Draft Guidance: Reporting electronic funds transfers to FINTRAC

New – Added on December 29, 2023

From: Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

This guidance comes into effect on June **, 2024.

This guidance explains the requirement to report electronic funds transfers to FINTRAC.

Please note this is a draft document and, as such, may be subject to change. Once in effect, this guidance will replace the following guidance which will be archived online:

- Guideline 8A: Submitting Non-SWIFT Electronic Funds Transfer Reports to FINTRAC Electronically

- Guideline 8B: Submitting SWIFT Electronic Funds Transfer Reports to FINTRAC

- Guideline 8C: Submitting Non-SWIFT Electronic Funds Transfer Reports to FINTRAC by Paper

Refer to the existing guidance above if you need to report an electronic funds transfer that occurs prior to June **, 2024.

Note:

- Throughout this guidance, references to dollar amounts (such as $10,000) are in Canadian dollars unless otherwise specified.

- The examples and scenarios are meant to help explain reporting requirements.

- The details used in these examples and scenarios such as names of persons, names of entities, addresses, phone numbers and email addresses are fictitious.

In this guidance

- 1. Who must comply

- 2. Key terms and concepts

- 3. Reporting requirements for casinos and financial entities

- 4. Reporting requirements for a money services business and a foreign money services business

- 5. Important considerations when reporting electronic funds transfers

- 6. How to submit a report to FINTRAC

- 7. The form for reporting electronic funds transfers

- 8. Other requirements associated with electronic funds transfers

- 9. Exceptions to reporting electronic funds transfers

- Annex A: Field instructions to complete an Electronic Funds Transfer Report

- Annex B: Initiation scenarios

- Annex C: Final receipt scenarios

- Details and history

- For assistance

Related links

Related acts and regulations

Related guidance

- Reporting transactions to FINTRAC: The 24-hour rule

- Travel rule for electronic funds and virtual currency transfers

- What is a Suspicious Transaction Report

- Reporting suspicious transactions to FINTRAC

- Reporting large cash transactions to FINTRAC

- Methods to verify the identity of persons and entities

- Compliance program requirements

- Ministerial directives and transaction restrictions

- Voluntary self-declaration of non-compliance

1. Who must comply

The following reporting entity sectors must comply with the electronic funds transfer reporting requirements:

- financial entities

- money services businesses and foreign money services businesses

- casinos

If you are a person who is a reporting entity, and you are also an employee of a reporting entity, your employer is responsible for meeting the electronic funds transfer reporting requirements associated with your activities as an employee.

Similarly, if you are a reporting entity that is an agent of or authorized to act on behalf of another reporting entity, it is the responsibility of the reporting entity for which you are an agent or acting on behalf to meet the reporting requirements associated with the activities you conduct on its behalf. This does not apply if you are a life insurance broker or agent (unless you are an employee as explained above).

A service provider can submit and correct an Electronic Funds Transfer Report on your behalf. However, as the reporting entity, you are ultimately responsible for meeting the requirements under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the Act) and associated Regulations, even if a service provider is reporting on your behalf. This legal responsibility cannot be delegated.

For more information, please refer to:

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- section 133(1)

- section 133(2)

2. Key terms and concepts

This section contains key terms and concepts for the electronic funds transfer report.

Electronic funds transfers

An electronic funds transfer is the transmission—by any electronic, magnetic or optical means—of instructions for the transfer of funds, including a transmission of instructions that is initiated and finally received by the same person or entity. In the case of SWIFT messages, only SWIFT MT-103 messages and their equivalent are included. An electronic funds transfer does not include a transmission of instructions for the transfer of funds:

- that involves the beneficiary withdrawing cash from their account

- that is carried out by means of a direct deposit or pre-authorized debit

- that is carried out by cheque imaging and presentment

- that is both initiated and finally received by persons or entities that are acting to clear or settle payment obligations between themselves, or

- that is initiated or finally received by a person or entity referred to in paragraphs 5(a) to (h.1) of the Proceeds of Crime (Money Laundering) Terrorist Financing Act (the Act) for the purpose of internal treasury management, including the management of their financial assets and liabilities, if one of the parties to the transaction is a subsidiary of the other or if they are subsidiaries of the same corporation

An international electronic funds transfer means an electronic funds transfer other than for the transfer of funds within Canada.

Initiation

Initiation is the first transmission of instructions for the transfer of funds. This occurs when you (the reporting entity) are the first reporting entity that initiates the sending of an electronic funds transfer at the request of a person or entity. For more information on when you must report the initiation of an international electronic funds transfer, refer to:

- 3. Reporting requirements for casinos and financial entities or

- 4. Reporting requirements for money services business and foreign money services business

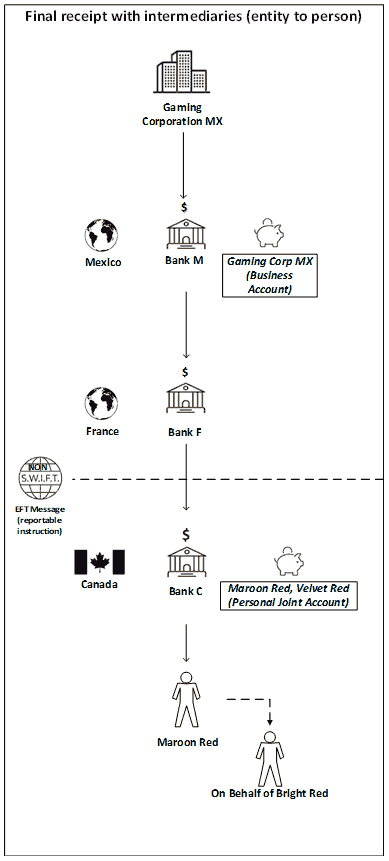

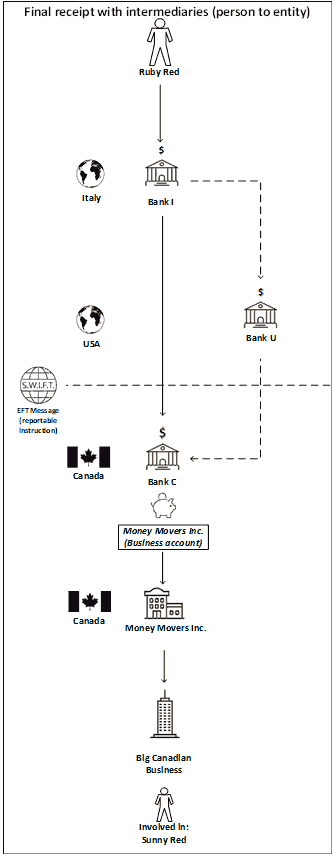

Final receipt

Final receipt is the receipt of instructions by the person or entity that is to make the remittance to a beneficiary. This occurs when you (the reporting entity) are the last reporting entity to receive an electronic funds transfer for remittance to a beneficiary. For more information on when you must report the final receipt of an international electronic funds transfer, refer to:

- 3. Reporting requirements for casinos and financial entities or

- 4. Reporting requirements for money services business and foreign money services business

Senders and Intermediaries

If you act as an intermediary in the sending of an international electronic funds transfer (incoming or outgoing), you will not have to report this transfer to FINTRAC because you do not initiate or finally receive the transfer. However, you will be required to keep records of these transfers, and include requester and beneficiary information with the transmission of instructions as per the travel rule.

