena, FINTRAC published an Operational Alert, Laundering of Proceeds from Online Child Sexual Exploitation, as part of Project Shadow, a new partnership aimed at combatting online child sexual exploitation. Co-led by Scotiabank and the Canadian Centre for Child Protection and supported by FINTRAC and the National Child Exploitation Crime Centre of the Royal Canadian Mounted Police, this new project is harnessing the power of financial intelligence to identify possible perpetrators—and broader networks—linked to this horrific crime.

Strategic Intelligence

In addition to case disclosures, FINTRAC uses the information it receives from regime partners and businesses across the country, as well as other sources of information, to produce valuable strategic intelligence in the fight against money laundering and terrorist activity financing. Through the use of analytical techniques, FINTRAC is able to identify emerging characteristics, trends and tactics used by criminals to launder money or fund terrorist activities. The goal of the Centre's strategic intelligence is to inform regime partners and policy decision-makers, businesses, Canadians and international counterparts about the nature and extent of money laundering and terrorist activity financing in Canada and throughout the world.

Throughout 2020–21, FINTRAC produced and disseminated to regime partners a number of strategic financial intelligence assessments and reports on a range of specific money laundering and terrorism financing trends, typologies and mechanisms in order to improve the detection, prevention and deterrence of these activities. The Centre also provided ongoing strategic financial intelligence to the Department of Finance Canada, the lead of Canada's Anti-Money Laundering and Anti-Terrorist Financing Regime, on a broad spectrum of money laundering and terrorist financing issues. For example, through the National Inherent Risk Assessment Working Group, FINTRAC supported the Department of Finance Canada in determining which business sectors or industries need to be assessed for money laundering and terrorism financing risk, and then conducting an assessment of those risks.

In December 2020, with the new requirement for dealers in virtual currency to register as money services businesses and submit suspicious transaction reports to FINTRAC, the Centre also generated and posted money laundering and terrorist financing indicators in relation to virtual currency transactions. Based on a detailed review of money laundering and terrorist financing cases, high-quality suspicious transaction reports and strategic information from international organizations such as the Financial Action Task Force and the Egmont Group, these indicators are meant to assist businesses, when combined with additional facts and context, in determining if there are reasonable grounds to suspect that a virtual currency transaction is related to the commission or attempted commission of a money laundering or terrorist financing offence.

In order to support international efforts to combat money laundering and terrorist financing, FINTRAC also contributed to a number of global strategic financial intelligence initiatives, including developing a terrorism financing module for the Egmont Centre of FIU Excellence and Leadership (ECOFEL) and participating in Joint Experts Meetings for the Financial Action Task Force.

| Departmental results | Performance indicators | Target | Date to achieve target | 2018–19 Actual results |

2019–20 Actual results |

2020–21 Actual results |

|---|---|---|---|---|---|---|

| FINTRAC's tactical financial intelligence disclosures inform investigative actions | Percentage of feedback from disclosure recipients that indicates that FINTRAC's financial intelligence disclosure was actionable | 85% | March 31, 2021 | 90% | 97% | 96% |

| FINTRAC's strategic financial intelligence informs policy and decision-making | Percentage of Regime partners using FINTRAC products to inform activities | 70% | March 31, 2021 | Not available | Not available | 70% |

| 2020–21 Main Estimates |

2020–21 Planned spending |

2020–21 Total authorities available for use |

2020–21 Actual spending (authorities used) |

2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 15,492,634 | 17,618,782 | 20,264,857 | 17,373,038 | -245,744 |

| 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents |

2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 108 | 111 | 3 |

Financial, human resources and performance information for FINTRAC’s Program Inventory is available in GC InfoBase.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Acquisition Management Services; Communication Services; Financial Management Services; Human Resources Management Services; Information Management Services; Information Technology Services; Legal Services; Material Management Services; Management and Oversight Services; and Real Property Management Services.

Results

Internal Services

As FINTRAC’s responsibilities and operations continue to grow in scope and complexity, its ability to deliver on its mandate is tied directly to its adaptability, the skills and dedication of its employees, and the tools and resources that it provides them to do their work. As an organization committed to excellence, the Centre is focused on the effective management of its human, technological and financial resources.

Protecting the Health and Safety of Employees

As FINTRAC effectively mobilized and reoriented its operations at the beginning of the COVID-19 global pandemic to ensure that it was able to deliver on its critical financial intelligence and compliance mandates, the Centre remained focused on keeping its people and its workplace safe. Throughout 2020–21, FINTRAC rigorously managed its onsite presence to respect local and federal public health restrictions and to ensure that its employees could maintain appropriate physical distancing in the workplace. This included employees migrating to remote work where they could do so efficiently and effectively. The Centre developed a comprehensive Safe at Work Playbook and a Manager’s Toolkit to ensure that employees were aware of, and respected, the extensive measures that were in place to keep them safe. FINTRAC also implemented signage in all work locations; made available non-medical masks and hand sanitizer, established rigorous cleaning procedures and provided readily available cleaning products; created technology enabled contact tracing and reporting protocols and a building access management application to monitor building occupancy; and shared real-time guidance on occupational health and safety matters.

In addition to keeping its people safe over the past year, the Centre focused on supporting their mental health and well-being. This included conducting a COVID-19 Pulse Check-in Survey, which helped guide FINTRAC in adapting to new working environments both in the workplace and when working remotely. The Centre also established an information portal on its internal website, provided weekly messages to staff and held numerous all-staff virtual events throughout 2020–21 to ensure employees remained connected to the Centre and each other, and informed of any changes or new initiatives during the rapidly evolving global pandemic. FINTRAC also took steps to understand the needs of its employees through a survey to help inform business resumption strategies and action. Communications often focused on the extensive mental health supports that were available for staff and their families. In addition, FINTRAC’s Ombuds and Champion for Mental Health were actively engaged in assisting, supporting and listening to individual employees and promoting, more broadly, information and advice to help staff manage the significant personal and professional challenges associated with the global pandemic.

Inclusive, Safe and Healthy Workplace

As part of its efforts to ensure a workplace that is inclusive, safe and healthy, FINTRAC is committed to promoting diversity, employment equity and multiculturalism. FINTRAC was among the first federal public sector organizations in 2020–21 to join the 50-30 challenge to increase the representation of women at the senior management level and the representation of other equity seeking groups in the various governance committees to enable a more direct influence on decision-making at the Centre. The Centre’s Executive Committee and 40 employees also participated in Positive Space Training, which raised awareness of the importance of creating positive space and adopting a culture of inclusivity. In addition, FINTRAC engaged with Specialisterne in a neurodiversity recruitment initiative which will facilitate the recruitment, integration and retention of individuals with cognitive disabilities in professional positions. FINTRAC also continues to promote diversity and employment equity through its job posters, selection processes, job fairs and open houses.

FINTRAC’s Employment Equity and Multiculturalism Committee, under the leadership of its Champion, organized a number of activities throughout the year. In the fall of 2020, for example, the Committee put together a Multiculturalism cookbook with recipes from employees. The proceeds from the sales of the cookbook were donated to the Government of Canada’s Workplace Charitable Campaign. This cookbook, which replaced the annual potluck because of the pandemic, provided an opportunity for employees to enjoy a diversity of cuisine and celebrate inclusion and multiculturalism.

FINTRAC is committed to implementing a Government of Canada initiative focused on using Gender-Based Analysis Plus (GBA Plus) to develop policies and programs. As part of its renewed governance, the Centre has a GBA Plus Champion and an ADM-level Champion on Gender-Inclusive Services who represents FINTRAC inter-departmentally and who is focused on building awareness about the policy direction and the issue, mobilizing various lines of business, and supporting consistency across the Government of Canada.