For more information, refer to

- Record keeping requirements for your sector

- Travel rule for electronic funds and virtual currency transfers

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c 17

- section 9.5

Other parties involved in an electronic funds transfer

The following table is a description of other parties that may be involved in an electronic funds transfer.

| Party | Description |

|---|---|

| Requester | A requester is a person or entity that requests the initiation of an electronic funds transfer. |

| Beneficiary | A beneficiary is a person or entity that will benefit from a transaction or to which the final remittance is made. |

| Third party | A third party is a person or entity that instructs another person or entity to act on their behalf for a financial activity or transaction. The third party may or may not be funding the transaction. For electronic funds transfers, a third party can be someone who instructs the requester or beneficiary. |

| Account holder if different from the requester | This occurs when the funds used to initiate a transfer are not withdrawn from the requester's account, but someone else's account. This only applies to financial entities and casino. (Money services businesses and foreign money services businesses are not recognized to have accounts for the purpose of the Act or Regulations.) |

Note:

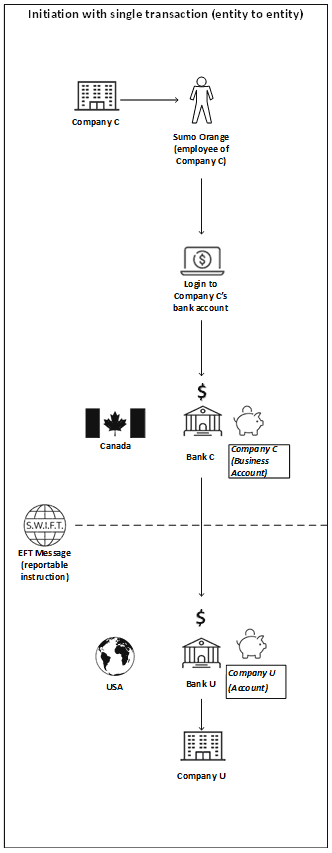

When a business (entity) needs to send an international electronic funds transfer, the information that you provide in an Electronic Funds Transfer Report will depend on the circumstances:

- If the person requesting the electronic funds transfer is an employee of the business, the employee is the requester. In the Electronic Funds Transfer Report, provide the requester's information:

- name

- date of birth

- employee's identification information

- business address

- business telephone number

Because the employee is requesting the transfer on behalf of the business, the business is the third party. Further, if the funds are withdrawn from the business' account, then the business is the account holder if different from the requester.

- If the person requesting the electronic funds transfer is the owner of a business, or holds an equivalent position within the business (for example, President, Chief Executive Officer), the business is the requester.

- If the person requesting the electronic funds transfer is someone other than an employee or owner (or equivalent), such as the business' accountant, the accountant is the requester. Because the accountant is requesting the transfer on behalf of the business, the business is the third party.

3. Reporting requirements for casinos and financial entities

Initiation

If you are a casino or financial entity, you must submit an Electronic Funds Transfer Report to FINTRAC when you initiate an international electronic funds transfer of $10,000 or more in in a single transaction at the request of a person or entity.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 7(1)(b) and 70(1)(b)

Final receipt

If you are a casino or financial entity, you must submit an Electronic Funds Transfer Report to FINTRAC when you finally receive an international electronic funds transfer of $10,000 or more in a single transaction.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 7(1)(c) and 70(1)(c)

- subsection for time

4. Reporting requirements for a money services business and a foreign money services business

Residential status

If you are a money services business or foreign money services business, you need to determine a requester's and/or beneficiary's residential status for certain transactions.

The residential status should reflect whether they are in Canada or outside Canada.

A residential status of in Canada means the client has a connection or residential tie to Canada. For example, a client has a residential status of in Canada when at least one of the following are met:

- the client's address is in Canada

- the document or information used to verify the client's identity is issued by a Canadian province or territory, or by the federal government, or

- the client's banking, credit card or other payment service is based in Canada

If the client does not have a connection or residential tie to Canada, then you must determine the client's residential status as outside Canada.

Having a residential status of in Canada does not mean the client is always physically in Canada. The following are examples of clients with in Canada residential status and the client is not physically in Canada:

- the client has an Ontario driver's licence and is working or living temporarily outside Canada

- the client's home address is in Canada and is attending school outside Canada

- the client's home address is in Canada and is regularly commuting from Canada to a place of work outside Canada

- the client has a Canadian passport and is vacationing outside Canada

You can determine your client's residential status based on your knowledge of the client when verifying their identity and during the course of your business relationship with the client. Changes to the client's residential status should be considered and recorded as you perform ongoing monitoring of the business relationship with the client.

Note:

If a client's residential status has been determined to be outside Canada based on the criteria above—but the client is physically present at a Canadian location of a money services business, then the physical presence of the client at the Canadian location supersedes their residential status. Specifically, when a client is physically present at a Canadian location of a money services business, the client is considered to be in Canada.

Why and when you need to determine residential status

You need to determine residential status to help you confirm if certain electronic funds transfers are international and therefore, reportable to FINTRAC.

As a money services business you will need to determine residential status (in Canada or outside Canada) when you are the initiator and final receiver of the same electronic funds transfer.

As a foreign money services business, you will need to determine residential status when you initiate and/or finally receive an electronic funds transfer to determine if it is reportable to FINTRAC.

Note for money services businesses:

For electronic funds transfers transmitted from or to Canada that you initiate or finally receive (but not both), you do not need to determine the requester or beneficiary's residential status. You must report this type of international electronic funds transfers to FINTRAC if it is a transfer of $10,000 or more in in a single transaction and it was:

- initiated by you at the request of a person or entity or

- finally received by you for remittance to a beneficiary

Refer to the Money services business and Foreign money services business sections for more information on your electronic funds transfer reporting requirements to FINTRAC.

Money services business

Initiation

If you are money services business, you must submit an Electronic Funds Transfer Report to FINTRAC when you initiate an international electronic funds transfer of $10,000 or more in in a single transaction at the request of a person or entity.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 30(1)(b)

Final receipt

If you are a money services business, you must submit an Electronic Funds Transfer Report to FINTRAC when you finally receive an international electronic funds transfer of $10,000 or more in a single transaction.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 30(1)(c)

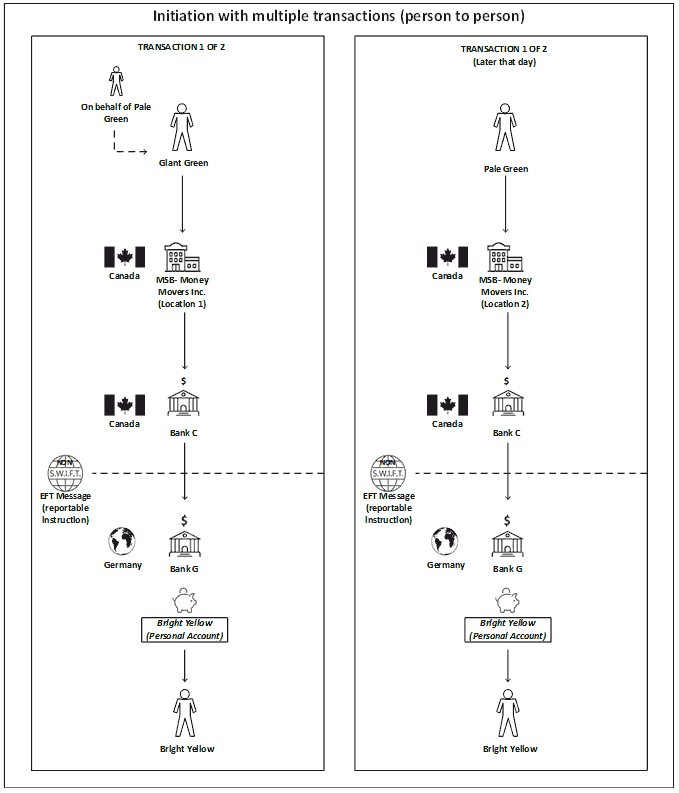

Initiation and final receipt

If you are a money services business, you must report:

- the initiation of an international electronic funds transfer of $10,000 or more in a single transaction, that is requested by a person or entity, if you also finally receive or will finally receive the same electronic funds transfer for a beneficiary

- the final receipt of an international electronic funds transfer of $10,000 or more in a single transaction, if you also initiate the same electronic funds transfer at the request of a person or entity.