Safeguarding Personal Information

In fulfilling its core financial intelligence and compliance mandates, FINTRAC is committed to safeguarding the information that it receives and discloses to Canada’s police, law enforcement and national security agencies. The Proceeds of Crime (Money Laundering) and Terrorist Financing Act strikes a careful balance between FINTRAC’s receipt and disclosure of personal information to support essential criminal and national security investigations and the rights of Canadians to be protected from unnecessary invasions of their privacy.

The safeguarding of personal information is critical to FINTRAC and clear principles for the protection of privacy are set out in its governing legislation, including strict limitations on the information that can be received and disclosed, clear requirements for maintaining and disposing of records, and a biennial audit of FINTRAC’s protection of information by the Office of the Privacy Commissioner. These principles are reinforced by the Centre’s own operational policies and security measures.

In 2019–20, FINTRAC updated its three-year Departmental Security Plan. The new plan summarizes the Centre's approach to managing security risks, outlines strategies, objectives, priorities and timelines to improve departmental security, contribute to the achievement of FINTRAC's Strategic Plan and Government of Canada security priorities. Additionally, FINTRAC undertook a comprehensive review of its security model to align it with the Centre's other modernization initiatives.

In 2019–20, the Office of the Privacy Commissioner launched its fourth review of FINTRAC’s privacy protection measures, focusing on the security controls that the Centre has in place to protect its information holdings. The Office of the Privacy Commissioner’s review will continue into 2021–22.

The protection of privacy is a clear priority and a critical result of FINTRAC’s work. While helping to protect the safety of Canadians and security of Canada’s economy, the Centre is determined to meet all of its obligations under the Privacy Act and the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

| 2020–21 Main Estimates |

2020–21 Planned spending |

2020–21 Total authorities available for use |

2020–21 Actual spending (authorities used) |

2020–21 Difference (Actual spending minus Planned spending) |

|---|---|---|---|---|

| 19,864,177 | 20,970,290 | 31,757,012 | 24,393,503 | 3,234,029 |

| 2020–21 Planned full-time equivalents |

2020–21 Actual full-time equivalents |

2020–21 Difference (Actual full-time equivalents minus Planned full-time equivalents) |

|---|---|---|

| 136 | 141 | 5 |

Analysis of trends in spending and human resources

Actual expenditures

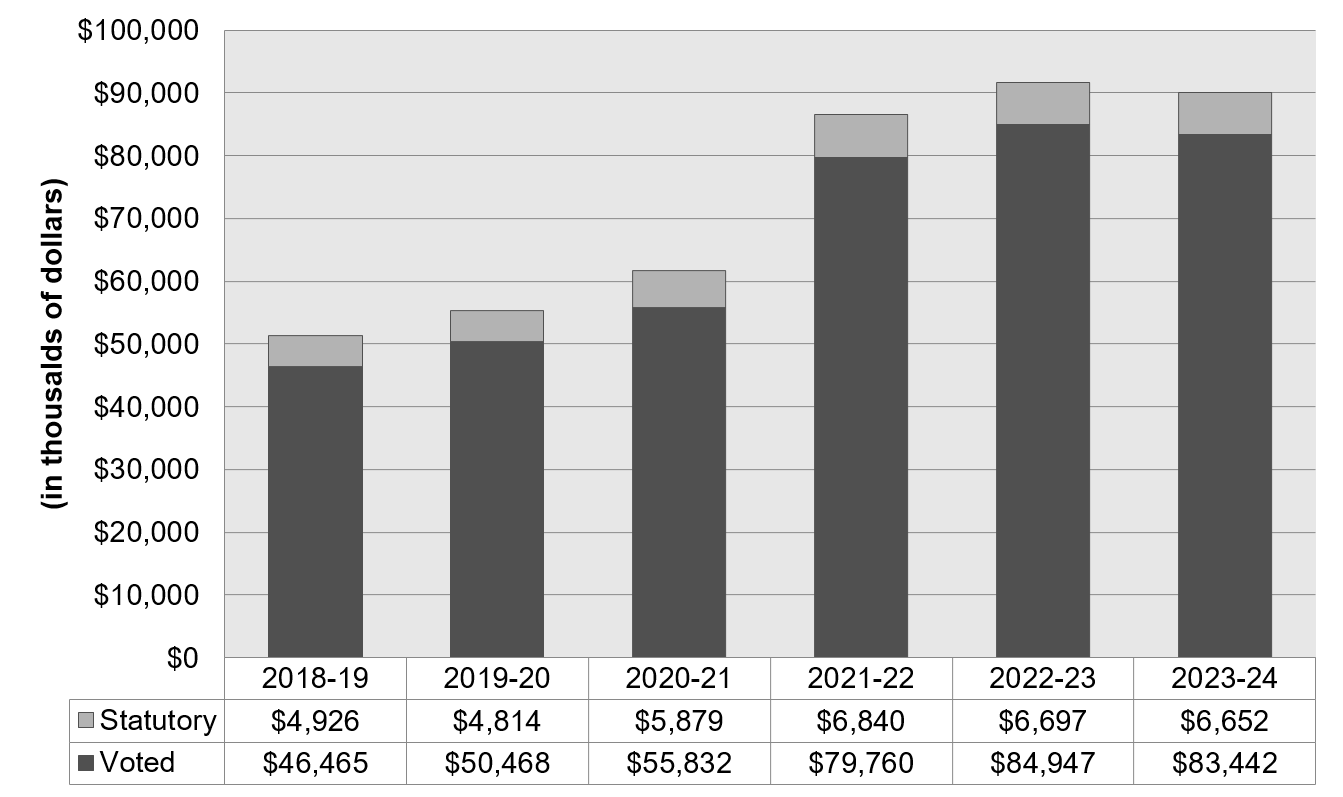

Departmental spending trend graph

The following graph presents planned (voted and statutory spending) over time.

View the text equivalent for Departmental Spending Trend

| Fiscal year | Statutory | Voted |

|---|---|---|

| 2018–19 | $4,926 | $46,465 |

| 2019–20 | $4,814 | $50,468 |

| 2020–21 | $5,879 | $55,832 |

| 2021–22 | $6,840 | $79,760 |

| 2022–23 | $6,697 | $84,947 |

| 2023–24 | $6,652 | $83,442 |

Actual Spending (2018–19 to 2020–21)

In 2019–20, actual spending was $55.3M. This is an increase of $3.9M compared to the 2018–19 spending of $51.4M. The increase in expenditures was primarily due to the following:

- Personnel expenditures increased by $2.2M. In 2019–20, FINTRAC’s Executive Committee approved an economic increase for employees dating back to 2018. Retroactive salary expenses were incurred for 2018 and 2019 annual cost of living wage increases, increasing personal expenditures in 2019–20.

- Professional and special services increased by $1.1M in 2019–20. Expenses increased in various service categories including legal services, informatics, management consulting, protection, and other professional services.

- Purchases, repairs and maintenance increased by $0.6M. Increased costs are attributable to machinery and equipment, as well as office buildings.

Actual spending in 2020–21 was $61.7M, an increase of $6.4M compared to 2019–20 expenditures. The increase in spending is primarily due to the following:

- Personnel expenditures increased by $5.4M in 2020–21 following an increase in the number of full-time equivalents.

- Professional and special services expenses increased by $0.9M due to an increase in costs for project management services.