This reporting requirement is meant to capture international electronic funds transfers that occur between clients who use the same money services business and when the transmission of instructions may not physically cross an international border.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 30(1)(d) and (e)

Summary of reporting requirements for money services business

When you are the initiator or final receiver of an electronic funds transfer, you do not need to determine the client's residential status. Refer to Table 1 for a summary of your reporting requirements when you are either the initiator or final receiver.

| Money services business is the | Money services business's client | Reporting requirement for the money services business |

|---|---|---|

| Initiator | Requester | Report the initiation of an international electronic funds transfer of $10,000 or more in a single transaction if the final receiver is located outside Canada |

| Final receiver | Beneficiary | Report the final receipt of an international electronic funds transfer of $10,000 or more in a single transaction if the initiator is located outside Canada |

When you are the initiator and final receiver of an electronic funds transfer, you will need to determine the residential status of the requester and beneficiary to determine if the electronic funds transfer is international and therefore, reportable. Refer to Table 2 for a summary of your reporting requirements when you are both the initiator and final receiver of an electronic funds transfer.

| Residential status of the client is determined to be | Reporting requirement for the foreign money services business | |

|---|---|---|

| In Canada | Outside Canada | |

| Requester | Beneficiary | Report the initiation of an international electronic funds transfer of $10,000 or more in a single transaction |

| Beneficiary | Requester | Report the final receipt of an international electronic funds transfer of $10,000 or more in a single transaction |

| (this cell is blank) | Requester and beneficiary | Report both:

|

| Requester and beneficiary | (this cell is blank) | No reporting obligation |

Foreign money services business

Initiation

If you are a foreign money services business, you must submit an Electronic Funds Transfer Report to FINTRAC when you initiate an electronic funds transfer of $10,000 or more in a single transaction at the request of a person or entity in Canada, and the electronic funds transfer is sent or is to be sent from one country to another. It should be noted that:

- in Canada means the requesting person or entity has a residential status of in Canada as explained in the Residential status section

- when a foreign money services business initiates an electronic funds transfer for a requester who has a residential status of in Canada, the foreign money services business is considered to be operating in Canada. If this transfer is sent to a receiving entity (final receiver) outside of Canada, then this transfer is sent from one country to another

- is to be sent means via an intermediary or if there is a delay

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 33(1)(b)

Final receipt

If you are a foreign money services business, you must submit an Electronic Funds Transfer Report to FINTRAC when you finally receive an electronic funds transfer of $10,000 or more in a single transaction for a beneficiary in Canada, and the transfer is sent or is to be sent from one country to another. It should be noted that:

- in Canada means the person or entity that is the beneficiary has a residential status of in Canada as explained in the Residential status section

- when a foreign money services business finally receives an electronic funds transfer for a beneficiary who has a residential status in Canada, the foreign money services business is considered to be operating in Canada. If the sending entity (initiator) is outside of Canada, then this transfer is sent from one country to another

- is to be sent means via an intermediary or if there is a delay

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections and 33(1)(c)

Initiation and final receipt

If you are a foreign money services business, you must report:

- the initiation of an international electronic funds transfer of $10,000 or more in a single transaction, that is requested by a person or entity in Canada, if you also finally receive or will finally receive the same electronic funds transfer for a beneficiary not in Canada

- the final receipt of an international electronic funds transfer of $10,000 or more in a single transaction, if you also initiate the same electronic funds transfer and the beneficiary is in Canada.

In Canada means the person or entity has a residential status in Canada as explained in residential status section.

This reporting requirement is meant to capture electronic funds transfers that occur between clients who use the same foreign money services business and therefore, the transmission of instructions may not physically cross an international border.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 33(1)(d) and (e)

Summary of reporting requirements for foreign money services business

If you are the initiator or final receiver of an electronic funds transfer, you will need to determine if the electronic funds transfer is reportable to FINTRAC by confirming

- the residential status of your client

- whether or not the transfer is sent from one country to another

Refer to Table 3 for a summary of your reporting requirements when your client is either the requester or the beneficiary.

| Foreign money services business is the | Client of the foreign money services business is the | Residential status of the client is determined to be | Sent from one country to another | Reporting requirement for the foreign money services business |

|---|---|---|---|---|

| Initiator | Requester | In Canada | Yes, when country location of the initiator (in Canada) is different from the final receiver (outside Canada) | Report the initiation of an electronic funds transfer of $10,000 or more in a single transaction |

| Initiator | Requester | In Canada | No, when country location of the initiator is the same as the final receiver (Canada for both) | No reporting obligation |

| Final Receiver | Beneficiary | In Canada | Yes, when country location of the initiator (outside Canada) is different from the final receiver (in Canada) | Report the final receipt of an electronic funds transfer of $10,000 or more in a single transaction |

| Final Receiver | Beneficiary | In Canada | No, when country location of the initiator is the same as the final receiver (Canada for both) | No reporting obligation |

If you are the initiator and final receiver of an electronic funds transfer, you will need to determine if the electronic funds transfer is reportable to FINTRAC by confirming

- the residential status of both your clients

Refer to Table 4 for a summary of your reporting requirements when you are both the initiator and final receiver of an electronic funds transfer.

| Client's residential status determined to be | Reporting requirement for the money services business | |

|---|---|---|

| In Canada | Outside Canada | |

| Requester | Beneficiary | Report the initiation of an international electronic funds transfer of $10,000 or more in a single transaction |

| Beneficiary | Requester | Report the final receipt of an international electronic funds transfer of $10,000 or more in a single transaction |

| (this cell is blank) | Requester and beneficiary | No reporting obligation |

| Requester and beneficiary | (this cell is blank) | No reporting obligation |

Note:

For electronic funds transfer reporting obligations, a foreign money services business is considered to be

- operating in Canada when it initiates or finally receives an electronic funds transfer for a client who has a residential status of in Canada at the time of the transaction

- not operating in Canada when it performs services, including electronic funds transfer services, for clients who are not in Canada.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act, S.C. 2000, c 17

- Section 5.1

5. Important considerations when reporting electronic funds transfers

When to submit an Electronic Funds Transfer Report

You must submit an Electronic Funds Transfer Report to FINTRAC within 5 business days after the day on which you initiate the transfer.