- Increases in spending for the acquisition of machinery and equipment, information and rentals were offset by decreases in expenses related to purchases, repair and maintenance, transportation and telecommunications, and utilities.

| Core Responsibilities and Internal Services | 2020–21 Main Estimates |

2020–21 Planned spending |

2021–22 Planned spending |

2022–23 Planned spending |

2020–21 Total authorities available for use |

2018–19 Actual spending (authorities used) |

2019–20 Actual spending (authorities used) |

2020–21 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 21,452,641 | 23,621,954 | 28,792,401 | 30,103,267 | 28,261,343 | 17,486,737 | 18,774,765 | 19,944,414 |

| Production and Dissemination of Financial Intelligence | 15,492,634 | 17,618,782 | 21,554,226 | 23,846,945 | 20,264,857 | 15,918,187 | 15,765,039 | 17,373,038 |

| Subtotal | 36,945,275 | 41,240,736 | 50,346,627 | 52,950,212 | 48,526,200 | 33,404,924 | 34,539,804 | 37,317,452 |

| Internal Services | 19,864,177 | 20,970,290 | 36,253,627 | 37,690,393 | 31,757,012 | 17,986,364 | 20,742,962 | 24,393,503 |

| Total | 56,809,452 | 62,211,026 | 86,600,574 | 91,640,605 | 80,283,212 | 51,391,288 | 55,282,766 | 61,710,955 |

Planned Spending (2021–22 to 2023–24)

Planned spending is expected to increase to $86.6M in 2021–22. The following year, expenditures are anticipated to increase by $5.0M, bringing it to a peak of $91.6M. In 2023–24, planned spending decreases by $1.5M to $90.1M. The variance in planned spending between 2021–22 to 2023–24 is largely based on the profile of funds announced in the July 2020 Economic and Fiscal Snapshot for fighting financial crime, relocation of FINTRAC's office space and the modernization of the cross-border currency reporting framework, as well as on the profile of funds announced in Budget 2019 to strengthen Canada's AML/ATF Regime.

Actual human resources

| Core responsibilities and Internal Services | 2018–19 Actual full-time equivalents | 2019–20 Actual full-time equivalents | 2020–21 Planned full-time equivalents | 2020–21 Actual full-time equivalents | 2021–22 Planned full-time equivalents | 2022–23 Planned full-time equivalents |

|---|---|---|---|---|---|---|

| Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations | 129 | 102 | 128 | 138 | 137 | 127 |

| Production and Dissemination of Financial Intelligence | 111 | 127 | 108 | 111 | 116 | 116 |

| Subtotal | 240 | 229 | 236 | 249 | 253 | 243 |

| Internal Services | 115 | 123 | 136 | 141 | 160 | 167 |

| Total | 355 | 352 | 372 | 390 | 413 | 410 |

Full-time Equivalents (FTEs) have increased from 352 in 2019–20 to 390 in 2020–21. Actual FTEs in 2020–21 exceed planned FTEs for 2020–21 by 18 FTEs. The increase in FTEs was the result of new resources announced in the July 2020 Economic and Fiscal Snapshot for fighting financial crime, relocation of FINTRAC's office space and the modernization of the cross-border currency reporting framework, as well as in Budget 2019, to strengthen Canada's anti-money laundering and anti-terrorist financing regime, and for FINTRAC to contribute to the national strategy to combat human trafficking.

In addition to the increase in resources, FINTRAC has modernized its approach to recruitment and staffing. In 2019–20, FINTRAC launched an enterprise talent acquisition framework and created a recruitment taskforce. The framework features an integrated vacancy management strategy, coupled with robust outreach and staffing processes. Efforts have been focused on reducing the time it takes to staff positions, providing optimized applicant-to-job fit, and recruiting high caliber candidates. These strategies contributed to filling vacant positions and increasing staff members in 2020–21.

FTEs are expected to increase in 2021–22 as vacant positions, related to the funding announced in Budget 2020 are filled. Following this projected increase, FTEs are expected to stabilize in 2022–23.

Expenditures by vote

For information on FINTRAC’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2020-2021.

Government of Canada spending and activities

Information on the alignment of FINTRAC’s spending with the Government of Canada’s spending and activities is available in GC InfoBase.

Financial statements and financial statements highlights

Financial statements

FINTRAC’s financial statements (unaudited) for the year ended March 31, 2021, are available on FINTRAC’s website.

Financial statements highlights

| Financial information | 2020–21 Planned results |

2020–21 Actual results |

2019–20 Actual results |

Difference (2020–21 Actual results minus 2020–21 Planned results) |

Difference (2020–21 Actual results minus 2019–20 Actual results) |

|---|---|---|---|---|---|

| Total expenses | 66,928,996 | 66,512,228 | 71,872,789 | -416,768 | -5,360,561 |

| Total revenues | 0 | 0 | 25 | 0 | -25 |

| Net cost of operations before government funding and transfers | 66,928,996 | 66,512,228 | 71,872,764 | -416,768 | -5,360,536 |

Actual Expenses (2019–20 to 2020–21)

In 2020–21, actual expenses were $66,512,228. This is a decrease of $5,360,561 compared to 2019–20 expenses of $71,872,789. The variance is primarily due to:

- A decrease in other expenditures of $13,724,899 following the write-off of an asset under construction in fiscal year 2019–20.

- An increase in salaries and employee benefits of $7,142,628 due to an increase in the number of full-time equivalents (FTE) on strength, as well as an increase in the allowance for vacation pay.

- An increase in professional and special services of $886,285 due to an increase in project management services in 2020–21.

Actual Revenues (2019–20 to 2020–21)

In 2020–21, actual revenues were $0. In the previous fiscal year FINTRAC earned $25 of revenue on the proceeds from disposal of non-capital assets.

| Financial Information | 2020–21 | 2019–20 | Difference (2020–21 minus 2019–20) |

|---|---|---|---|

| Total net liabilities | $11,336,894 | $12,408,321 | -$1,071,427 |

| Total net financial assets | $6,026,264 | $8,864,033 | -$2,837,769 |

| Departmental net debt | $5,310,630 | $3,544,288 | $1,766,342 |

| Total non-financial assets | $4,632,440 | $4,489,093 | $143,347 |

| Departmental net financial position | -$678,190 | $944,805 | -$1,622,995 |

Actual total net liabilities (2019–20 to 2020–21)

In 2020–21, total net liabilities were $11,336,894. This is a decrease of $1,071,427 compared to 2019–20 total net liabilities of $12,408,321. The overall decrease primarily consists of the following:

- A decrease in accounts payable and accrued liabilities of $2,883,837. This includes a decrease in salaries and wages payable due to exceptional retroactive payments in 2019–20, as well as the timing of the paydays at the end of the fiscal year.

- An increase in vacation pay and compensatory leave of $1,788,050. This is largely attributable to a temporary suspension of the mandatory cash out of excess unused vacation and compensatory leave in fiscal year 2020–21.

Actual total net financial assets (2019–20 to 2020–21)

In 2020–21, total net financial assets were $6,026,264. This is a decrease of $2,837,769 compared to 2019–20 total net financial assets of $8,864,033. The decrease primarily consists of the following:

- A decrease in the amount due from Consolidated Revenue Fund of $1,574,616 resulting from a decrease in liabilities such as accounts payable and accrued salaries.

- A decrease in accounts receivable and advances of $1,176,394. This includes other government departments (OGD) accounts receivable.

Actual Departmental net debt (2019–20 to 2020–21)

In 2020–21, departmental net debt was $5,310,630. This is an increase of $1,766,342 compared to 2019–20 departmental net debt of $3,544,288 due to the changes in liabilities and financial assets described above.

Corporate Information

Organizational profile

Appropriate Minister: The Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance

Institutional Head: Sarah Paquet, Director and Chief Executive Officer

Ministerial portfolio: Finance

Enabling instrument: Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c. 17. (PCMLTFA)

Year of commencement: 2000

Reporting framework

FINTRAC’s Departmental Results Framework and Program Inventory of record for 2020–21 are shown below.