You must submit an Electronic Funds Transfer Report to FINTRAC within 5 business days after the day on which you finally receive the transfer.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- Subsection 132(1)

24-hour rule

You must also submit an Electronic Funds Transfer Report to FINTRAC in accordance with the 24-hour rule. That is, you must submit a report when you:

- initiate 2 or more international electronic funds transfers that total $10,000 or more within a static 24-hour window, and you know that the transactions:

- were requested by the same person or entity

- were requested on behalf of the same person or entity (third party), or

- are for the same beneficiary (person or entity)

- finally receive 2 or more international electronic funds transfers that total $10,000 or more within a static 24-hour window, and you know that the transactions:

- were requested by the same person or entity, or

- are for the same beneficiary (person or entity)

SWIFT and non-SWIFT transfers

SWIFT (Society for Worldwide Interbank Financial Telecommunication) and non-SWIFT electronic funds transfers must be aggregated together in accordance with the 24-hour rule.

Example:

- Chantal requests an international transfer of $12,000 be sent to Marie in Portugal. The bank initiates this transfer using the SWIFT network.

- Chantal requests another international transfer of $7,000 be sent to Robert in the United States. The same bank initiates this transfer using a non-SWIFT network.

If these 2 transactions fall within the bank's 24-hour window for aggregation, then these 2 transactions must be aggregated and reported to FINTRAC under the 24-hour rule because:

- these transactions were requested by the same person and total more than $10,000.

- SWIFT and non-SWIFT transfers need to be aggregated and submitted in the same Electronic Funds Transfer Report

For more information, please refer to:

Legal reference

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 127(1)(a) to (c)

- subsections 128(1)(a) to (b)

Foreign currency

If you initiate or finally receive an electronic funds transfer in a foreign currency, convert the amount into Canadian dollars using the exchange rate published by the Bank of Canada in effect at the time of the transaction to determine whether you have reached the reporting threshold amount of $10,000 CAD.

If an exchange rate is not published by the Bank of Canada, then you must use the rate you establish in the normal course of your business at the time of the transaction.

Your process for establishing an exchange rate to determine if you have reached the reporting threshold amount should be outlined in your compliance policies and procedures.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- section 125(a)

- section 125(b)

6. How to submit a report to FINTRAC

You must submit an Electronic Funds Transfer Report to FINTRAC electronically using the following options:

- FINTRAC Web Reporting System (FWR) (geared towards reporting entities with lower reporting volumes)

- FINTRAC API Portal (secure system-to-system transfer of report information)

Note about paper form:

If you do not have the technical capability to submit reports electronically to FINTRAC, you must submit reports in paper form.

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- section 131(1)

- section 131(2)

7. The form for reporting electronic funds transfers

In this section

Note

- For details about submission limits (for reports submitted electronically), refer to:

- To find out how to create subject profiles (for reports submitted through FINTRAC Web Reporting System), refer to:

Form structure

The Electronic Funds Transfer Report form has 2 main sections: General information and Transaction information

| Main sections of the form | Type of information for each section |

|---|---|

| General information |

|

| Transaction information |

|

Note

|

|

Form highlights

The Electronic Funds Transfer Report form can be used to report the

- initiation of an international electronic funds transfer or

- final receipt of an international electronic funds transfer

When completing the form, you must select the direction (initiation or final receipt) and provide information about the transfer. The direction you select may have an impact on:

the level of effort (for example, mandatory or reasonable measures) for a field. Specifically, the level of effort for a field in an initiation report may be the same or different for the identical field in a final receipt report.

Example

When you initiate an electronic funds transfer and the requester is a person, the requester's date of birth field is mandatory.

When you finally receive an electronic funds transfer, the requester's date of birth field is reasonable measures.

the information you provide for a field in an initiation report and the identical field in a final receipt report.

Example

If you are initiating an electronic funds transfer, you must provide your information in the initiator fields as you are the initiator.

If you finally receive an electronic funds transfer, you must provide the initiator's information in the initiator fields (and not your information as you are the final receiver).

The form also contains fields where you can provide information on all parties involved in the transfer of funds (for example, multiple requesters, sources of funds, account holders, third parties and beneficiaries).

8. Other requirements associated with electronic funds transfers

In this section

Compliance program

Your compliance program's policies and procedures must outline your process and criteria on:

- selecting exchange rates and their source

- aggregating transactions

- determining if you are dealing with a person or entity

- submitting reports to FINTRAC

If you have an automated or triggering system in place to detect when the threshold amount is reached for reporting, a person may still assess the transaction(s), as a best practice, to ensure the submission of an Electronic Funds Transfer Report.

Your compliance program must also include training on suspected money laundering and terrorist financing activities in relation to your business.

For more information:

Suspicious transactions

In addition to reporting electronic funds transfers, you may also be required to submit Suspicious Transaction Reports to FINTRAC when you have reasonable grounds to suspect that a transaction is related to the commission, or the attempted commission, of a money laundering or terrorist activity financing offence. Therefore, you may be required to submit an Electronic Funds Transfer Report and a Suspicious Transaction Report for the same transaction.

For more information:

- What is a Suspicious Transaction Report

- Reporting suspicious transactions to FINTRAC

- Money laundering and terrorist financing indicators under All FINTRAC guidance – Transaction reporting requirements

Large cash transactions

There may be instances where you may be required to submit a Large Cash Transaction Report in addition to an Electronic Funds Transfer Report. For example, if a person or entity provides $10,000 cash and requests that you initiate an international electronic funds transfer, you must submit a Large Cash Transaction Report in addition to an Electronic Funds Transfer Report.

For more information:

Travel rule

You must ensure that specific information is included with an electronic funds transfer that you initiate, send or receive.

For more information:

Record keeping

When you submit an Electronic Funds Transfer Report to FINTRAC, you must keep a copy of it for at least 5 years from the date the report was created.

For more information, consult:

- your sector-specific guidance under All FINTRAC guidance – Record keeping requirements

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- section 144

- subsection 148(1)(c)

Verifying the identity of persons and entities

There are requirements on when and how to verify the identity of persons and entities for electronic funds transfers.

For specific information, consult:

- Methods to verify the identity of persons and entities

- your sector-specific guidance on when to verify the identity of persons and entities under All FINTRAC guidance – Know your client requirements

Third party determination

For the purposes of reporting an electronic funds transfer, there are requirements to determine whether:

- the requester of an electronic funds transfer is acting on behalf of another person or entity

- the beneficiary of an electronic funds transfer is acting on behalf of another person or entity

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- Schedule 2

- Schedule 3

Ministerial directives

You must consider all requirements issued under a ministerial directive along with your electronic funds transfer reporting requirements.

For more information:

Voluntary self-declaration of non-compliance

If you discover instances of non-compliance related to your electronic funds transfer reporting requirements, FINTRAC strongly encourages you to report a voluntary self-declaration of non-compliance.

For more information:

9. Exceptions for electronic funds transfers

There are exceptions to reporting electronic funds transfer under the 24-hour rule.

For more information on these exceptions, consult:

- Reporting transactions to FINTRAC: The 24-hour rule (section 5. Exceptions to the 24-hour rule)

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 127(2)(a) to (c)

- subsections 128(2)(a) to (c)

Annex A: Field instructions to complete an Electronic Funds Transfer Report

This annex contains instructions on how to complete the fields in an Electronic Funds Transfer Report.

The Electronic Funds Transfer Report form can be used to report the

- initiation of an international electronic funds transfer or

- final receipt of an international electronic funds transfer

When completing the form, you must select the direction (initiation or final receipt) and provide information about the transfer. The direction you select may have an impact on:

the level of effort (for example, mandatory or reasonable measures) for a field. Specifically, the level of effort for a field in an initiation report may be the same or different for the identical field in a final receipt report.

Example

When you initiate an electronic funds transfer and the requester is a person, the requester's date of birth field is mandatory.

When you finally receive an electronic funds transfer, the requester's date of birth field is reasonable measures.

the information you provide for a field in an initiation report and the identical field in a final receipt report.

Example

If you are initiating an electronic funds transfer, you must provide your information in the initiator fields as you are the initiator.

If you finally receive an electronic funds transfer, you must provide the initiator's information in the initiator fields (and not your information as you are the final receiver).

Note:

In this Annex, the field instructions apply to both the initiation and final receipt of an international electronic funds transfer except when indicated otherwise. In addition:

- If the field name is listed once, this means the level of effort for this field (for example, mandatory or reasonable measures) is the same for both an initiation and a final receipt report.

- If the field name is listed twice with different symbols, this means the level of effort for this field (for example, mandatory or reasonable measures) is different for an initiation and final receipt report.

- If the field name is listed once with "Initiation only", this means the field only appears on an initiation report.

- If the field name is listed once with "Final receipt only", this means the field only appears on a final receipt report.

In addition:

- Some fields only become applicable on the completion of other fields.

- Some field instructions may only apply to the electronic report submissions and not paper submissions.

- Fields that are not applicable are to be left blank. When a field is not applicable:

- do not enter "Not applicable", "N/A" or "n/a", or

- do not substitute any other abbreviations, special characters ("x", "-" or "*") or words ("unknown") in the field

- Failure to provide applicable reporting information will result in non-compliance and may lead to criminal or administrative penalties. To learn more about potential enforcement actions:

In this annex

Standardized field instructions

This section contains instructions for completing some fields that appear in multiple sections of the form.

In this section

Name fields

| Name fields | Instructions |

|---|---|

| Surname | Provide the last name of the person. |

| Given name | Provide the first name of the person. Note: If a person has only a single name, enter "XXX" in the "Given name" field and the person's single name in the "Surname" field. |

| Other/Initial | Provide the middle or other name(s) of the person, or their initial(s) if no other names apply. |

| Alias | Provide the name a person uses, or by which they are known, other than the name provided under surname, given name, or other/initial. |

| Name of entity | Provide the full name of the entity. |

Address fields

Provide the address details in the structured or unstructured fields (as applicable) as explained below.

Structured address fields

Structured address fields include:

- Apartment/Room/Suite/Unit number

- House/Building number

- Street address

- City

- District

- Country

- Province or state (code) – For provinces or states in Canada, the United States or Mexico, select from the list of options.

- Province or state (name) – For provinces or states outside Canada, the United States or Mexico, provide the name of the province or state.

- Sub-province and/or sub-locality

- Postal or zip code

If you have the ability to separate the information

You must report it in the structured address fields.

For example, if a person lives at #10-123 Main Street, Richmond, British Columbia, Canada A1B 2C3, complete the address fields as follows:

| Structured address fields | Information provided |

|---|---|

| Apartment/Room/Suite/Unit number | 10 |

| House/Building number | 123 |

| Street address | Main Street |

| City | Richmond |

| Country | Canada |

| Postal code | A1B 2C3 |

If you are unable to separate the address information into the structured address fields

If, for example, your system groups the Apartment/Room/Suite/Unit number with the House/Building number and Street address, then provide:

- all the address information in the street address field

- the city, province, country and postal code in their respective fields

If there is no civic address

If a person or entity's address is in an area where there is no civic address, provide a description of the physical location.

For example, if a person lives in the third house to the right after the community center in Tinytown, Saskatchewan, Canada X1Y 2Z2, complete the address fields as follows:

| Structured address fields | Information provided |

|---|---|

| Street address | Third house to the right after the community center |

| City | Tinytown |

| Province | SK |

| Country | Canada |

| Postal code | X1Y 2Z2 |

Note: If you use the structured address fields, you cannot use the unstructured address fields to provide additional information.

Unstructured address field

You should only use the unstructured address field when it is not possible to separate the address information. This typically occurs when you are uploading a large volume of reports and the data originates from outside your organization. For example, when you are in final receipt of an electronic funds transfer and the foreign address of the person who requested the transfer information cannot be easily populated into the structured address fields.

If possible, enter information about the country in the Country field and provide the unstructured address information in the following format:

- street address/city/province or state/postal code or zip code

Invalid addresses

The following are not valid addresses, and should not be provided in either the structured or unstructured address fields:

- a post office box without a complete physical address (for example, PO Box 333)

- general delivery address

- only a suite number (for example, Suite 256) without additional address information

Persons who are transient or have no fixed address

For persons who are transient (for example, travelling in a recreational vehicle or temporarily working in a camp) and have no fixed address, you are required to provide the following information:

| Type of person | What to provide |

|---|---|

| Canadian residents | Their permanent Canadian address, even if that is not where they are currently residing |

| Foreign clients travelling in Canada for a short period of time | Their foreign residential address |

| Foreign clients living in Canada for a longer period of time (such as a student) | The person's temporary Canadian address |

Occupation/business fields

| Occupational/business fields | Instructions |

|---|---|

| Occupation |

When entering occupation information, you should be as descriptive as possible. For example, if the person is:

You can enter a numeric classification code and the code title in this field (for example, NOC – National Occupational Classification). However, a numeric code on its own is not sufficient as you need a written description of the occupation as explained above. Note: If your client indicates that they are the manager of Blue Moon Auto Parts Ltd., you would enter “manager of auto parts company” in the occupation field and “Blue Moon Auto Parts Ltd.” in the name of employer field as explained below. |

| Name of employer |

Enter the name of the person’s employer. Do not provide the name of a supervisor or manager. This field is meant to capture the name of the business that employs the person. If the person has multiple employers, you only need to provide one but it should be the person’s primary employer. Providing the name of employer can augment the description of a person’s occupation. For example, “retail clothing store manager for ABC high-end clothing store” and “retail clothing store manager for XYZ discount clothing store” are more descriptive than “retail clothing store manager” on its own. |

| Nature of entity’s principal business |

You should be as descriptive as possible when entering the entity’s principal business. If the entity’s principal business is “sales,” provide the type of sales, such as “pharmaceutical sales” or “retail clothing sales.” You can enter a numeric classification code and the code title in this field (for example, NAICS – North American Industry Classification System). However, a numeric code on its own is not sufficient, as you need a written description of the nature of the entity’s principal business as explained above. |

Identification fields

| Identification fields | Instructions | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Identifier type |

Select the identifier type for the person or entity as applicable. If the identifier type is not listed, select “Other” and provide details. If you use the dual process method to identify a person, you must provide details of both sources of information in the identifier type fields. Note: Don’t report a Social Insurance Number (SIN) to FINTRAC. In addition, you cannot use documentation for identification purposes where it is prohibited by provincial legislation. For more information on how to identify persons and entities, refer to:

|

||||||||

| Number associated with identifier type | This is the number indicated on the identifier type that was used to verify the identity of the person or entity. For example, on a driver’s licence, the licence number is the identification number and on a Certificate of Incorporation, the incorporation number is the identification number. | ||||||||

| Jurisdiction of issue (country, province or state) |

Provide the country, province, or state that issued the documentation used to identify the person or entity.

|

Telephone number fields

| Location of telephone number | Instructions |

|---|---|

| Canada or the United States | Enter the area code and local number (for example, 999-999-9999). |

| Outside Canada or the United States |

Enter the:

For example, “99-999-9999-9999” would indicate:

|

Specific field instructions for the Electronic Funds Transfer Report

This section contains instructions for the report fields and are laid out in the same order as they appear on the Electronic Funds Transfer Report.

Note: For some fields, the instructions:

- have not been provided and are indicated as "Instructions not specified"

- can be found in the Standardized field instructions section

Field categories

Fields are categorized as either:

- mandatory

- mandatory for processing

- mandatory if applicable, or

- reasonable measures

| Field categories | Instructions |

|---|---|

| Mandatory | These fields are indicated with an asterisk symbol (*) and must be completed. Because an Electronic Funds Transfer Report can include multiple transactions conducted within 24 consecutive hours that total $10,000 or more, the information for some mandatory fields may not have been obtained at the time of the transaction. In this case, the fields become "reasonable measures" fields, and the instructions for reasonable measures (below in this table) must be applied. Note: If an Electronic Funds Transfer Report contains multiple transactions conducted within 24 consecutive hours and 1 of these transactions is $10,000 CAD or more, then the mandatory fields will apply.

Legal references

|

| Mandatory for processing | These fields are indicated with a double dagger symbol (‡) and must be completed. |

| Mandatory if applicable | These fields are indicated with a dagger symbol (†) and must be completed if they are applicable to you or the transaction being reported. |

| Reasonable measures | You must take reasonable measures to obtain the information for all non-mandatory fields in the report, if they are applicable. Reasonable measures are the steps that you must take, as outlined in your policies and procedures, to obtain the information that can include asking the person or entity involved in the transaction for the information. If you obtain the information, you must report it. You must also provide the information if it is contained within your systems or records. Legal references

|

In this section

General information

| Fields | Instructions |

|---|---|

| * Reporting entity number | You must enroll in FINTRAC Web Reporting System (FWR) to submit reports electronically. Provide the identifier number assigned to you by FINTRAC at enrolment. |

| ‡ Reporting entity report reference number | A number assigned to each report by:

|

Which one of the following types of reporting entities best describes you?

| Fields | Instructions |

|---|---|

| * Activity sector | Enter your business activity sector. If you are involved in more than 1 type of business activity, indicate the one applicable to the transaction being reported. If there is more than 1 business activity for 1 or more transactions on the report, select only 1 to indicate your principal type of business activity. |

Whom can FINTRAC contact about this report?

Enter the contact information of the person you would like FINTRAC to liaise with in the event that a follow up is required.

You must ensure that all of your contacts' information is up to date in FINTRAC Web Reporting System (FWR) prior to submitting your report(s).

Report information

| Fields | Instructions |

|---|---|

| ‡ Electronic funds transfer direction | Select:

When you select the electronic funds transfer direction (initiation or final receipt):

|

| ‡ Aggregation type | Indicate the type of aggregation used when multiple transactions occur within a consecutive 24-hour period:

If the report is for 1 transaction only, or for a ministerial directive, then aggregating transactions does not apply and you should select "Not applicable". Note: You must provide a start date/time and end date/time in the fields below, even if there is no aggregation and you select "not applicable" in the aggregation type field. |

| ‡ 24-hour period start date and time | Provide the start date and time of the 24-hour period. You must include the time zone (that is, UTC offset) in the 24-hour period start time field. You must enter the start time in the following format: HH:MM:SS±ZZ:ZZ. For example, 1:25:06 pm in Ottawa, Ontario would be reported as 13:25:06-05:00. |

| ‡ 24-hour period end date and time | Provide the end date and time of the 24-hour period. If your 24-hour period starts at 8:00 am, it would end at 7:59 am the following day. You must include the time zone (that is, UTC offset) in the 24-hour period end time field. The field above provides instructions for formatting. Note: The start date/time and end date/time that you provide will establish the 24-hour period in which you look for possible aggregate transactions, and report all applicable transactions within. Because you must aggregate on each party separately (requester, on behalf of [third party], or beneficiary), it is possible to have multiple 24-hour windows (for example, a 24-hour window for requesters that is different than your 24-hour window for beneficiaries). |

| Ministerial directive | If a transaction is being reported to FINTRAC under a ministerial directive, then indicate this by selecting the ministerial directive in the report. Leave this field blank if the transaction(s) are not part of a ministerial directive. Note:

|

Transaction information

Information about the transaction

| Fields | Instructions | ||||||

|---|---|---|---|---|---|---|---|

| *Electronic funds transfer type | Select:

|

||||||

| * Date and time of transaction | Enter the date and time of the electronic funds transfer. It cannot be a future date. Initiation:

Final receipt:

A report can contain multiple transactions that took place in different time zones, but these transactions should all be within your 24-hour aggregation window that is indicated by the 24-hour period start date and time and the 24-hour period end date and time in the report. ExamplesIf your report indicates that the 24-hour window is from 12:00 am to 11:59 pm Eastern Standard Time (EST) and you have transactions that occurred in both EST and Pacific Standard Time (PST) zones, you will need to do the following:

Your process to convert and report transactions that occur in different time zones should be documented in your policies and procedures to ensure your reporting is consistent. For more information: |

||||||

| * Amount | Initiation: Example

Final receipt: Example You finally receive $11,000 for the beneficiary. If you charge a service fee of $50 so that only $10,950 is remitted to the beneficiary, you would still report $11,000 in the amount field |

||||||

| * Currency type | Enter the currency of the funds being transferred, including if it was in Canadian dollars. If the currency type is not in the list provided, you must select "Other" and provide the full name of the currency. | ||||||

| Exchange rate | Provide the rate of exchange that you used for the transaction. | ||||||

| ‡ Threshold indicator | Select:

|

||||||

| ‡ Reporting entity transaction reference number | This is a unique number assigned to each transaction by:

|

||||||

| ‡ Have you applied a regulatory exception to this transaction? | Select:

Under Part 6 of the Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, your requirement to keep records, verify identity and make a politically exposed persons and heads of international organization determination do not apply if your client is:

Therefore, if your client is a public body, very large corporation or trust, or a subsidiary of a public body or very large corporation or trust (as described above), and the client is a requester or beneficiary of an electronic funds transfer, you may have limited information to provide on the client in the electronic transfer report. In this case, you should select Yes. |

Legal references

- Proceeds of Crime (Money Laundering) and Terrorist Financing Regulations, SOR/2002-184

- subsections 154(2)(m), (n) and (o)

For money services businesses and foreign money services businesses only

Complete this section if you selected initiation as the direction of this report.

| Fields | Instructions |

|---|---|

Question 1 |

Select:

|

Question 2 |

Instructions not specified. |

| † (If yes to questions 1 and 2) What is the requester's residential status? | Select the appropriate status:

|

| † (If yes to questions 1 and 2) What is the beneficiary's residential status? | Same instructions as above. |

|

Question 3 |

Select one of the following options:

|

For money services business and foreign money services business only

Complete this section if you selected final receipt as the direction of this report.

| Fields | Instructions |

|---|---|

|

Question 1 |

Select:

|

|

Question 2 |

Instructions not specified. |

| † (If yes to questions 1 and 2) What is the requester's residential status? | Select the appropriate status:

Refer to Residential status in section 4, Reporting requirements for money services business and foreign money services business for information on how to determine residential status. |

| † (If yes to questions 1 and 2) What is the beneficiary's residential status? | Same instructions as above. |

|

Question 3 |

Select one of the following options:

|

Source of funds involved at initiation

If you have information on any source of funds involved in the transaction, you must report it.

If there are multiple sources, you must provide information for each source.

| Fields | Instructions |

|---|---|

| ‡ Was information about the source (person / entity) of funds obtained? | This field is a "Yes/No" question. Select "Yes" if you have:

Otherwise, select "No" to indicate that you do not have the information. |

| How were the funds obtained? | This is how the requester initially acquired the funds used for the transaction, not where the funds may have been transferred from. For example, you can obtain funds from activities such as:

This information must be reported if obtained. |

Source of funds – person

| Fields | Instructions |

|---|---|

| Surname | Refer to Name fields under "Standardized field instructions". |

| Given name | Same instructions (Name fields) |

| Other/initial | Same instructions (Name fields) |

| Account number | Provide the account number for the source of funds. It is acceptable to include the financial institution number and branch number as part of an account number. |

| Policy number | Instructions not specified |

| Identifying number | If there is no account or policy number, provide an identifying number if available. |

Source of funds – entity

| Fields | Instructions |

|---|---|

| Name of entity | Refer to Name fields under "Standardized field instructions". |

| Account number | Provide the account number for the source of funds. It is acceptable to include the financial institution number and branch number as part of an account number. |

| Policy number | Instructions not specified |

| Identifying number | If there is no account or policy number, provide an identifying number if available. |

Note about the source of funds fields

Although the following 3 fields are all about how the requester obtained the funds and the source of funds, they are different:

- How were the funds obtained?

- Was information about the source (person / entity) of funds obtained?

- Source of funds – person or entity

The following example demonstrates their differences.

Example:

Vicky Violet brings in $12,000 cash for deposit into her bank account and tells the bank that she obtained this cash when she sold her car to Griffin Grey.

She was only able to provide Griffin Grey's name to the bank because she did not have information on his account number, policy number or identifying number.

As such, the source of funds fields would be completed as follows:

| Source of funds fields | Information provided in the field |

|---|---|

| How were the funds obtained? | Sale of car |

| Was information about the source (person / entity) of funds obtained? | Yes |

| Source of funds | Griffin Grey |

For more information on completing these fields, please refer to field descriptions.

Requester

| Fields | Instructions |

|---|---|

| ‡ Requester type | Select:

|

Requester – person

Provide all the information you have on 1, or multiple persons who requested the initiation of the transfer.

| Fields | Instructions |

|---|---|

| † Surname | Refer to Name fields under "Standardized field instructions". |

| † Given name | Same instructions (Name fields) |

| Other/Initial | Same instructions (Name fields) |

| Alias | Same instructions (Name fields) |

| Client number | Instructions not specified |

| Apartment/Room/Suite/Unit number | Refer to Address fields under "Standardized field instructions". |

| House/Building number | Same instructions (Address fields) |

| † Street address | Same instructions (Address fields) |

| † City | Same instructions (Address fields) |

| District | Same instructions (Address fields) |

| † Country | Same instructions (Address fields) |

| † Province or state (code) | Same instructions (Address fields) |

| † Province or state (name) | Same instructions (Address fields) |

| Sub-province and/or sub-locality | Same instructions (Address fields) |

| Postal or zip code | Same instructions (Address fields) |

| Unstructured address details | Refer to Unstructured address fields under "Standardized field instructions". |

| Telephone number | Refer to Telephone number fields under "Standardized field instructions". |

| Extension | Same instructions (Telephone number fields) |

| Email address | Instructions not specified |

Initiation: Final receipt: Date of birth |

Instructions not specified |

| Country of residence | Enter the primary country of residence for the person. It can be the same or different from the country entered in the address section. |

Initiation: Final receipt: Occupation |

Refer to Occupation/business fields under "Standardized field instructions". |

| Name of employer | Same instructions (Occupation/business fields) |

Identification of the requester – person

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Identifier type |

Refer to Identification fields under "Standardized field instructions". |

| † If "Other", please specify | Same instructions (Identification fields) |

Initiation: Final receipt: Number associated with identifier type |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (country) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (code) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (name) |

Same instructions (Identification fields) |

Account or reference information related to the electronic funds transfer

Provide the account or reference information as it relates to the electronic funds transfer.

| Fields | Instructions |

|---|---|

| † Reference number | If the transaction involved a reference number, provide it in this field. If the transaction involves an account at a financial entity, securities dealer or casino (account-based reporting entity), do not provide the account number information in this field—instead, provide that information in the account number field. For all other reporting entities, if you have an internal account number that is used as a reference number, then provide the internal account number in this field. |

| Other number related to reference number | Provide any other number related to the reference number as applicable. |

Initiation: Final receipt: Financial institution number |

Instructions not specified |

Initiation: Final receipt: Branch number |

Instructions not specified |

| † Account number | If the transaction involves an account at a financial entity, securities dealer or casino (account-based reporting entities), provide that account number. If you are not an account-based reporting entity (for example, a money services business), but the transaction involves an account at an account-based reporting entity (for example, a financial entity), provide that account number in this field. |

Initiation: Final receipt: Account type |

Instructions not specified |

| † If 'Other', please specify | Instructions not specified |

Initiation: Final receipt: Account currency |

Instructions not specified |

| Date account opened | Instructions not specified |

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Surname |

Refer to Name fields under "Standardized field instructions". |

Initiation: Final receipt: Given name |

Same instructions (Name fields) |

| Other/Initial | Same instructions (Name fields) |

| Field | Instructions |

|---|---|

Initiation: Final receipt: Name of entity |

Refer to Name fields under "Standardized field instructions". |

Information about requesting the transaction online

| Fields | Instructions |

|---|---|

| Type of device used | Instructions not specified |

| † If 'Other', please specify | Instructions not specified |

| Username | Instructions not specified |

| Device identifier number | Instructions not specified |

| Internet protocol address | Instructions not specified |

| Date and time of online session in which request is made | Instructions not specified |

Requester – entity

Provide all the information you have on 1, or multiple entities specified as the requesters of the transfer.

| Fields | Instructions |

|---|---|

| † Name of entity | Refer to Name fields under "Standardized field instructions". |

| Client number | Instructions not specified |

| Apartment/Room/Suite/Unit number | Refer to Address fields under "Standardized field instructions". |

| House/Building number | Same instructions (Address fields) |

| † Street address | Same instructions (Address fields) |

| † City | Same instructions (Address fields) |

| District | Same instructions (Address fields) |

| † Country | Same instructions (Address fields) |

| † Province or state (code) | Same instructions (Address fields) |

| † Province or state (name) | Same instructions (Address fields) |

| Sub-province and/or sub-locality | Same instructions (Address fields) |

| Postal or zip code | Same instructions (Address fields) |

| Unstructured address details | Refer to Unstructured address fields under "Standardized field instructions". |

| Telephone number | Refer to Telephone number fields under "Standardized field instructions". |

| Extension | Same instructions (Telephone number fields) |

Initiation: Final receipt: |

Refer to Occupation/business fields under "Standardized field instructions". |

| ‡ Do you have incorporation or registration information? | Instructions not specified |

| Incorporated or registered? | Instructions not specified |

| † Incorporation number / † Jurisdiction of issue (country, province or state) | Provide the incorporation number and jurisdiction of issue of the entity requesting the transaction for each jurisdiction where the entity is incorporated. If the jurisdiction is a province or state:

|

| † Registration number / † Jurisdiction of issue (country, province or state) | Provide the registration number and jurisdiction of issue of the entity requesting the transaction for each jurisdiction where the entity is registered. If the jurisdiction is a province or state:

For Canadian entities, a registration number can include the 9-digit business number assigned to that entity by the Canada Revenue Agency (CRA). |

Identification of the requester – entity

Provide the following information that was used to verify the identity of the entity. For some entities, this information may be the same as the registration or incorporation information.

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Identifier type |

Refer to Identification fields under "Standardized field instructions". |

| † If "Other", please specify | Same instructions (Identification fields) |

Initiation: Final receipt: Number associated with identifier type |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (country |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (code) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (name) |

Same instructions (Identification fields) |

Person authorized to bind the entity or act with respect to the account (maximum 3)

If the requester is an entity, provide the information for up to 3 persons who are authorized to:

- bind the entity, or

- act with respect to the account

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Surname |

Refer to Name fields under "Standardized field instructions". |

Initiation: Final receipt: Given name |

Same instructions (Name fields) |

| Other/Initial | Same instructions (Name fields) |

Account or reference information related to the electronic funds transfer

Provide the account or reference information as it relates to the electronic funds transfer.

| Fields | Instructions |

|---|---|

| † Reference number | If the transaction involved a reference number, provide it in this field. If the transaction involves an account at a financial entity, securities dealer or casino (account-based reporting entity), do not provide the account number information in this field—instead, provide that information in the account number field. For all other reporting entities, if you have an internal account number that is used as a reference number, then provide the internal account number in this field. |

| Other number related to reference number | Provide any other number related to the reference number as applicable. |

Initiation: Final receipt: |

Instructions not specified |

Initiation: Final receipt: Branch number |

Instructions not specified |

| † Account number | If the transaction involves an account at a financial entity, securities dealer or casino (account-based reporting entities), provide that account number. If you are not an account-based reporting entity (for example, a money services business), but the transaction involves an account at an account-based reporting entity (for example, a financial entity), provide that account number in this field. |

Initiation: Final receipt: Account type |

Instructions not specified |

| † If 'Other', please specify | Instructions not specified |

Initiation: Final receipt: Account currency |

Instructions not specified |

| Date account opened | Instructions not specified |

Account holder (person) of account above

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Surname |

Refer to Name fields under "Standardized field instructions". |

Initiation: Final receipt: Given name |

Same instructions (Name fields) |

| Other/Initial | Same instructions (Name fields) |

Account holder (entity) of account above

| Field | Instructions |

|---|---|

|

Initiation: Final receipt: Name of entity |

Refer to Name fields under "Standardized field instructions". |

Information about requesting the transaction online

| Fields | Instructions |

|---|---|

| Type of device used | Instructions not specified |

| † If 'Other', please specify | Instructions not specified |

| Username | Instructions not specified |

| Device identifier number | Instructions not specified |

| Internet protocol address | Instructions not specified |

| Date and time of online session in which request is made | Instructions not specified |

Account holder if different from the requester

Provide information on the holder of the account from which the funds are withdrawn if different from the requester

| Fields | Instructions |

|---|---|

| ‡ Were the funds withdrawn from an account not held by the requester (person/entity)? | Instructions not specified |

| Account holder type | Select:

|

Person who is account holder if different from the requester

| Fields | Instructions |

|---|---|

| † Surname | Refer to Name fields under "Standardized field instructions". |

| † Given name | Same instructions (Name fields) |

| Other/Initial | Same instructions (Name fields) |

| Alias | Same instructions (Name fields) |

| Client number | Instructions not specified |

| Apartment/Room/Suite/Unit number | Refer to Address fields under "Standardized field instructions". |

| House/Building number | Same instructions (Address fields) |

| † Street address | Same instructions (Address fields) |

| † City | Same instructions (Address fields) |

| District | Same instructions (Address fields) |

| † Country | Same instructions (Address fields) |

| † Province or state (code) | Same instructions (Address fields) |

| † Province or state (name) | Same instructions (Address fields) |

| Sub-province and/or sub-locality | Same instructions (Address fields) |

| Postal or zip code | Same instructions (Address fields) |

| Unstructured address details | Refer to Unstructured address fields under "Standardized field instructions". |

| Telephone number | Refer to Telephone number fields under "Standardized field instructions". |

| Extension | Same instructions (Telephone number fields) |

| Email address | Instructions not specified |

Initiation: Final receipt: |

Instructions not specified |

| Country of residence | Enter the primary country of residence for the person. It can be the same or different from the country entered in the address section. |

Initiation: Final receipt: Occupation |

Refer to Occupation/business fields under "Standardized field instructions". |

| Name of employer | Same instructions (Occupation/business fields) |

Identification of the person who is the account holder if different from the requester

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Identifier type |

Refer to Identification fields under "Standardized field instructions". |

| † If "Other", please specify | Same instructions (Identification fields) |

Initiation: Final receipt: Number associated with identifier type |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (country) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (code) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (name) |

Same instructions (Identification fields) |

Relationship of the account holder (person) above to the requester

| Fields | Instructions |

|---|---|

Initiation: Final receipt: |

Select the relationship of the account holder to the requester. |

| † If "Other", please specify | Instructions not specified |

Entity who is account holder if different from the requester

| Fields | Instructions |

|---|---|

| † Name of entity | Refer to Name fields under "Standardized field instructions". |

| Client number | Instructions not specified |

| Apartment/Room/Suite/Unit number | Refer to Address fields under "Standardized field instructions". |

| House/Building number | Same instructions (Address fields) |

| † Street address | Same instructions (Address fields) |

| † City | Same instructions (Address fields) |

| District | Same instructions (Address fields) |

| † Country | Same instructions (Address fields) |

| † Province or state (code) | Same instructions (Address fields) |

| † Province or state (name) | Same instructions (Address fields) |

| Sub-province and/or sub-locality | Same instructions (Address fields) |

| Postal or zip code | Same instructions (Address fields) |

| Unstructured address details | Refer to Unstructured address fields under "Standardized field instructions". |

| Telephone number | Refer to Telephone number fields under "Standardized field instructions". |

| Extension | Same instructions (Telephone number fields) |

| Email address | Instructions not specified |

Initiation: Final receipt: Nature of entity's principal business |

Refer to Occupation/business fields under "Standardized field instructions". |

| ‡ Do you have incorporation or registration information? | Instructions not specified |

| Incorporated or registered? | Instructions not specified |

Initiation: Final receipt: Incorporation number / Jurisdiction of issue (country, province or state) |

Provide the incorporation number and jurisdiction of issue of the entity for each jurisdiction where the entity is incorporated. If the jurisdiction is a province or state:

|

Initiation: Final receipt: |

Provide the registration number and jurisdiction of issue of the entity for each jurisdiction where the entity is registered. If the jurisdiction is a province or state:

For Canadian entities, a registration number can include the 9-digit business number assigned to that entity by the Canada Revenue Agency (CRA). |

Identification of the entity who is the account holder if different from the requester

Provide the following information that was used to verify the identity of the entity. For some entities, this information may be the same as the registration or incorporation information.

| Fields | Instructions |

|---|---|

Initiation: Final receipt: Identifier type |

Refer to Identification fields under "Standardized field instructions". |

| † If "Other", please specify | Same instructions (Identification fields) |

Initiation: Final receipt: Number associated with identifier type |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (country) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (code) |

Same instructions (Identification fields) |

Initiation: Final receipt: Jurisdiction of issue (province or state) (name) |

Same instructions (Identification fields) |

Person authorized to bind the entity or act with respect to the account (maximum 3)