Departmental Results Framework

Core Responsibility 1: Compliance with Anti-Money Laundering and Anti-Terrorism Financing Legislation and Regulations

-

Departmental Result: Reporting entities are compliant with their anti-money laundering and anti-terrorist financing obligations and requirements

- Indicator: Percentage of assessed reporting entities not requiring enforcement action

- Indicator: Percentage of Financial Transaction Reports submitted to FINTRAC that meet validation rules as an indicator of quality

Internal Services

Core Responsibility 2: Production and Dissemination of Financial Intelligence

-

Departmental Result: FINTRAC's tactical financial intelligence informs investigative actions

- Indicator: Percentage of feedback from disclosure recipients that indicate that FINTRAC's financial intelligence disclosure was actionable

-

Departmental Result: FINTRAC's strategic financial intelligence informs policy and decision making

Indicator: Percentage of Regime partners utilizing FINTRAC products to inform activities

Program inventory

Program: Compliance Program

Program: Strategic Policy and Reviews

Program: Financial Intelligence Program

Program: Strategic Intelligence Research and Analytics

Raison d'être, mandate and role: who we are and what we do

Raison d'être, mandate and role: who we are and what we do is available on FINTRAC's website.

Operating context

Information on the operating context is available on FINTRAC's website.

Supporting information on the program inventory

Financial, human resources and performance information for FINTRAC's Program Inventory is available in GC InfoBase.

Supplementary information tables

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs as well as evaluations and GBA Plus of tax expenditures.

Organizational contact information

Mailing address

Financial Transactions and Reports Analysis Centre of Canada

234 Laurier Avenue West

Ottawa, Ontario K1P 1H7

Canada

Telephone: 1-866-346-8722 (toll free)

Email: guidelines-lignesdirectrices@fintrac-canafe.gc.ca

Website(s): https://www.fintrac-canafe.gc.ca/intro-eng

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A report on the plans and expected performance of an appropriated department over a 3 year period. Departmental Plans are usually tabled in Parliament each spring.

- departmental priority (priorité)

- A plan or project that a department has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired departmental results.

- departmental result (résultat ministériel)

- A consequence or outcome that a department seeks to achieve. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A quantitative measure of progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that connects the department’s core responsibilities to its departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- experimentation (expérimentation)

- The conducting of activities that seek to first explore, then test and compare the effects and impacts of policies and interventions in order to inform evidence-based decision-making, and improve outcomes for Canadians, by learning what works, for whom and in what circumstances. Experimentation is related to, but distinct from innovation (the trying of new things), because it involves a rigorous comparison of results. For example, using a new website to communicate with Canadians can be an innovation; systematically testing the new website against existing outreach tools or an old website to see which one leads to more engagement, is experimentation.

- full time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person year charge against a departmental budget. For a particular position, the full time equivalent figure is the ratio of number of hours the person actually works divided by the standard number of hours set out in the person’s collective agreement.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical process used to assess how diverse groups of women, men and gender-diverse people experience policies, programs and services based on multiple factors including race ethnicity, religion, age, and mental or physical disability.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2020–21 Departmental Results Report, those high-level themes outlining the government’s agenda in the 2019 Speech from the Throne, namely: Fighting climate change; Strengthening the Middle Class; Walking the road of reconciliation; Keeping Canadians safe and healthy; and Positioning Canada for success in an uncertain world.

- horizontal initiative (initiative horizontale)

- An initiative where two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence based performance information. Performance reporting supports decision making, accountability and transparency.

- plan (plan)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally, a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead to the expected result.

- planned spending (dépenses prévues)

- For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports. - program (programme)

- Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

- program inventory (répertoire des programmes)

- Identifies all the department’s programs and describes how resources are organized to contribute to the department’s core responsibilities and results.

- result (résultat)

- A consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

- statutory expenditures (dépenses législatives)

- Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

- target (cible)

- A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

- voted expenditures (dépenses votées)

- Expenditures that Parliament approves annually through an appropriation act. The vote wording becomes the governing conditions under which these expenditures may be made.

- Date Modified: